Written By : Getahun Teferi SAP Functional and Business Consultant Electrical and Computer Engineer Certified SAP Digital Badge in SAP S_4HANA Cloud - Support and Success Essentials for SAP Consultant

Table of Contents | ||

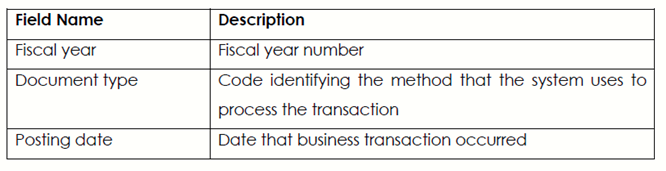

1.INTRODUCTION | 3 | |

| 1.1 | Financial Accounts Overview | 4 |

| 1.2 | Structures in SAP Finance | 5 |

2. GENERAL LEDGER | 6 | |

| 2.1 | Finance Organizational Structures & Master Data General Ledger Accounting | 7 |

| 2.2 | Accounting Transactions in General Ledger | 7 |

| 2.2.1 | Park Document | 8 |

| 2.2.2 | Post parked Document | 10 |

| 2.2.3 | Enter General Ledger Account Document | 11 |

| 2.2.4 | Change General Ledger Accounting Document | 12 |

| 2.2.5 | Display General Ledger Document | 14 |

| 2.2.6 | General Ledger Document Reversal | 15 |

| 2.2.7 | Clear General Ledger Account | 17 |

| 2.2.8 | Post with Clearing | 19 |

| 2.3 | General Ledger Period End Closing | 21 |

| 2.3.1 | Create Recurring Entry Document | 22 |

2.3.2 | Change Recurring Document | 24 |

| 2.3.3 | Create Posting from Recurring Documents | 25 |

| 2.3.4 | Delete Recurring Document | 27 |

| 2.3.5 | Enter Accrual / Deferral Document | 29 |

| 2.3.6 | Reversing Posting for Accruals / Deferred Documents | 31 |

| 2.3.7 | Foreign Currency Valuation | 32 |

| 2.4 | General Ledger Reporting | 33 |

| 2.4.1 | Execute Financial Statements | 34 |

| 2.4.2 | Display G/L Balances | 35 |

| 2.4.3 | GL Account Line-Item Display | 35 |

3. ACCOUNTS PAYABLE | 36 | |

| 3.1 | Accounting Transactions in AP | 36 |

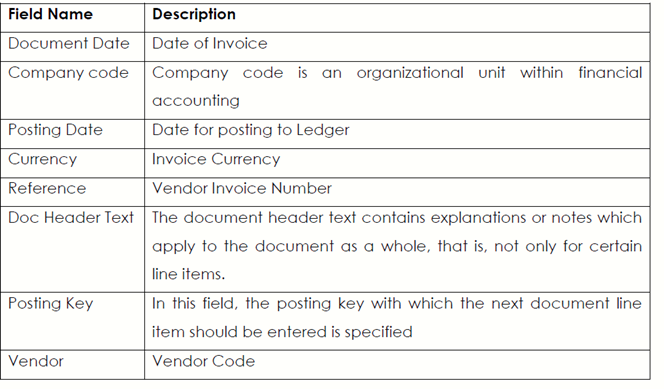

| 3.1.1 | Vendor Invoice Parking | 36 |

| 3.1.2 | Change Parked document | 38 |

| 3.1.3 | Display Parked Document | 38 |

| 3.1.4 | Posting / Delete Parked Document | 40 |

| 3.1.5 | Vendor Invoice | 41 |

| 3.1.6 | Park / Edit Credit Memo | 42 |

| 3.1.7 | Post Credit Memo | 44 |

| 3.1.8 | Post Outgoing payment | 46 |

| 3.1.9 | Display Accounting document | 48 |

| 3.1.1 | Clear Vendor Account | 50 |

| 3.1.1 | 1 Reset Cleared items | 52 |

| 3.1.1 | 2 Document Reversal | 54 |

| 3.2 | Advance Payments in Accounts Payable | 55 |

| 3.2.1 | Down Payment Request | 55 |

| 3.2.2 | Post Vendor down payment | 57 |

| 3.2.3 | Clear Vendor down payment | 58 |

| 3.3 | Check voiding | 60 |

| 3.3.1 | Voiding of Unused Checks | 60 |

| 3.3.2 | Void Issued checks | 61 |

| 3.3.3 | Cancel Check payment | 63 |

| 3.3.4 | Display the Check Register | 64 |

| 3.4 | Correspondences & Foreign Currency Revaluation | 64 |

| 3.4.1 | Vendor Correspondence Request | 64 |

| 3.4.2 | Maintain Correspondence | 65 |

| 3.4.3 | Foreign Currency Revaluation | 66 |

| 3.5 | Vendor Report | 68 |

| 3.5.1 | Display Vendor Balance | 68 |

| 3.5.2 | Vendor Line-Item Display | 71 |

| 3.5.3 | Vendor payment History with IO Sorted List | 73 |

3.6 | Vendor Invoice with Purchase Order | |

3.6.1 | Invoice Verification | |

4. ACCOUNTS RECEIVABLE | 75 | |

| 4.1 | Accounting Transactions in Accounts Receivable | 75 |

| 4.1.1 | Park Customer Invoice | 75 |

| 4.1.2 | Post Customer Invoice | 76 |

| 4.1.3 | Post Customer Credit Memo | 77 |

| 4.1.4 | Change Parked Document | 79 |

| 4.1.5 | Display Accounting Document | 80 |

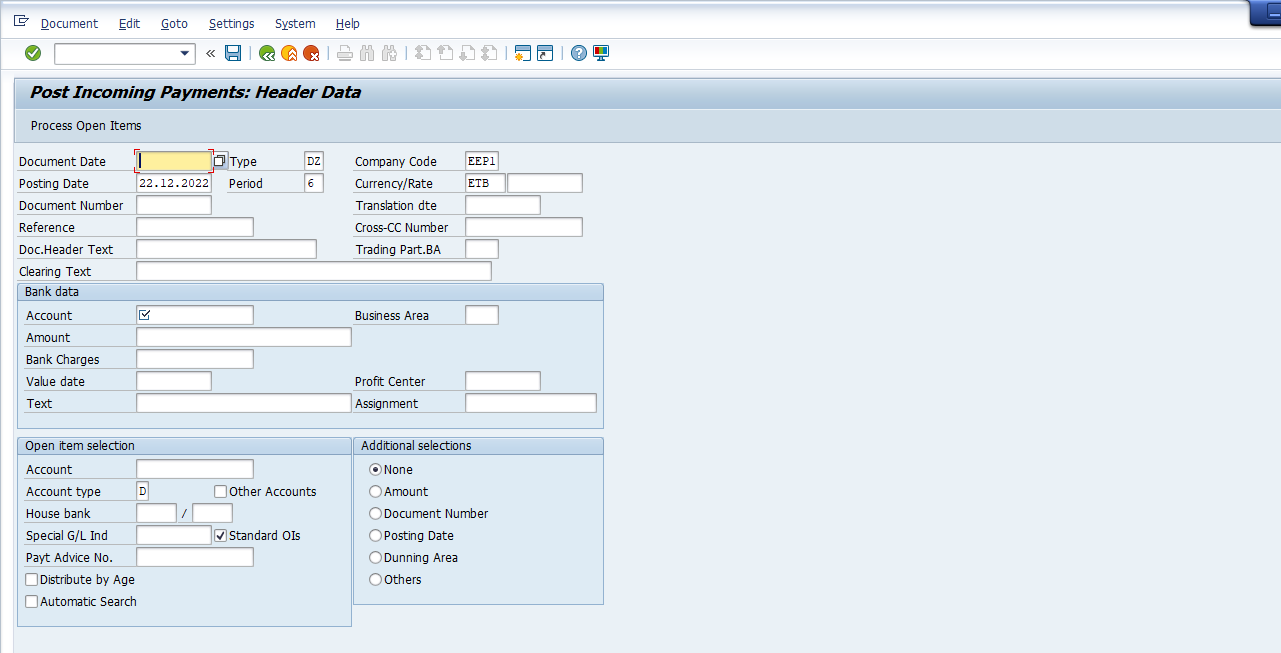

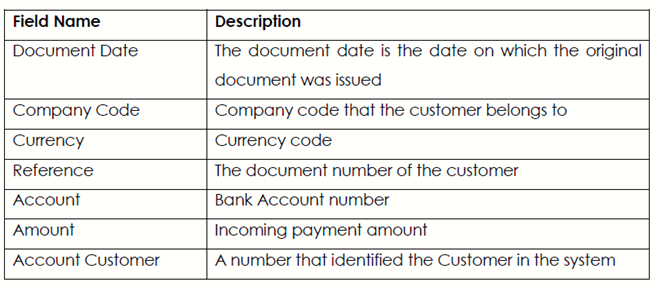

| 4.1.6 | Post Incoming Payments | 82 |

| 4.1.7 | Reset Cleared Items | 84 |

| 4.1.8 | Document Reversal | 86 |

| 4.1.9 | Clear Customer Account | 86 |

| 4.2 C | Customer Account Reports | 88 |

| 4.2.1 | Customer Balance Display | 88 |

| 4.2.2 | Customer Account Analysis | 90 |

| 4.2.3 | Display / Change Line Items | 92 |

5. BANK AND CASH | 94 | |

| 5.1 | Cash Journal (Petty Cash Transactions) | 94 |

| 5.1.1 | Recording a Cash Receipt | 94 |

| 5.1.2 | Enter an Expense Transaction | 96 |

| 5.1.3 | Reverse Cash Journal | 97 |

6. ASSET MANAGEMENT | 99 | |

| 6.1 | Overview of Acquire To Retire process | 99 |

| 6.2 | Asset Master Maintenance | 102 |

| 6.2.1 | Creating Fixed Asset Master Data | 102 |

| 6.2.2 | Change Asset Master | 102 |

| 6.2.3 | Display Asset Master | 103 |

| 6.2.4 | Lock Fixed Asset | 104 |

| 6.3 | Asset Accounting – Business Transactions | 105 |

| 6.3.1 | Asset Acquisition | 105 |

| 6.3.2 | View Asset Values | 109 |

1.INTRODUCTION

1.1 Financial Accounting Overview

The Financial Accounting (FI) application component fulfills all the international requirements that must be met by the financial accounting department of an organization. It provides the following features:

Management and representation of all accounting data

All business transactions are recorded according to the document principle, which provides an unbroken audit trail from the financial statements to the Individual documents.

Open and integrated data flow

Data flow between Financial Accounting and the other components of the SAP System is ensured by automatic updates

Data is available in real time within Financial Accounting. Postings made in the subledgers always generate a corresponding posting in the general ledger.

Preparation of operational information to assist strategic decision-making within the organization

Integration of Financial Accounting with other components

All accounting-relevant transactions made in Logistics (LO) or Human Resources (HR) components are posted real-time to Financial Accounting by means of automatic account determination. This data can also be passed on to Controlling (CO).

This ensures that logistical goods movements (such as goods receipts and goods issues) are exactly reflected in the value-based updates in accounting.

Integration within Financial Accounting

Every posting that is made in the subledgers generates a corresponding posting to the assigned G/L accounts. This ensures that the subledgers are always reconciled with the general ledger.

Features

The Financial Accounting application component comprises the following subcomponents:

- General Ledger (FI-GL)

- Accounts Payable (FI-AP)

- Accounts Receivable (FI-AR)

- Bank Accounting (FI-BL)

- Asset Accounting (FI-AA)

1.2 Structures in SAP Finance

Ledgers

New General Ledger Accounting, unlike Classical general ledgers, enable parallel Accounting to meet the requirements of several, varying accounting principal requirements. For example, in a globalized environment, an international business may produce one Statement to suit IFRS, GAAP, etc. SAP has only one leading ledger (that corresponds to the local accounting principle eg. IFRS) yet at the same time may have Non-Leading Ledger to enable reporting to meet GAAP.

Chart of Accounts and Company code

Chart of Accounts is a variant that contains parameters for General Ledgers. These are assigned to the Company Code before the Company Code can be used.

2.GENERAL LEDGER

2.1 Finance Organizational Structures & Master Data General Ledger Accounting

General ledger accounts are master data that is used in day-to-day transaction processing in various modules of the SAP ERP system.

Each general ledger is set up according to a chart of accounts. The chart of accounts contains the definitions of all G/L accounts in an ordered form. The definitions consist mainly of the account number, account name, and the type of G/L account, that is, whether the account is a P&L type account of a balance sheet type account.

The general ledger contains a record of all relevant accounting transactions from a business point of view in the G/L accounts. In order to keep a clear overview, the general ledger often only contains collective postings.

In such cases, the information posted is displayed in more detail in the subsidiary ledgers, which provide their information to the general ledger in summarized Form.

There are various methods of creating the general ledger master record but before its creation there are requirements that need to be fulfilled first:

Master data must be maintained centrally to ensure data integrity.

2.2. Accounting Transactions in General Ledger

Transaction processing in General Ledger will relate to processing of General Ledger journals and performing account enquiries in the General Ledger.

You can comfortably create and post a G/L account document using a one-screen transaction. The entry screen is divided into the following areas:

- Header data (here, the data for the document header is compiled) Line-item information (here, the line items for the document are entered)

- Information area (here, the debit and credit totals are displayed) Apart from the single screen general ledger accounting transactional processing SAP also offer the general parking and posting methods and it is necessary to have a good command of how it operates.

In the initial screen, you enter the data for the document header. Additionally, you enter the posting key and the account for the first line item. The posting key provides the system with information regarding the account type (G/L account, customer, vendor, asset, material) and determines the layout of the entry screen for the line item.

With this information, the entry screen for the first line item is set up. You enter the data for the first line item and access the next screen by entering the posting key and account for the next line item.

In the next screen, you enter the information for the second line item and continue to the next line item(s) as needed in the same manner. Journals can also be processed in foreign currency in the general ledger.

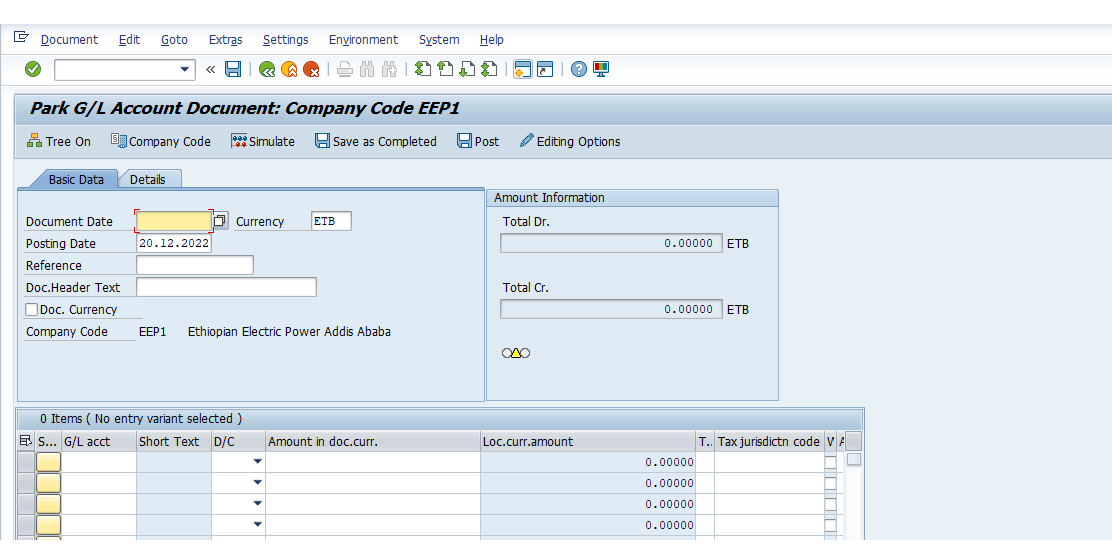

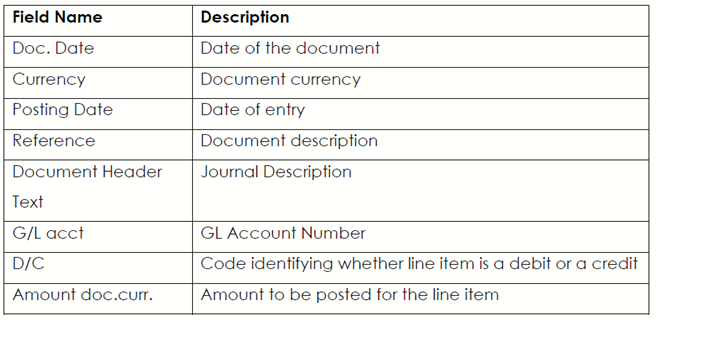

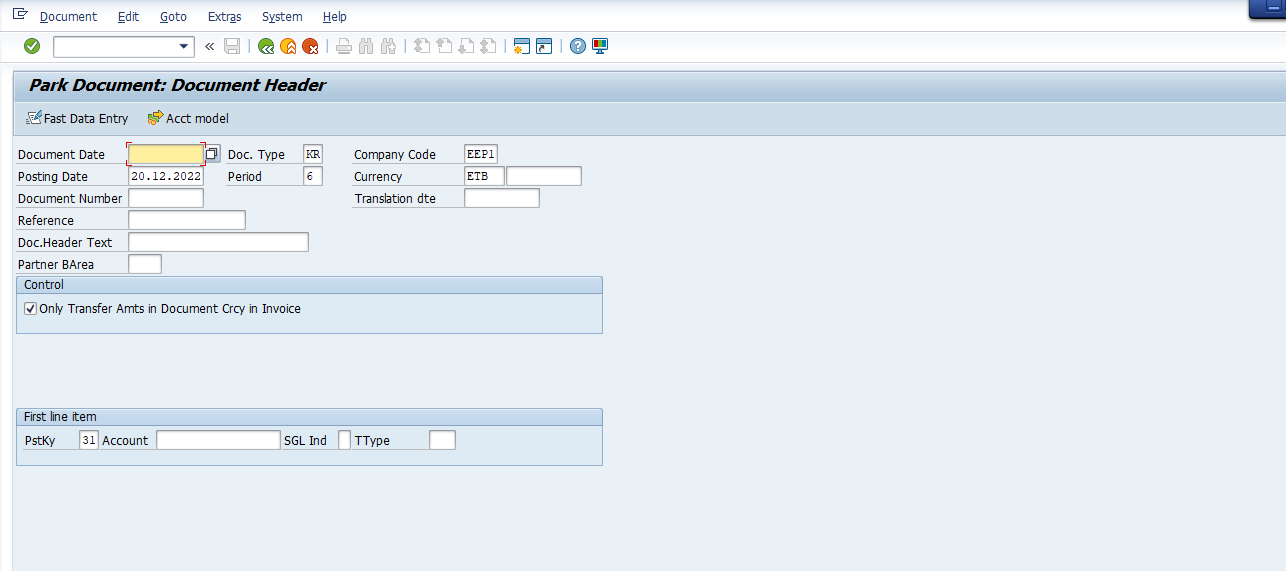

2.2.1 Park Document – FV50

Journals that have been parked need to be checked before they are posted (approved) in the system. The system allows you to change parked document in the event that it contains some errors.

Steps:

1.Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → General Ledger → Posting → Edit / Park GL document

1. Update the following required and optional fields

2. Click on the Enter button

3. Click on Save as Completed button to record you changes.

4. A message will appear on the status bar: Document no. xxxxxxx was parked

5. Click on the Back button to go back to SAP Easy Access screen.

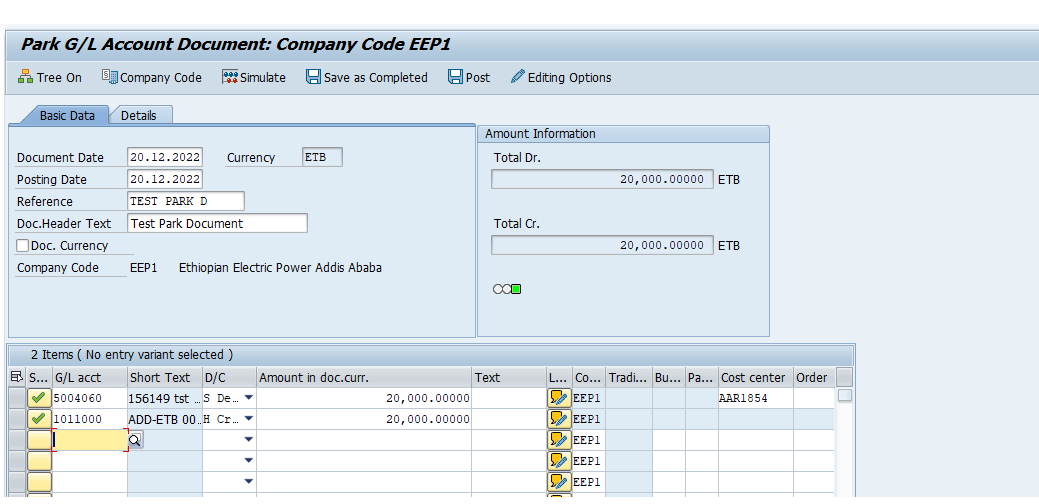

2.2.2. Post Parked Document – FBV0

Posting is similar to signing a document and is a supervisory function therefore you are also required to subject the parked journal to scrutiny before approving by posting.

After parking journals are checked, and if they are correct, they will be posted.

Steps:

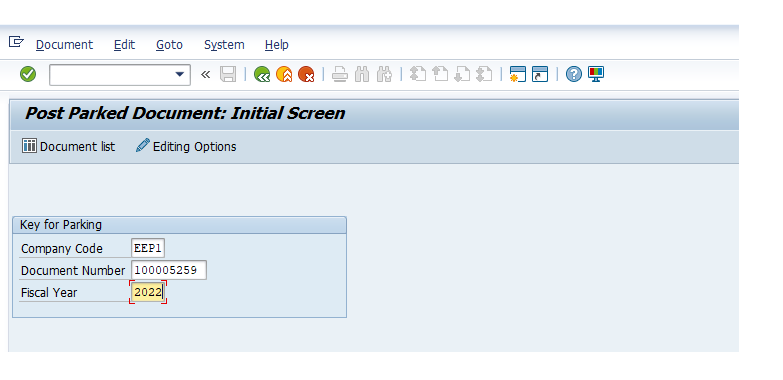

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → General Ledger →Documents → Parked Documents → Post/Delete

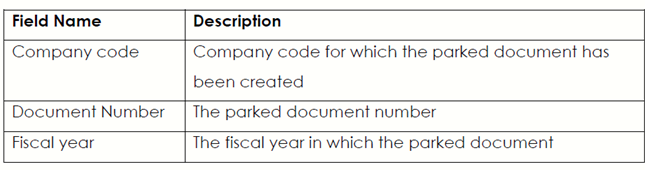

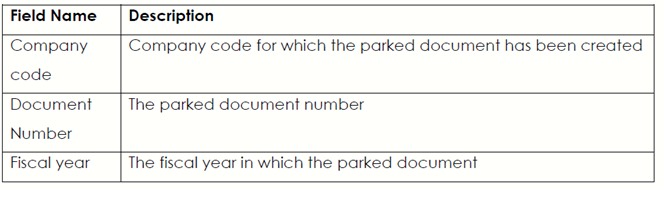

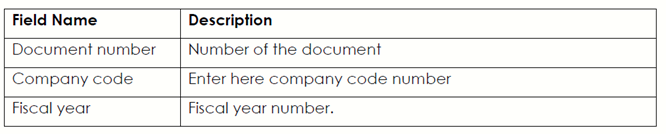

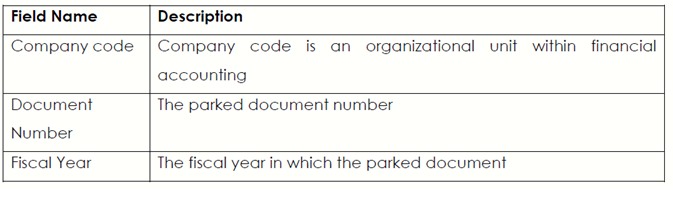

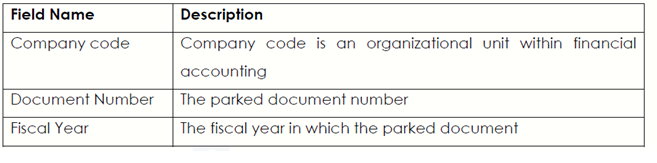

2. Update the following required and optional fields:

3. Click on the Enter button:

4. Click on Simulate button to simulate the posting

5. Click on the Back button

6. Click on the Post button

7. A message will appear informing you that a Document number was posted in company XXXX.

Note : you can post other journals from this screen without exiting to the post document initial screen.

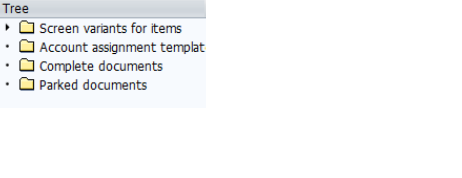

8. Click on the Tree on button

9. Click on the Parked documents arrow

10. Select the Parked document to be posted by double clicking on it.

11. Click on the Post button

12. A message will appear informing you that a Document no. beginning with number XXX was posted in Company code XXXX

13. Click on the Enter button

14. Click on the Exit button or press Shift-F3 until the SAP Easy Access screen is displayed

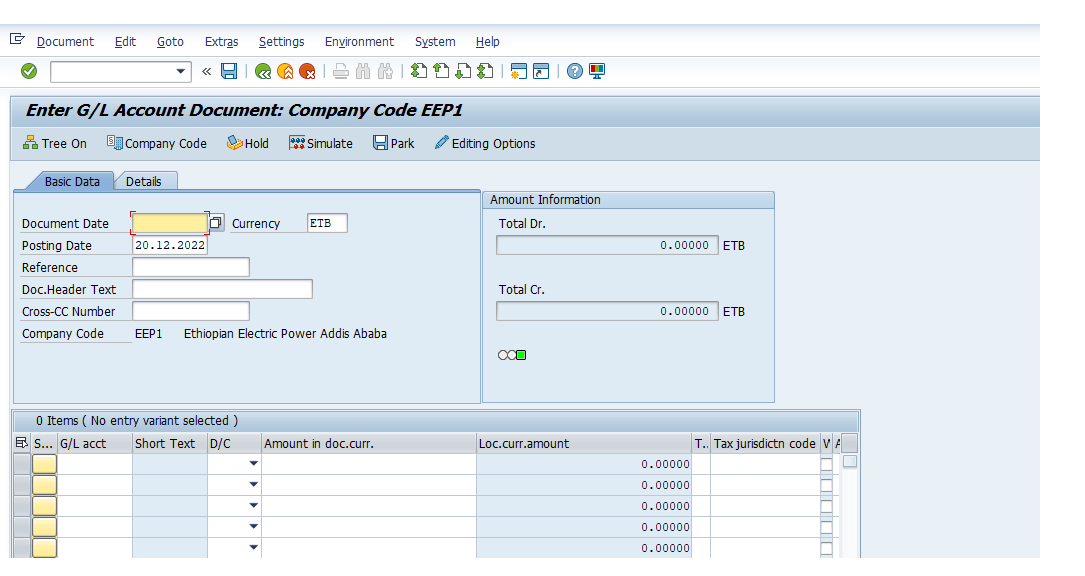

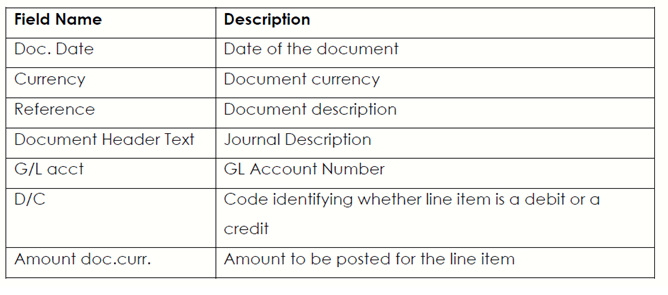

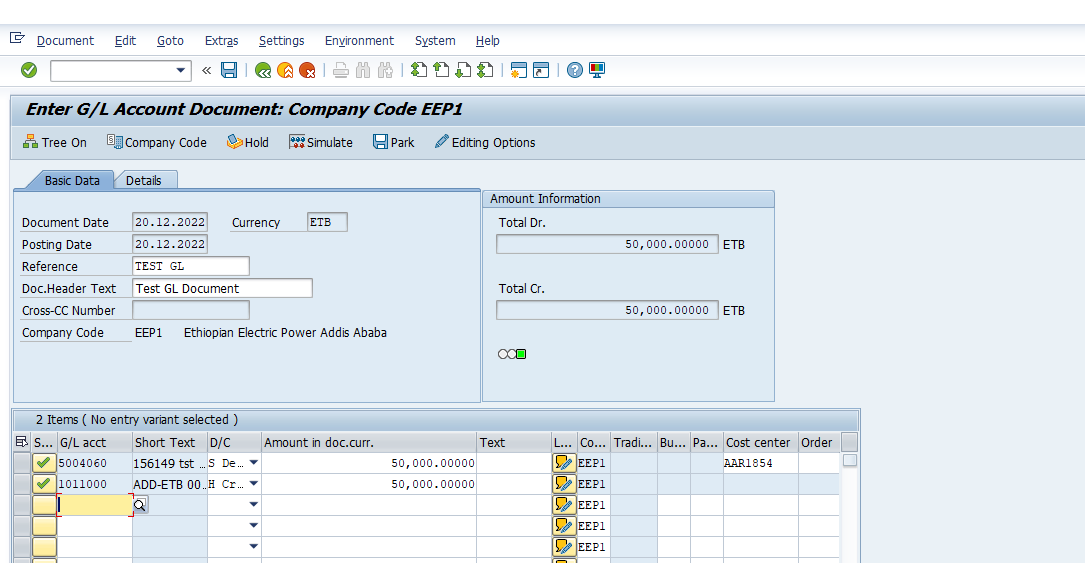

2.2.3. Enter General Ledger Account Document – FB50

The SAP System allows you to carry out postings direct into the General Ledger accounts without going through the parking functionality please note that this depends on the roles assigned to you.

Steps :

1. Access transaction by :

SAP Access Menu → Accounting → Financial Accounting → General Ledger → Posting → Enter GL Account Document

2. Update the following required and optional fields:

3. You can Simulate document before posting. To do so, click Simulate button. Simulation enables the user to review the journal as if it had been posted including any system generated postings. The system also validates the posting data.

4. Click Back button

5. To Post the document, click Save button.

6. The system will generatea document number please take note of that number.

7. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

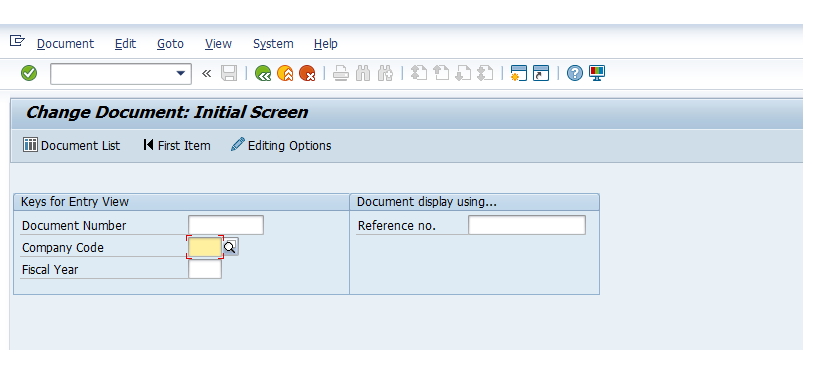

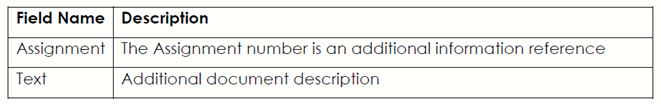

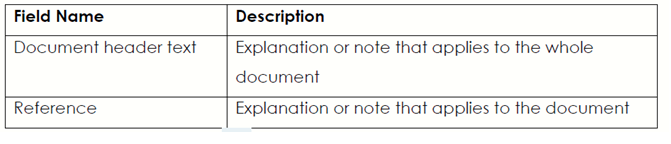

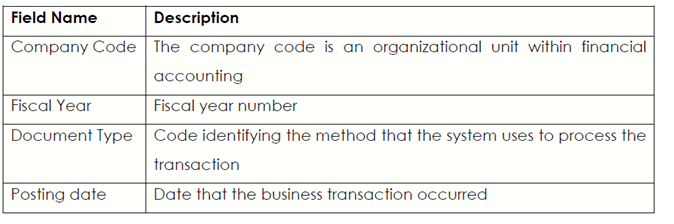

2.2.4. Change General Ledger Accounting Document-FB02

Transaction fed in by other modules especially from logistics, lack certain information.

You are required to add more information to the automatically created financial documents, e.g., Text field, via document change. SAP system allows you to change certain fields these are text, assignment, document header text and reference fields.

However, amount and account fields cannot be changed.

Steps:

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → General Ledger →Document → Change

2. Enter the Document number xx0000xxx

3. Enter the Company Code XXXX

4. Enter the Fiscal Year XXXX or leave field blank

5. Click on the Enter button to proceed.

6. Double click on the First line item to make changes.

7. You can change the contents of the following fields

8. Click on the Document header button Botton or press F5

9. You can change the contents of the following fields:

10. Click on the Continue button or press Enter

11. Click on the Save button or press Ctrl+S

12. A message will appear on the status bar informing you of what has happened to the document you changed.

13. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access Screen.

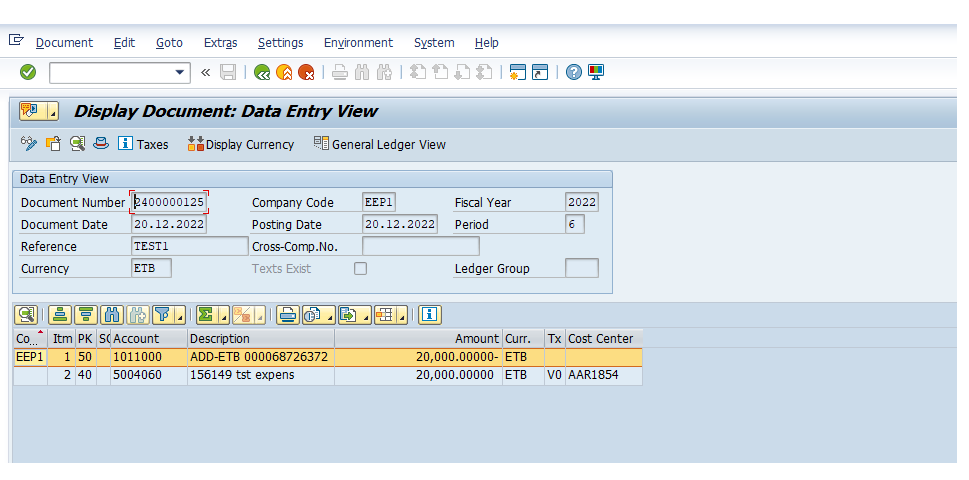

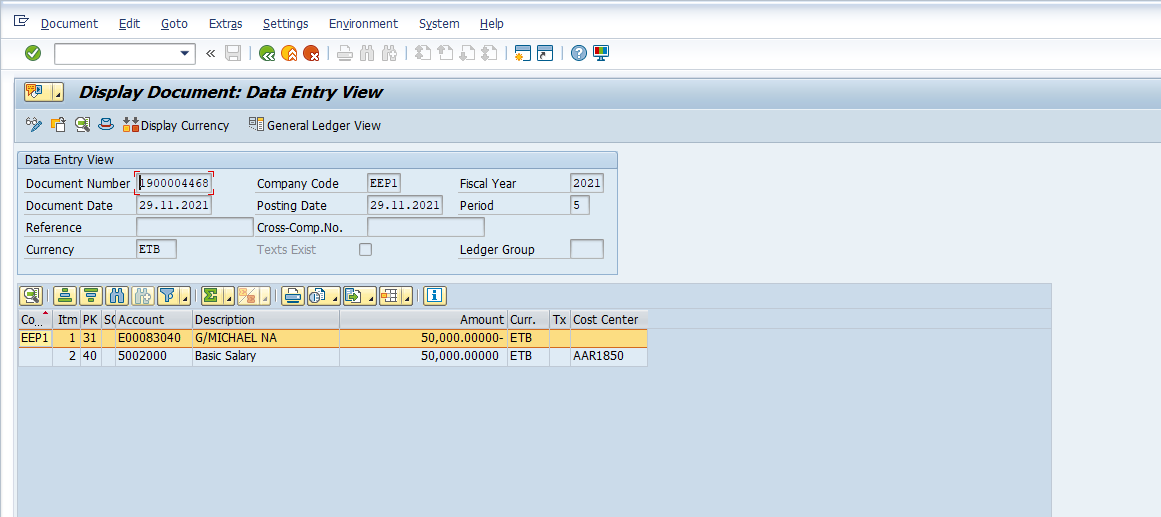

2.2.5. Display General Ledger Document – FB03

Journals can be displayed by authorized users at any time by using display GL Journal transaction. Users can search for the specific journal using a number of search criteria including document number, journal date, type, user and generally any other information on the original journal.

This function aids users in executing general ledger document queries and users candisplay single journal or journal lists.

Steps:

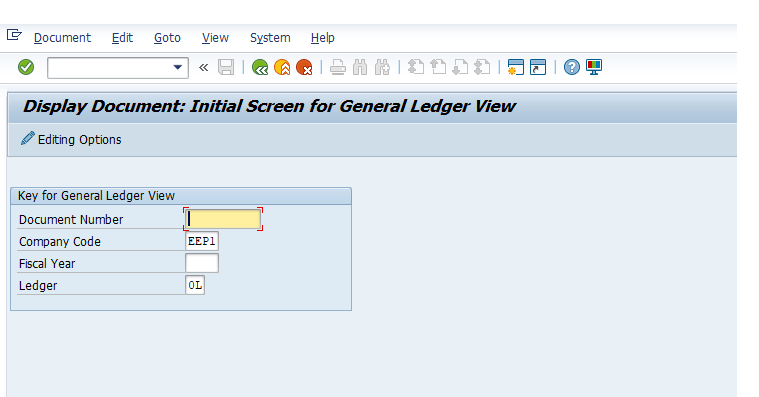

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → General Ledger →Document → Display

2. Enter the Document Number xx000000xx

3. Enter the Company Code XXXX

4. Enter the Fiscal Year XXXX or leave field blank.

5. Click on the Enter button to proceed.

6. Click on the General Ledger View button to change you screen view.

Note: the system will show you more fields not shown under entry view

7. Click on the Document header button

8. Analyze it and Click on the Enter Continue / Confirm button to leave the displayed document header sub screen.

9. Click on the Back button to the display document initial screen. Use document search function:

when you don’t know the document number.

10. Click on the Document List button.

11. Enter the Company Code XXXX

12. Enter the Fiscal Year XXXXX

13. Enter in the dd.mm.yyyy to dd.mm.yyyy posting date field.

14. Click in the Own documents only check box

15. Click on the Execute button to proceed and a list of the documentsthat you processed will be displayed

16. Double click on the Document number to view other details

17. To exit this transaction, click on the Exit button or press Shift-F3 until the SAP Easy Access screen is displayed.

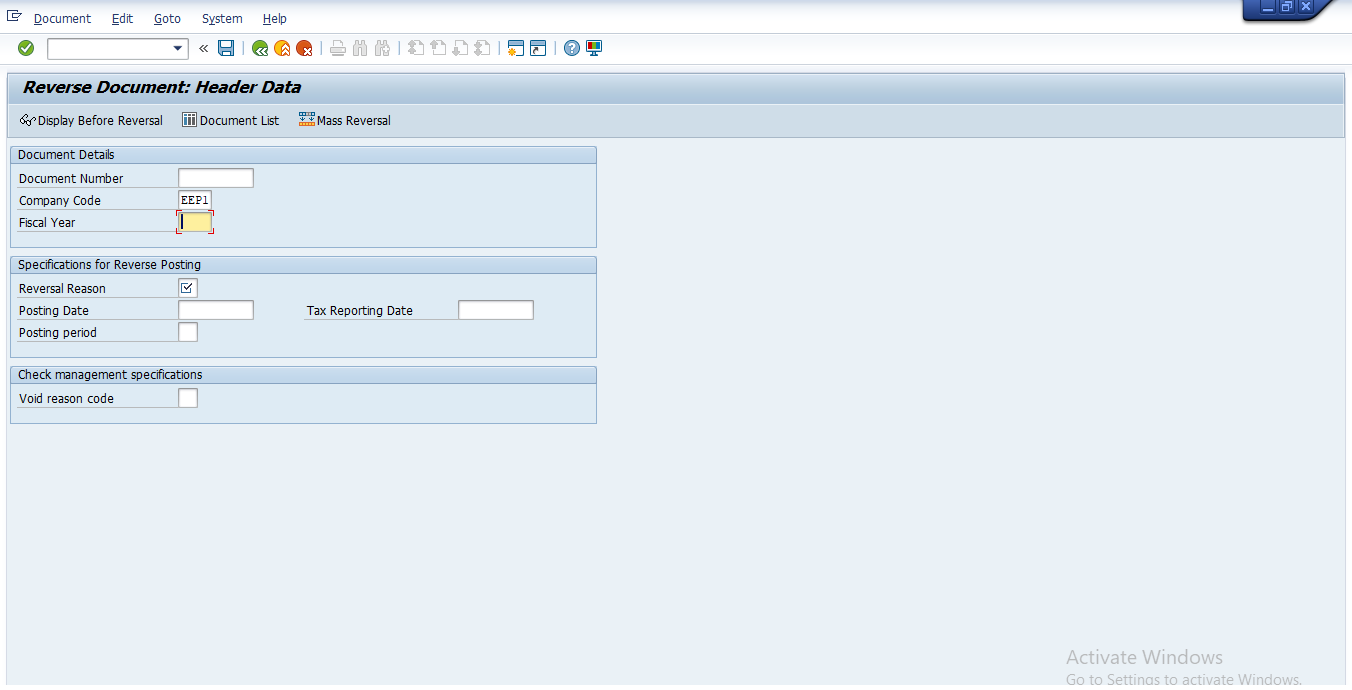

2.2.6. General Ledger Document Reversal – FB08

The General ledger journal you posted earlier was posted to the wrong accounts. Reverse the journal and re Park and post to the correct accounts. The reversal document posts ‘opposite’ entries to the ledger.

The system offers various ways of reversing journals the “automatic reversal” processor the manual reversal process. The manual process involves (credit memo) parking, checking and posting with complete opposite posting keys to the original document.

Steps:

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → General Ledger → Document → Reverse → Individual Reversal

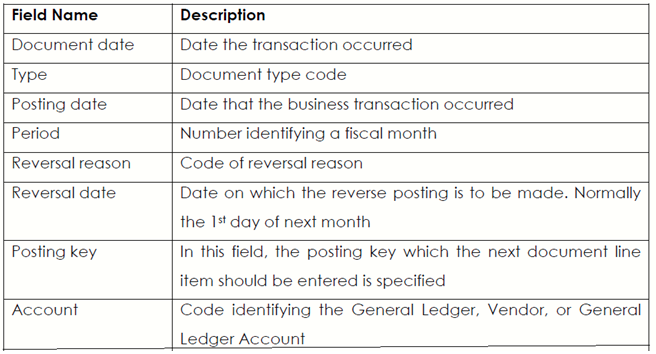

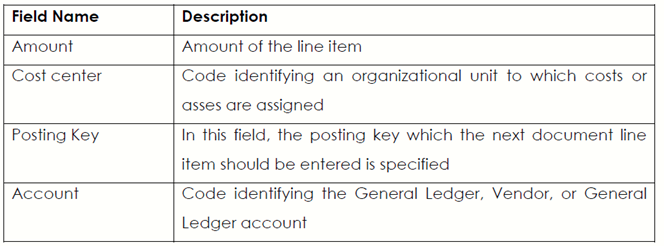

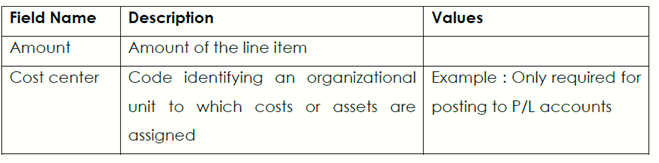

2. Update the required and optional fields by capturing the necessary data:

2.1. Update Reversal Reason the Document to be Reversed

3. Click the Enter button to confirm the entries.

4. Click the Display before reversal button to have an overview of the document you about to reverse.

5. Click on the Back button

6. Click on the Save button or press Ctrl+S to post the reversal.

7. A message will appear on the status bar: Document no. XXXX was posted inCompany Code XXXX

8. Click on the Exit button or press Shift + F3 to return to the SAP Easy Access screen.

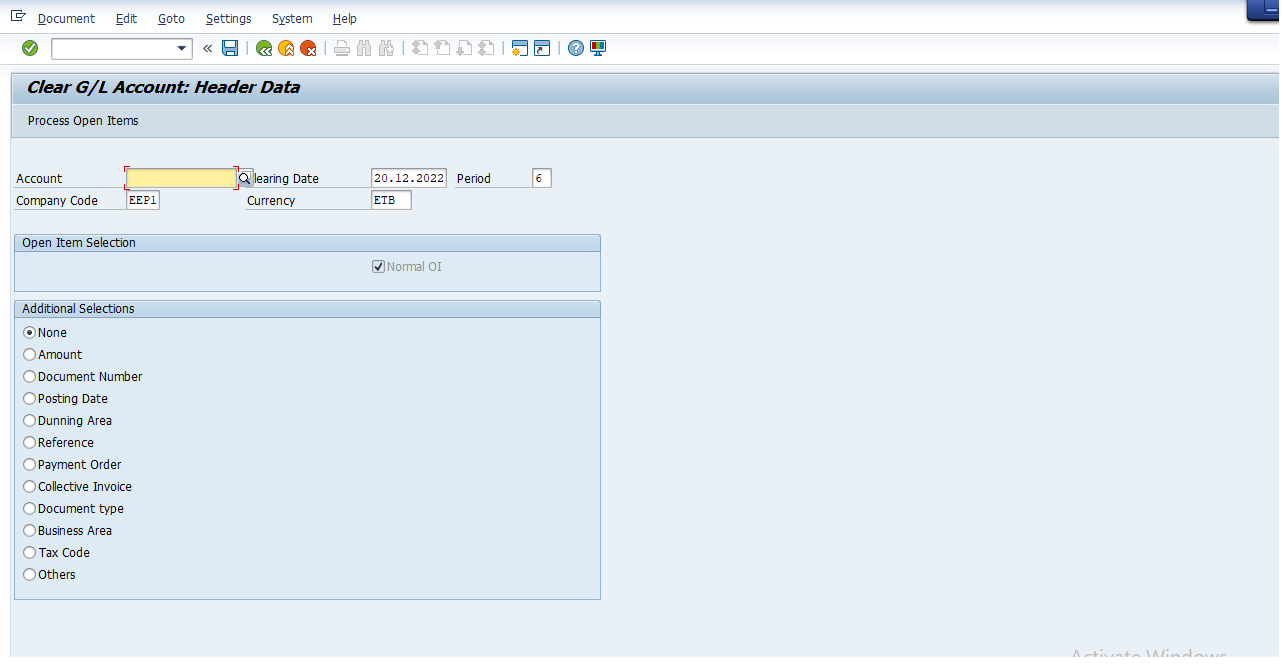

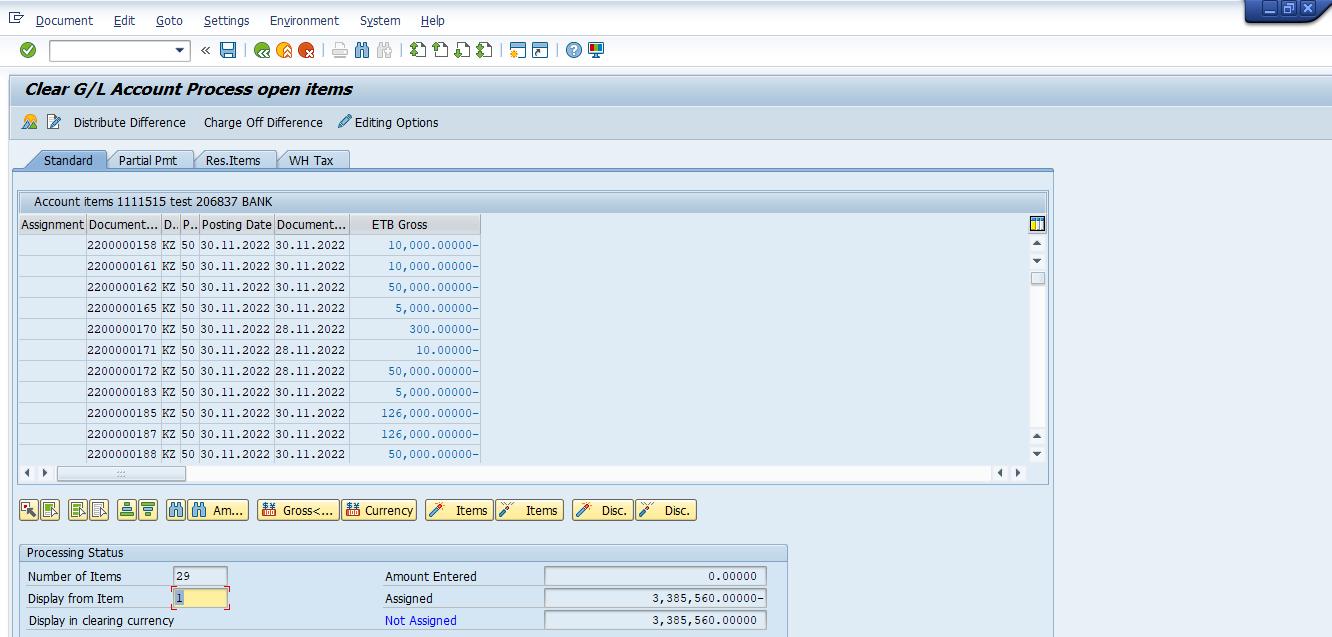

2.2.7. Clear General Ledger Account – F-03

Some GL Accounts are managed as Open Item accounts. The system provided a clearing function that allows assigning and ‘clearing’ of debits to credits based on legitimate assignment reasons. Unmatched items therefore remain on the account as OPEN and represent the balance of the account to be reconciled. The clearing can be made at the time of the second posting, or alternatively later on After the debit and credit have been posted to the account.

Note: For the general ledger account to be cleared OPEN item management must be active. Refresh memory G/L master data creation

There are some postings in G/L (General Ledger) that have not been cleared. You want to clear these posting.

Steps:

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → General Ledger → Account → F-03 Clear

2. Update the following required and optional fields:

Note: This function differs from posting with a clearing transaction or posting with a payment in the following ways: You do not need to enter a document header. You can only clear open items from one general ledger account.

3. Click on the Process open items button or press Shift+F4. The system will display open items that fulfill previously entered criteria:

4. Choose and Select the items you want to clear. Double click on each of the items. The system will highlight these items in blue. When the value in the field “Not assigned” is equal to “0”, you can clear open items. If the value is not zero, the difference in the amount must be treated as partial or residual items.

5. Check your document before posting. Select Document → Simulate.

6. Click on Save button or press Ctrl + S

7. A message will appear on the status bar that Document no. XXXX was posted in Company Code XXXX

8. Click on the Back button or press F3.

9.Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen

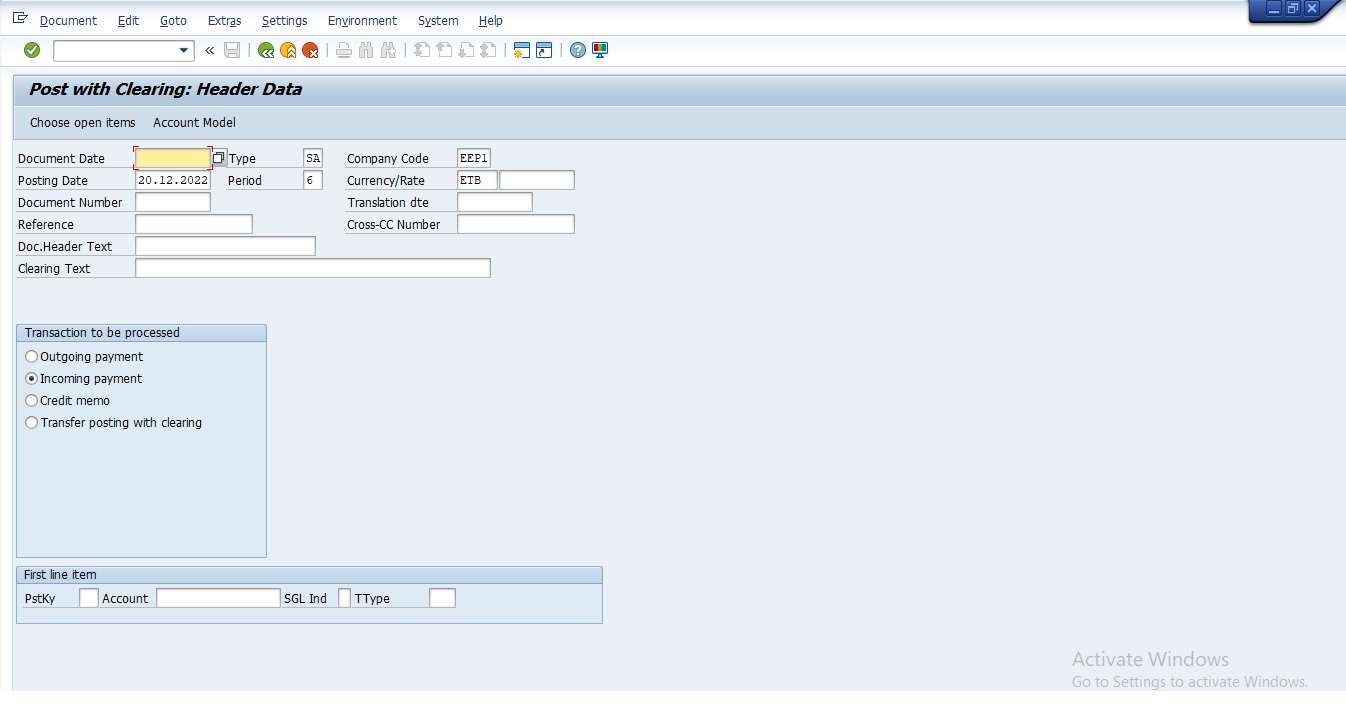

2.2.8. Post with Clearing – F-04

The SAP system allows you to post a transaction and at the same time clear the account(s) that are involved.

Steps:

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → General Ledger → Posting → Post with Clearing

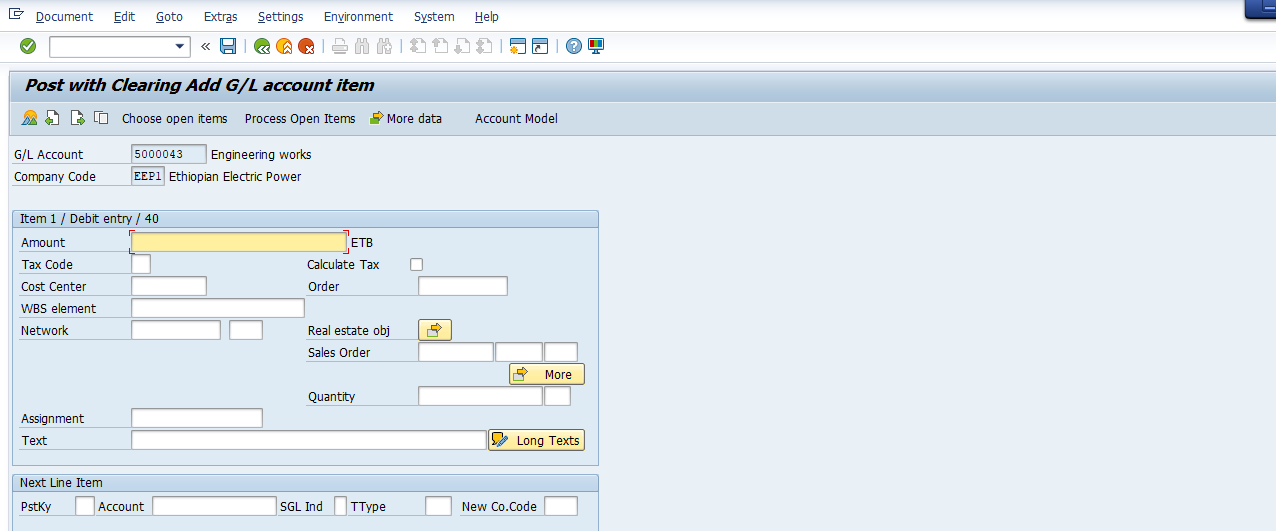

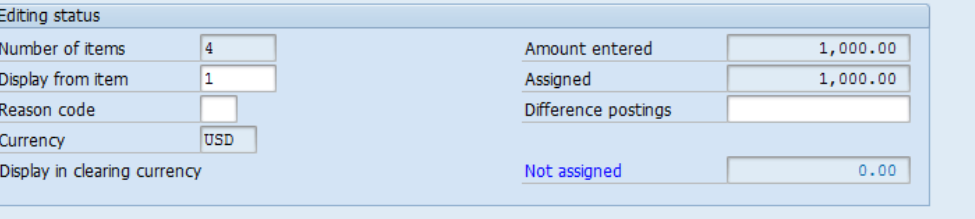

2.Update the following required fields:

3. Click on the Incoming Payment Radio button

4. Click on the Continue button or press Enter

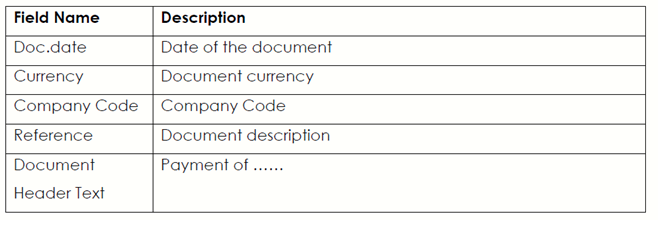

5. Enter Amount xxxxxx in the amount field.

6. Enter Appropriate profit/Cost Centre.

7. Click on the Choose open items button

8. Enter General Ledger account xxxx in the account field

9. Click on the Process open items button

10. All open items are selected by default. To deselect the items first click the Select All button.

11. Then click Deactivate items button. All the open items are now deactivated (they are no longer highlighted in blue)

12. Now you need to choose and select the items you want to clear. Double click on the Gross field for each of those items to be cleared.

13. You will need to select one or more documents to balance this clearing Scroll through the remaining documents and select this document.

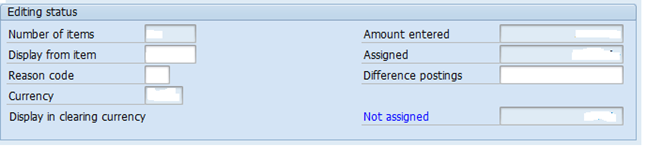

Note: The system will highlight these items in blue. When the value of the field not assigned is equal ‘0’ and you can clear open items. See scree below

14. To check your document before posting. Select Document → Simulate.

15. Click the Save button.

16. The message bar displays: “Document no. xxxxxxx was posted in company codeXXXX”

17. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

2.3 GL Period End Closing

The closing of a period is performed in three sets of steps: pre-closing, managerial closing and financial closing.

•Pre-Close activities ensure that all necessary entries have been posted in the General Ledger (G/L), including entries from feeder systems/sub ledgers and accruals and recurring entries posted directly to the G/L. Pre-close activities occur in both the old and new months.

• Managerial Close activities involve the re-assignment of costs throughout the entire organization, using the allocation and settlement functionality provided within Controlling (CO).

• Financial Close activities include final adjustments to valuations and balances prior to the Final close and preparation of reports. Adjustments from the cost flows recorded in the managerial closing activities are updated to FI through the reconciliation ledger posting.

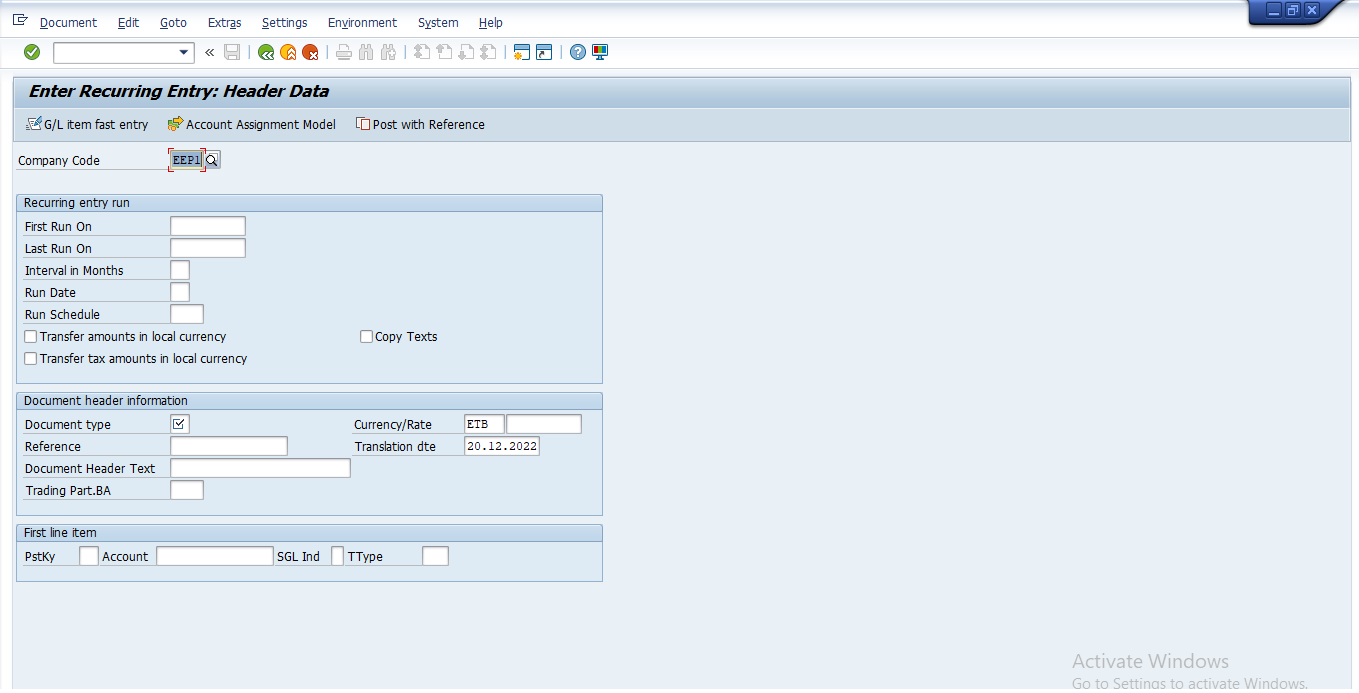

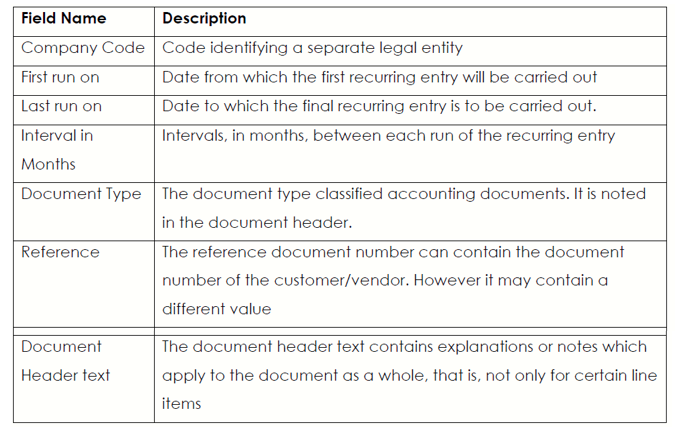

2.3.1. Create Recurring Entry Document – FBD1

The recurring entry document function automates postings of transactions that repeat every month (same amount, same account) such as payments for rent or interest, legal fees, and property taxes, It is not a ‘real’ accounting document and therefore does not affect the account balance.

The system uses the recurring entry original document that you create as a reference when you execute the recurring postings at period end. It will automatically generate the accounting documents and posting

Steps:

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → General Ledger → Posting → Reference Documents → Recurring Document →Create

2. Update the following required fields:

3. Call up fast entry screen by clicking on Fast Data Entry button.

Note: A message will appear on the status bar informing you that documentxx0000xx was stored in Company Code XXXX

5. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

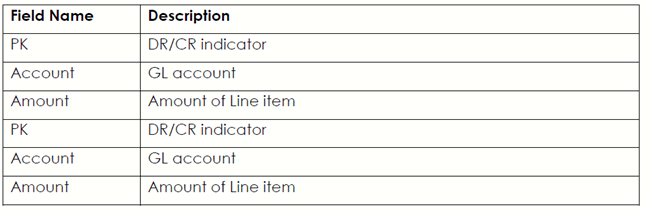

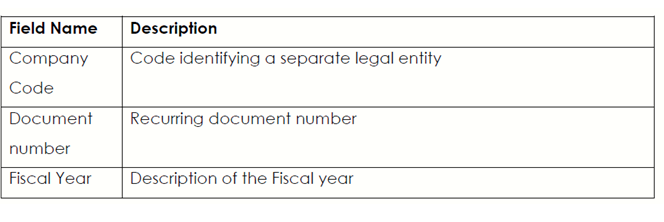

2.3.2. Change Recurring Document – FBD2

The recurring entry document function automates postings of transactions that repeat every month (same amount, same account) e.g., Accruals / Deferrals postings. It is not a ‘real’ accounting document and therefore does not affect the account balance.

Steps:

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → General Ledger → Document → Reference Documents → Recurring Document → FDB2 - Change

2. Update the following required fields:

2. Update the following required fields:

3. Click on the Continue button or press Enter

4.Double click on the one of the document line items. 5. Click on the Document Header button.

6. Make the modification in the document header field

7. Click the Save button. A message will appear on the status bar informing you that document xxxx has been changed

8. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

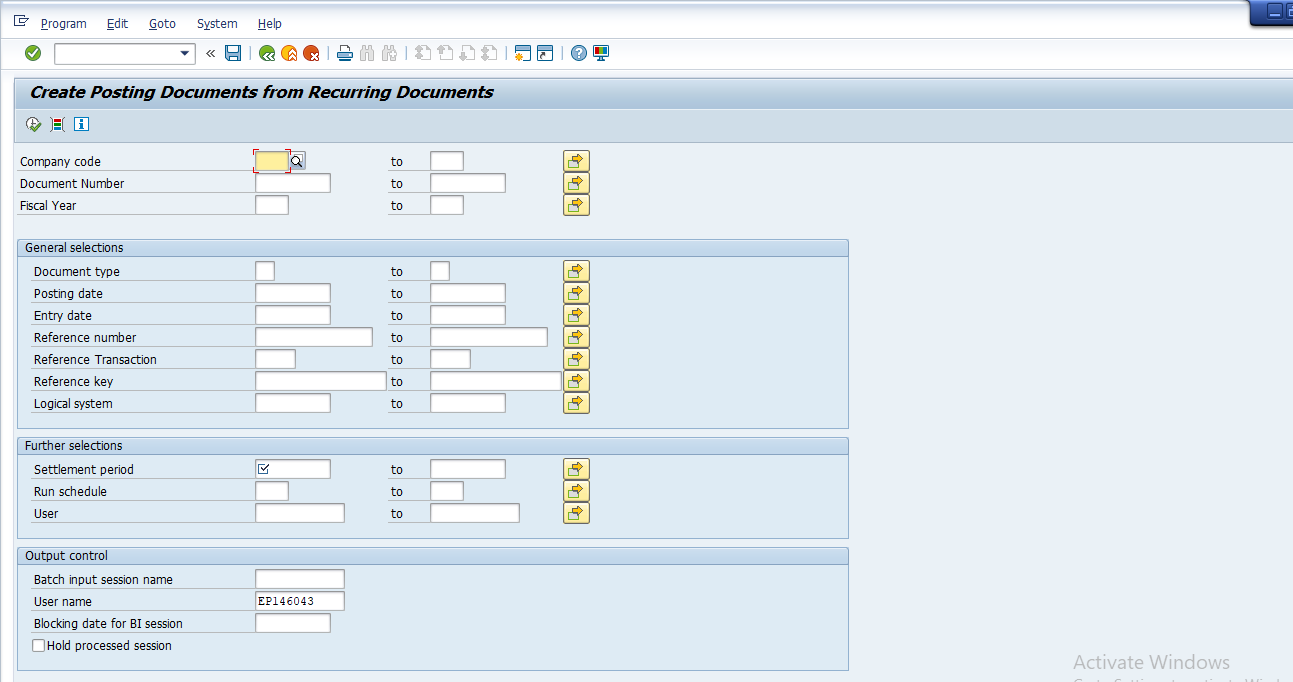

2.3.3. Create Postings from Recurring Documents – F.14

Recurring Journals are reference documents that have been created. They contain posting information that will be used by the recurring document posting program.

Steps:

Access transaction by:

SAP Access Menu Accounting → Financial Accounting → General Ledger → Periodic Processing → Recurring Entries → Execute

2. Update the following required fields:

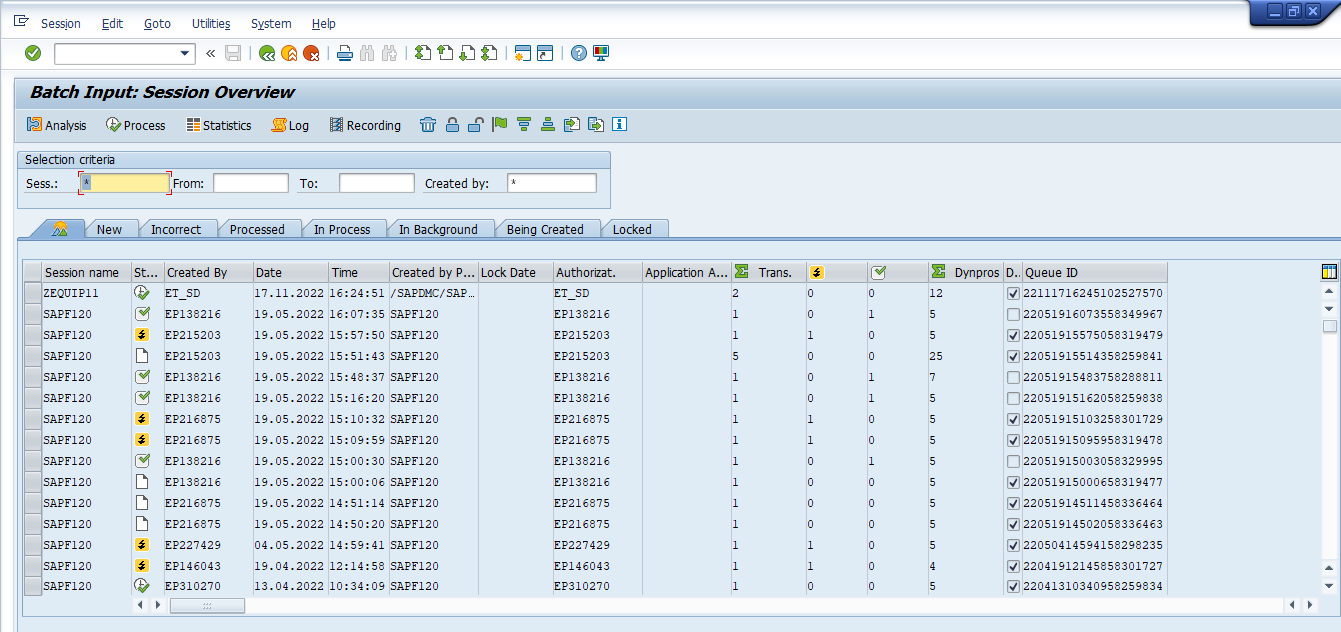

3. Press Execute button the system will generate a message “Session SAPF120” has been created.

4. Click on the menu – System→ Services → Batch Input → Sessions

5. Update the following required and optional fields

Note: Processing Options

Process Foreground: the system will immediately generate the documents online. You will have to confirm every entry screen generated. Only recommended if you have a law volume of transactions and screens (see # of screens above) and you wish to verify the same of the transaction details directly.

Display Errors only: the system will process the transactions without displaying them online. However, if there are any errors or problems (e.g., GL account does not exist) the system will display this for corrective action.

Background: the system processes the transactions in background mode. This is generally the normal action and a “low priority processing” option. The system will process the data during times of ‘low’ system activity/priority. The system processes the job. Users have to check the job status and job log to verify that processing has been completed and without errors.

6. If there are several batches under your user select the one you want to process by clicking on it once.

7. Click on the Process button

8. Select the Radio Process /foreground button

9. Click on the Process button to commence processing.

10. Press Enter for each screen until you reach the Final screen where the system generates the message Batch input has been completed.

The system generates the transactions and screens based on the original recurring document.

11. Click on the Exit batch input button to return to the SAP Easy Access screen.

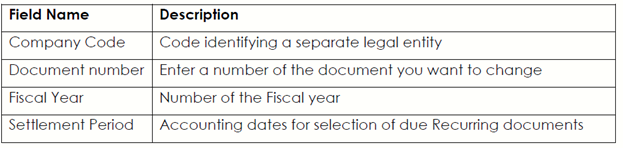

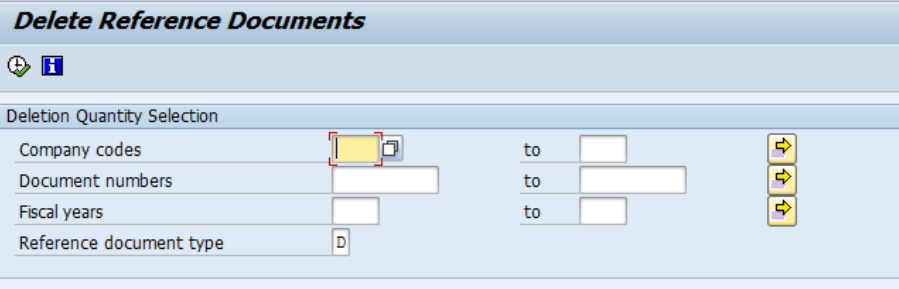

2.3.4. Delete Recurring Document – F.56

The recurring entry document function automates postings of transactions that repeat every month (same amount, same account) e.g. Accruals / Deferrals postings. It is not a ‘real’ accounting document and therefore does not affect the account balance.

A recurring document is no longer required. You will now delete the recurring document.

Note: - Before performing this, go to FBD2 (Change) give the recurring entry document number that you want to delete then click view select Recurring Entry Data and set the deletion indicator and save it.

Steps:

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → General Ledger → Document → Reference Documents → Recurring Document → Delete

2. Update the following required and optional fields:

3. Click on the Execute button

Note : The screen lists the Recurring Documents with deletion indicators selected will be displayed.

4. Click the Back button

5. Deselect the Test Run indicator

6. Click on the Execute button

7. A message will appear that this is a production run. Press enter to accept.

8. Click on the Execute button to check whether your deletion was successful.

9. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

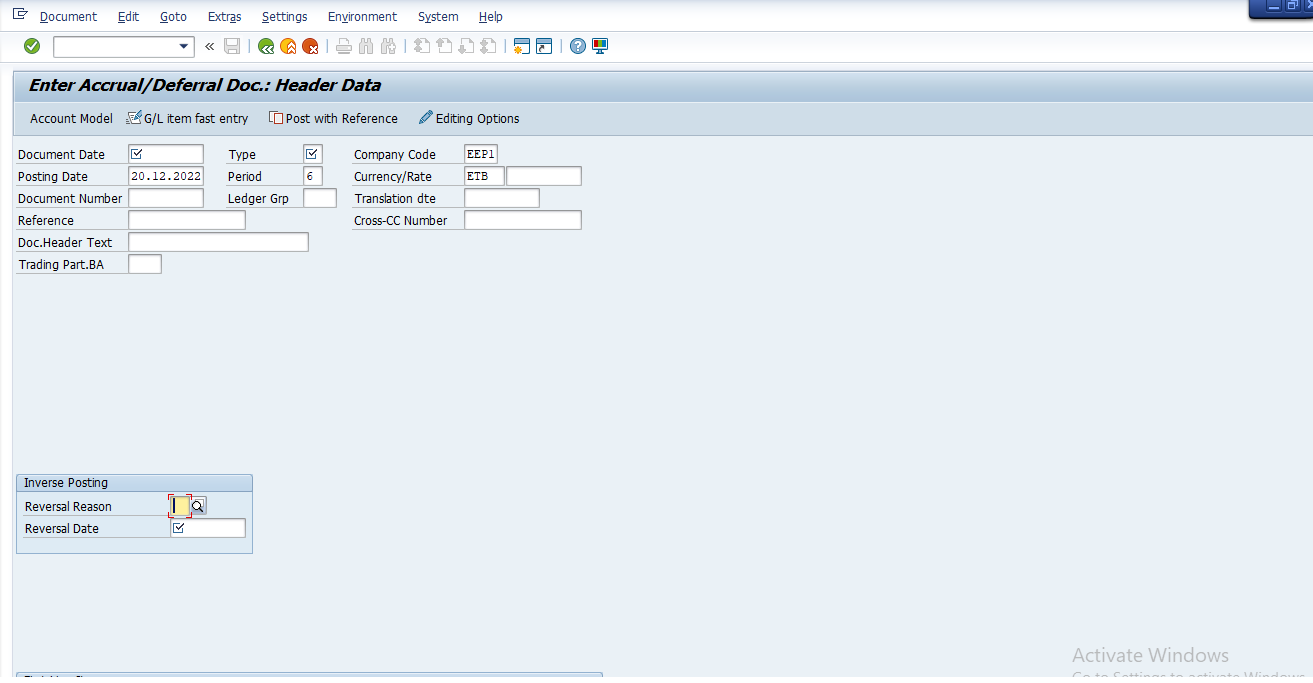

2.3.5 Enter Accrual/Deferral Document – FBS1

This function allows you to automatically post accruals and deferrals:

Accruals – an accrual is any expenditure before the closing key date, which represents an expense for any period after this date.

Deferrals – Deferred income is any receipts before the closing key date thatrepresent revenue for any period after this date.

Accrual/deferral documents are created and have a ‘reversal date’. The accruals can be reversed automatically.

Steps:

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → General Ledger → Periodic Processing → Closing → Valuate → Enter Accrual / Deferral Doc

2. Update the following required and optional fields:

3. Click on the Enter button to confirm your entries.

4. Update the following required and optional fields:

5. Click on the Enter button or press Enter to confirm your entries.

6. Select form the menu Document → Simulate

7. Click on the Save button or press Ctrl + S

8. A message will appear on the status bar: Document no. XXXXXX was posted inCompany Code XXXX

9. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

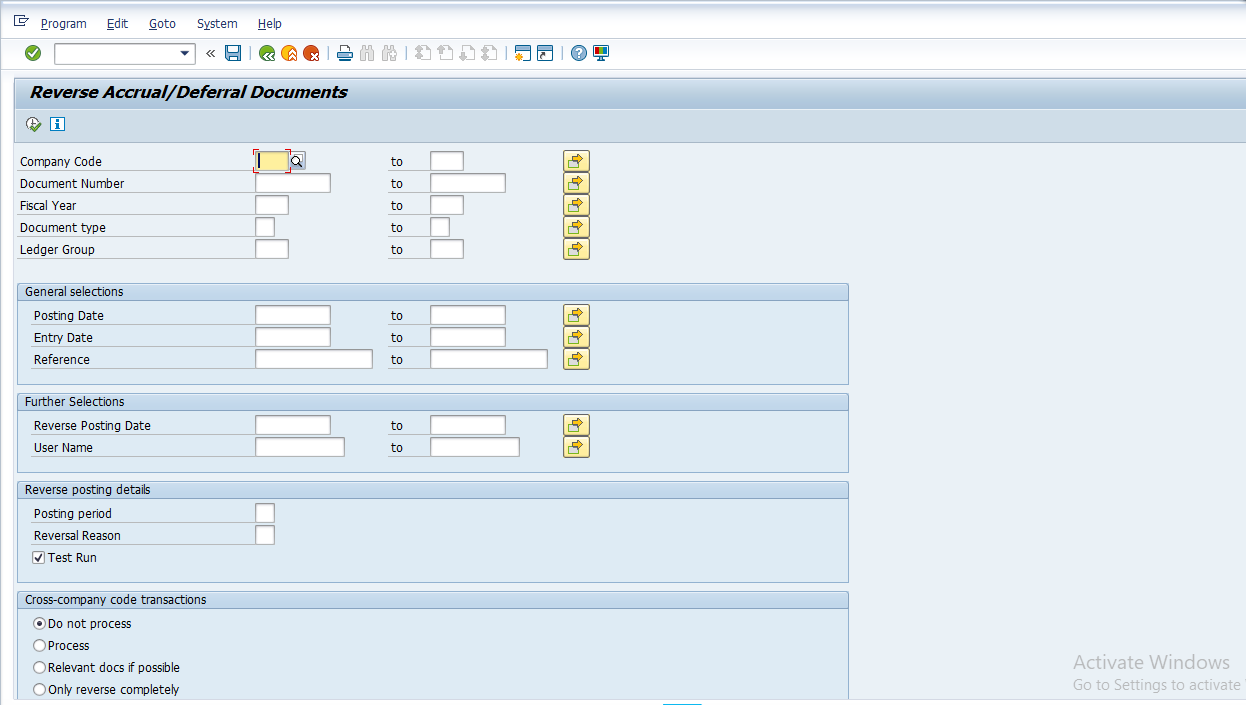

2.3.6 Reversing Posting for Accruals / Deferred Documents –

This function allows you to reverse previously posted accrual / deferral. The systemposts a reversal by entering an identical amount to the opposite side of the account, thereby offsetting the original amount.

Steps :

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Periodic Processing → Closing → Valuate → F.81 → Accrual / Deferral Document

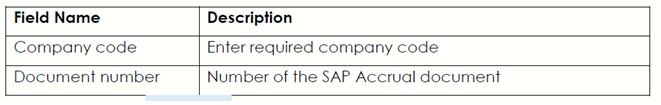

2. Update the following required and optional fields:

3. Click in the Test Run check box.

4. Click Execute button. The system will display a list of documents that are to be reversed.

5. Click on the Back button or press F3

6. Deselect Test Run check box

7. Click Execute button

8. A list will be displayed showing the original documents together with their reversal documents.

Note : a message will appear on the status bar: “ All documents werereversed”.

9. Click on the Exit button or press Shift+F3 to return to the SAP Easy Accessscreen.

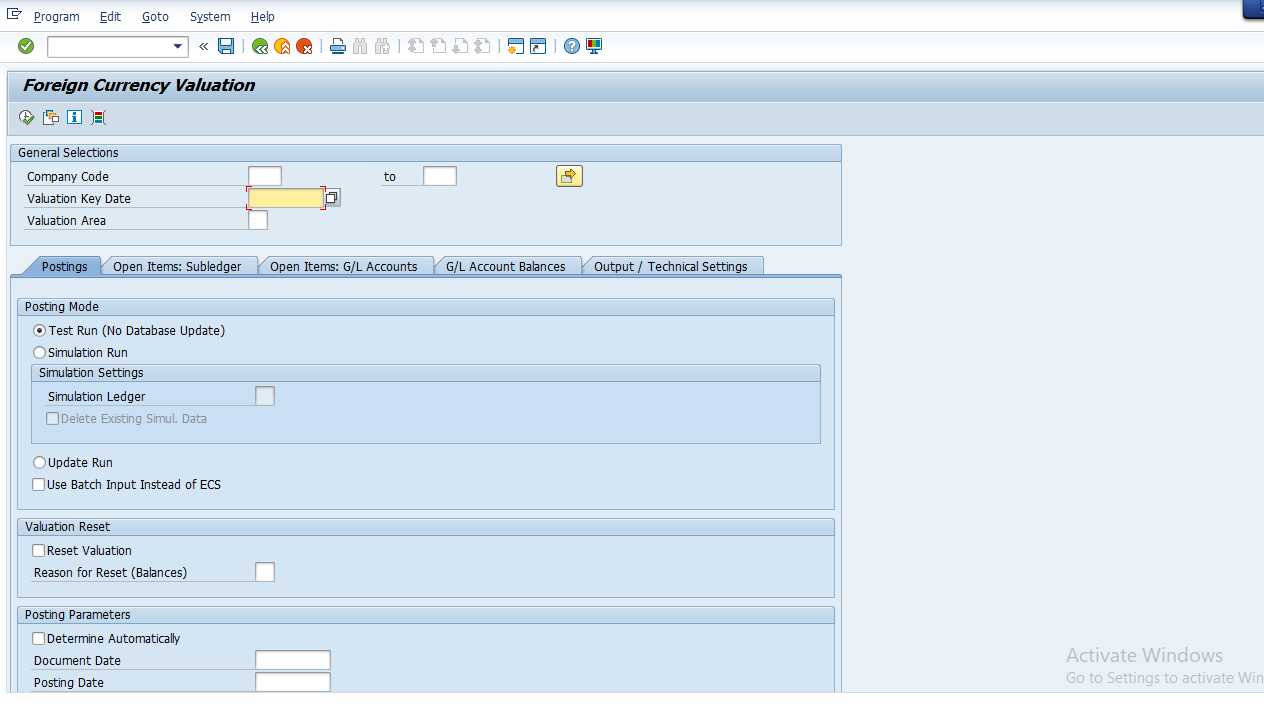

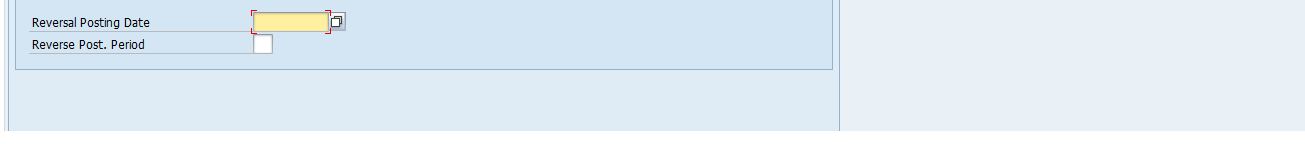

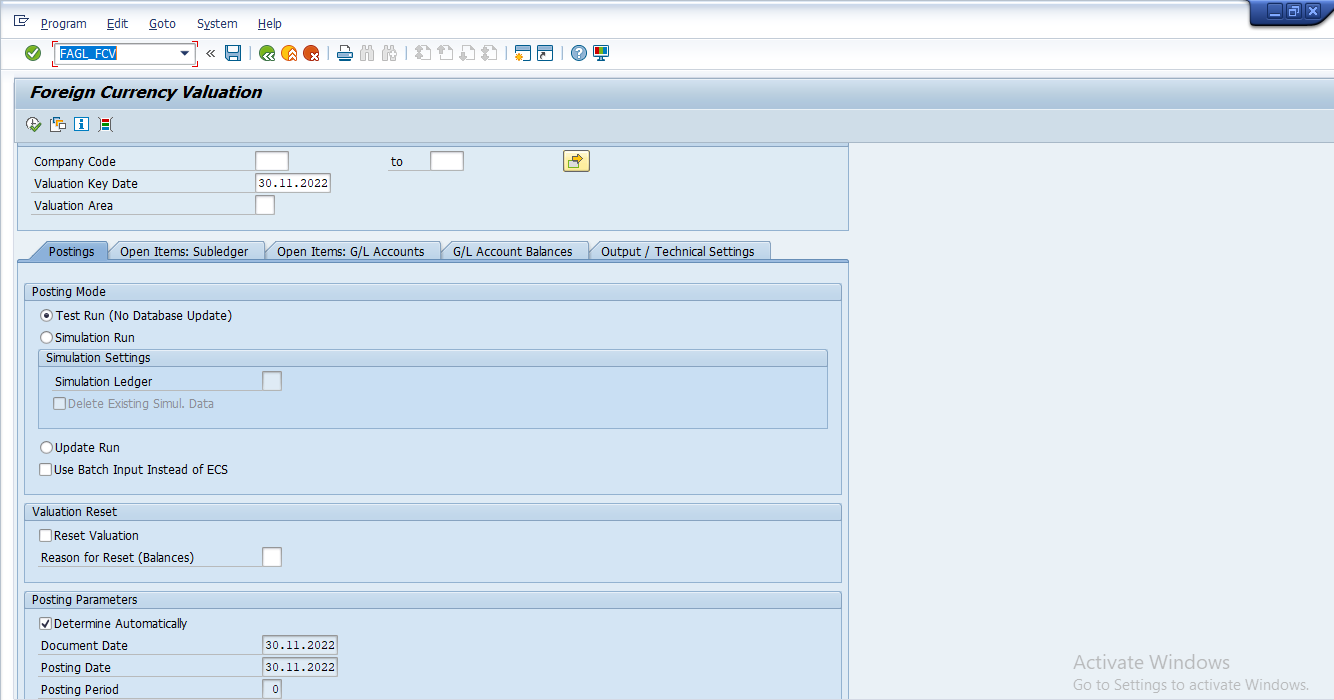

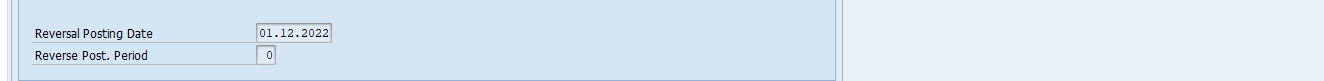

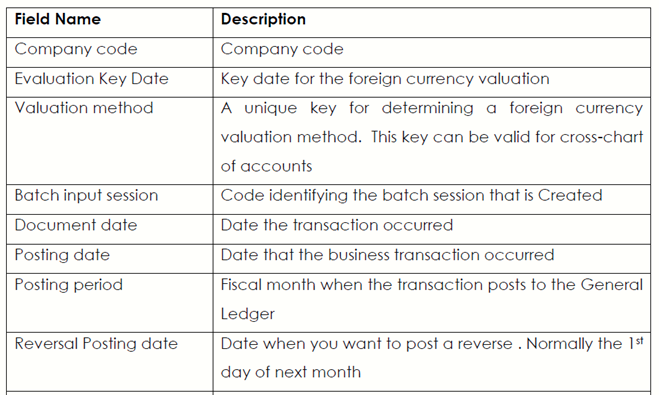

2.3.7. Foreign Currency Valuation – FAGL_FCV

You carry out the foreign currency valuation before you can create the financial statements.

The valuation includes the following accounts and items:

Foreign currency balance sheet accounts, that is, G/L accounts that you run in foreign currency (the balances of the G/L accounts in foreign currency are valuated) Open items (customers, vendors, G/L accounts) posted in foreign currency (the line items are valuated)

Steps :

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → Accounts Payable →Periodic Processing → Closing → Valuate → Foreign Currency Valuation of open items New)

3. Click on the Open Item tab

4. Select Valuate Vendor Open Items by clicking in the check box.

5. Select Valuate Customer Open Items by clicking in the check box, if so required.

You can select only particular General Ledger / General Ledger accounts to be valuated. If you leave the selection fields empty (like in our example), all the accounts will be selected for valuation.

6. Click on the Execute button to perform valuation.

Note: The system does not create the postings immediately but creates a batch input session instead.

7. Click on the Back button or press F3

8. To post the valuation, you need to process the Batch Input Session that you’ve just created. You can open another SAP session. From the main menu choose System → Services→ Batch input → Sessions

9. Select the session you want to process. (Select the row that contains your Batch input session, , e.g FAGL_FC_VAL

10. Click on the Process button

11. Click in the Display error only Radio button

12. Click on the Process button to begin the posting of documents

13. Once the session is processed, you need to check the results. To analys your batch input session, follow the menu path:

14. From the main menu choose System → Services → Batch input → Sessions

15. Select the row that contains your Batch Input Session FAGL_FC_VAL

16. The analysis button the system will display the details regarding thesession that was processed

17. Click on the Back button or press F3

18. As a result of valuation some accounting documents were posted. To displaythem record one document number and use the transaction FB03 (Document Display):

19. Update the following required and optional fields:

20. Click on the Enter button or press Enter to confirm your entries

21. In order to display your document in local currency, click on the Display Currency button

22. Click on the Enter button

23. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen

2.4. General Ledger Reporting

A general ledger is kept in order to provide the information needed to create a balance sheet and a profit and loss statement.

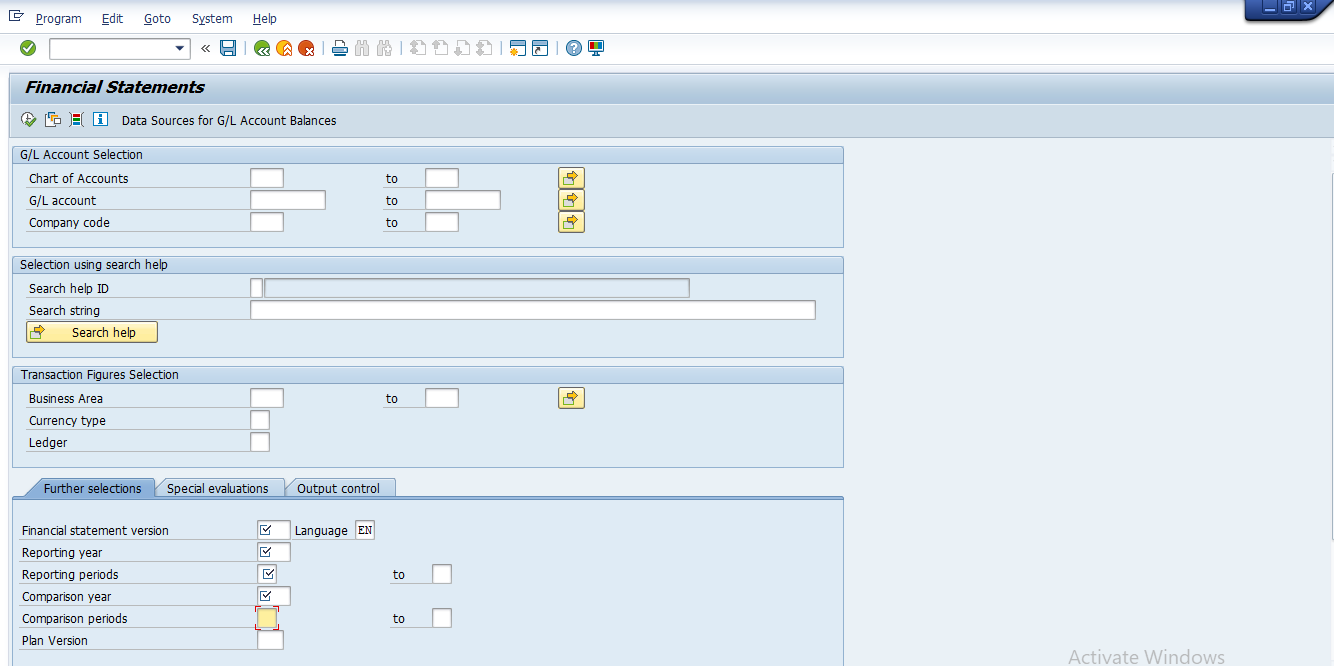

2.4.1. Execute Financial Statements S_ALR_87012284 / F.01

Steps :

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → General Ledger → Information systems → General Ledger Reports (New) → General → Actual Comparisons → Financial Statement

8. Enter Year XXXX in the Comparison year field

9. Enter 1 to 12 in the Comparison year fields.

10. Click Execute button

11. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

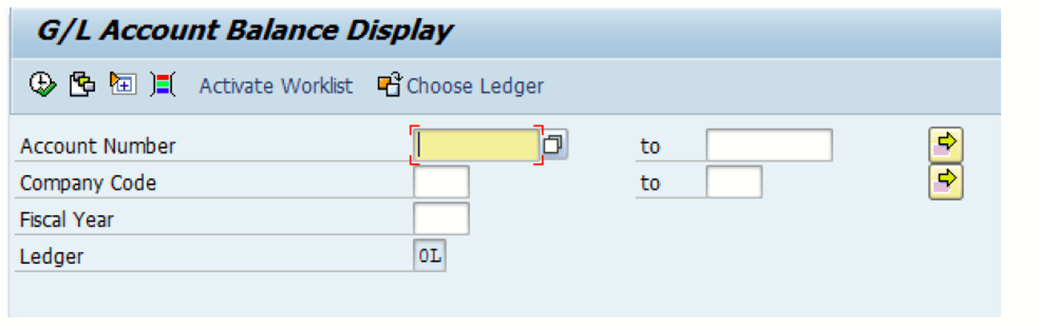

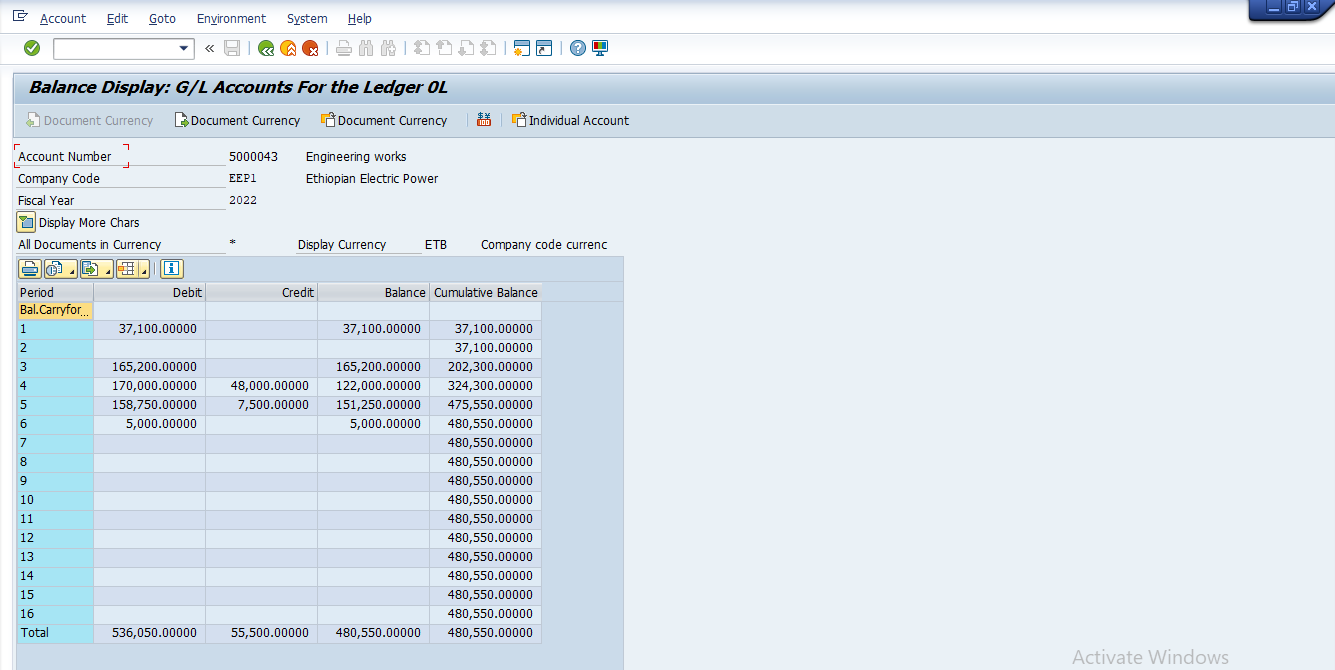

2.4.2. Display G/L Balances – FAGLB03

The SAP system offers a functionality which enables you to have a quick view of the General Ledger accounts balances; you have been tasked Analyse and report on the balances in one of the accounts under your department

Steps :

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → General Ledger → Account → Display Balances (new) 2. Enter xxxxxxxx to xxxxxxxx in account number fields

2. Enter xxxxxxxx to xxxxxxxx in account number fields

3. Enter Company code XXXX in Company code field

4. Enter Fiscal year YYYY in Fiscal year field.

5. Click Execute button.

6. Click on the Individual Account button.

7. A pop up screen will be displayed within the main screen and will contain a listing of the General ledger accounts. To view balances in a single G/L account double Click the G/L account number within the below screen.

8. A listing of General Ledger line items will be displayed.

9. Click layout button to change layout of the displayed items.

10. Select Column content you want to remove or add.

11. Click on the hide selected fields button or Click on the show selectedFields button

12. Click on the Copy button

13. Your report will be adjusted to incorporate the changes you have made

14. Click on the Exit button or press Shift+F3 to return to the SAP Easy Accessscreen.

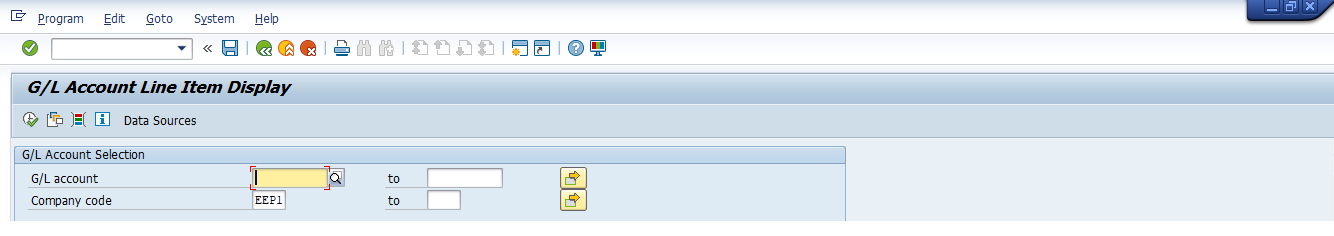

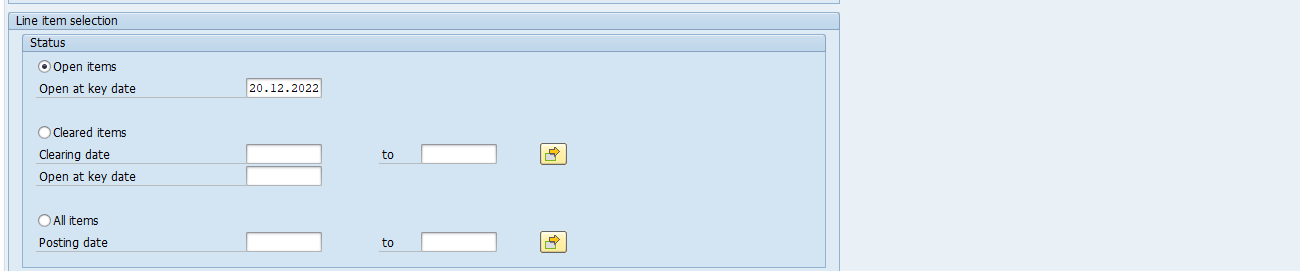

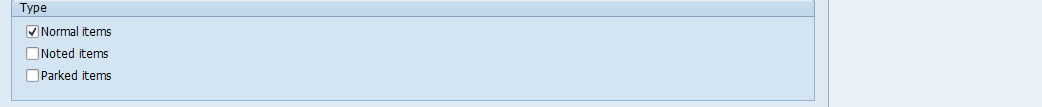

2.4.3. GL Account Line-Item Display – FBL3N

FBL 3N enables users to gather and display information on GL Account Line items. Users can view information on all items or narrow the transaction to include open or cleared ones only. Further, screen option allows you to establish variants to use regularly and select specific criteria for this display.

I.Open items- Select this radio button if you only want to fetch the open items. This radio button becomes relevant if the open items flag is checked on the G/L master in FS00.

II.Cleared items- If you select this radio button, it will only show you items that have been cleared, i.e., it will not show items that are currently open.Under cleared items, there is a field for clearing date. Enter a value in this field to restrict this tcode to a specific clearing date.

III. All items – Select this radio button if you want to fetch both open and cleared items.

Note- If you are searching for a document and do not find it, then select the all items radio button and try to enter a wide range for this report.

You can also select the checkboxes for special G/L and the other options next to it to see if the item you posted meets this criterion.

Steps :

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → General Ledger → Account → Display / Change Line items

2. Enter xxxxxxxx or xxxxxxx to yyyyyyy in GL account number fields

3. Enter XXXX in Company code field

4. Select the Line-Item Selection Radio Button

5. Select the check box for Normal / Noted / Parked items

6. The Dynamic Selection Criteria allows you to narrow the parameters of the selection even further.

7. Click Execute button.

8. Double click on individual document number to see additional details.

9. Click layout button to change layout of the displayed items.

10. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

3. ACCOUNTS PAYABLE

Accounts Payable records all accounting transactions for dealings with suppliers.

Much of its data is obtained from procurement (Materials Management)

3.1 Accounting Transactions in AP

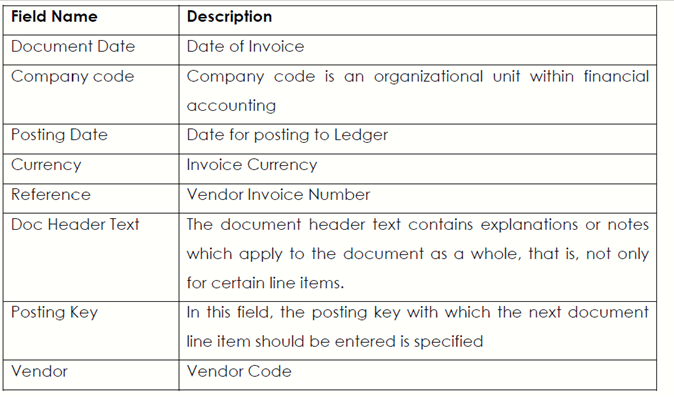

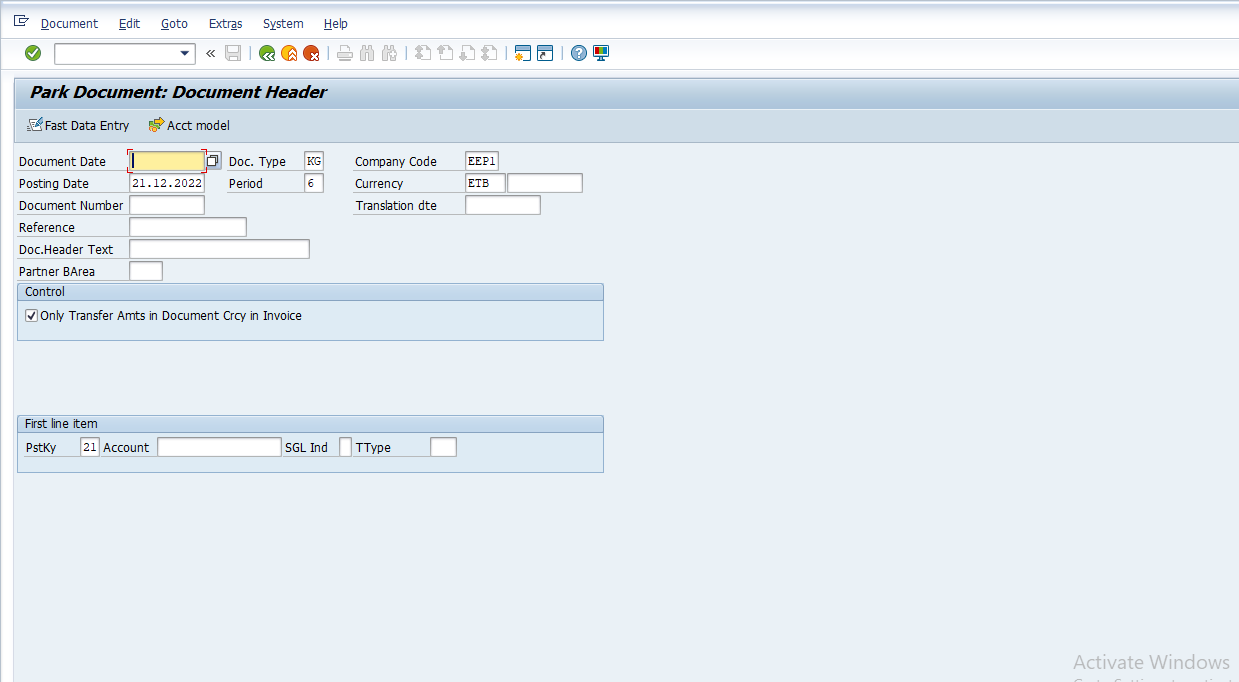

3.1.1 Vendor Invoice Parking – F-63

Using this standard accounting function, you can enter invoice in the system without posting the Accounts Payable sub ledger. The PARKED Invoice is subsequently checked, approved and posted to Accounts Payable. You can also park an incomplete document.

Steps:

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → Accounts Payable →Document Entry → Document Parking → Park Document

2. Update the required and optional fields:

3. Click on the Enter button to confirm the entries.

4. Enter Value in the amount field for the first item.

5. Enter Text that describes the transaction in the text field.

6. Enter Posting Key 40 in the Posting Key field.

7. Enter General Ledger Account xxxxxxx being charged/debited in the account field.

8. Click the Enter button to confirm the entries.

9. Enter a * (star) in the Amount field for the Second item then press enter to adopt the amount from the first line item.

10. Select Tax Code in the Tax code field

11. Enter Cost Center in cost center field.

12. +(plus) in the text field then press Enter to adopt the text from the first liniertem.

13. Click on the Document overview button

14. Click on the Save button or press Ctrl+S to park the Invoice.

15. The System will display a message at the status bar: Document Number : xxxas parked in Company Code XXXX.

16. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

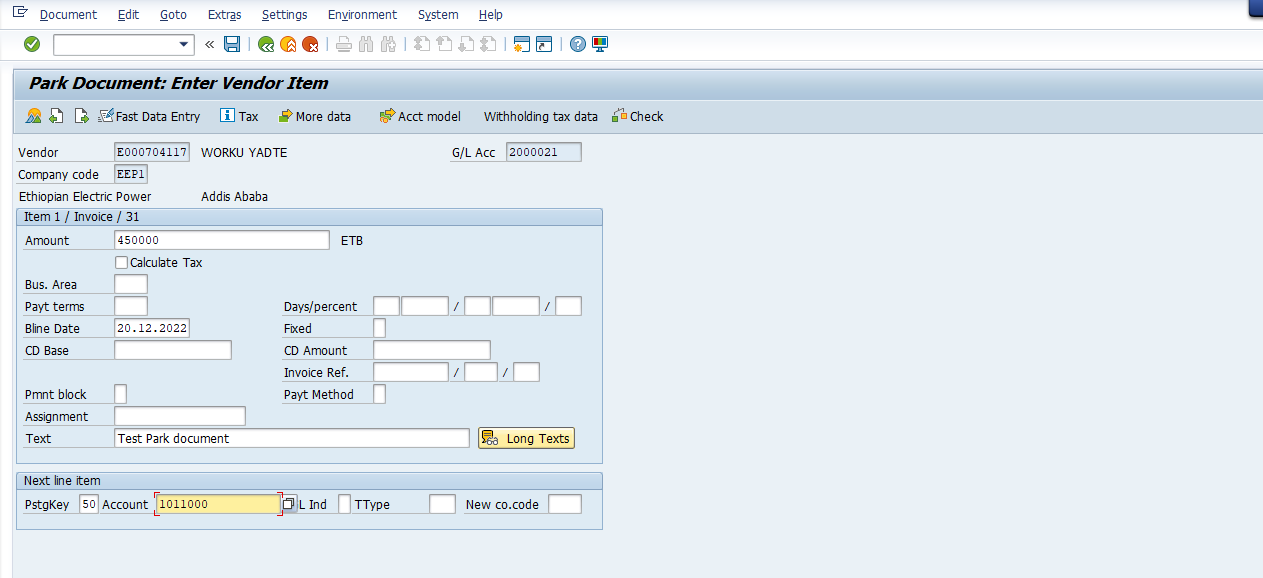

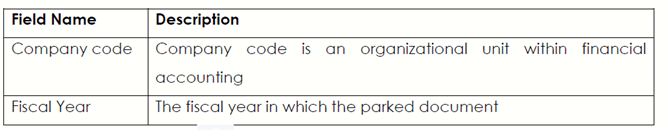

3.1.2. Change Parked document FBV2

•Parked Vendor’s invoices need to be verified before they are posted; therefore, errors can be corrected before being posted. A document had been parked but did not contain adequate text and also that there were no reference details entered on the document.

•You are required to correct the document before posting.

Steps:

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Payable → Document Entry → Document Parking → Park / Edit Invoice

2. Update the required and optional fields:

3. Click on the Enter button

4. Enter Reference in the Reference field (in the Edit Parked Document Screen)

5. Change data in the text field

6. Click on the Save button to record you changes.

7. A message will appear on the status bar; a preliminary posted Document no. XXXXXX has been changed

8. Click on the Exit button or press Shift+F3 until the SAP Easy Access screen is displayed.

3.1.3. Display Parked Document - FBV3

A parked document is subject to a verification process before it can be posted, the SAP system allows for the display of such documents so that this process can be fulfilled.

Steps :

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → Accounts Payable →Document Entry → Document Parking → Park / Edit Invoice

2. Update the required and optional fields:

3. Click on the Enter button.

4. Click on each tab button to display data.

5. To exit this transaction, click on the Exit button or press Shift+F3 until the SAP Easy Access screen is displayed

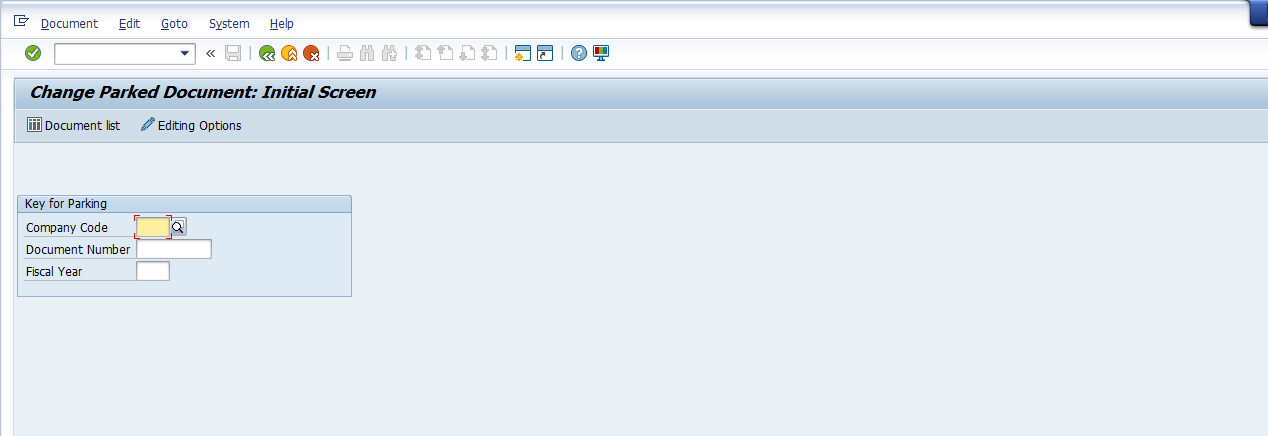

3.1.4 Posting / Delete Parked Document - FBV0

A vendors’ Invoice was parked twice for the same service however it was picked before it was posted. In the SAP system a parked document can be deleted but once a document is posted it cannot be deleted. It will only be regularized by entering a reversal document.

You can choose to post the parked document in this environment or choose to delete it.

Steps:

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Payable → Document → Parked Document → Post/Delete

2. You can choose from the menu Document → Select parked document

3. Update the required and optional fields:

4. Click on the Enter button.

5. Select from menu Document → Delete parked document

6. A message will appear on the status bar: Parked Document no. xxxxxxx deleted..

7. To exit this transaction, click on the Exit button or press Shift+F3 until the SAP Easy Access screen is displayed.

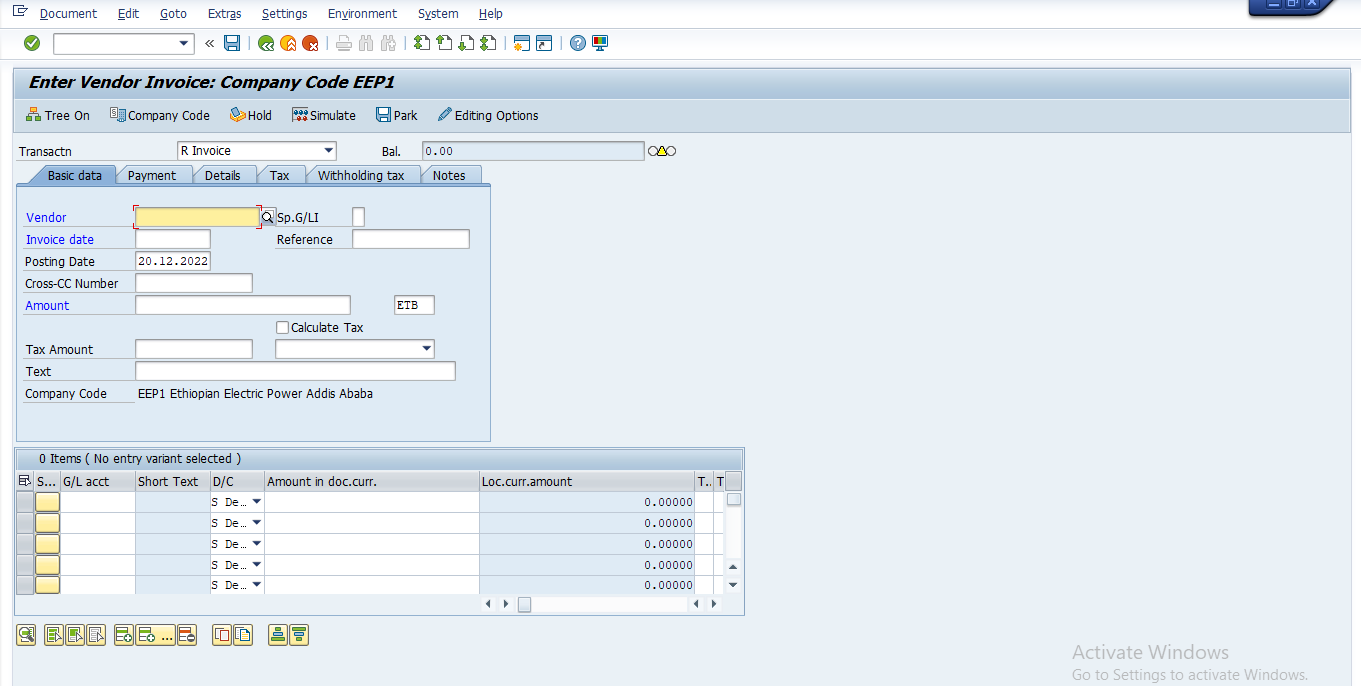

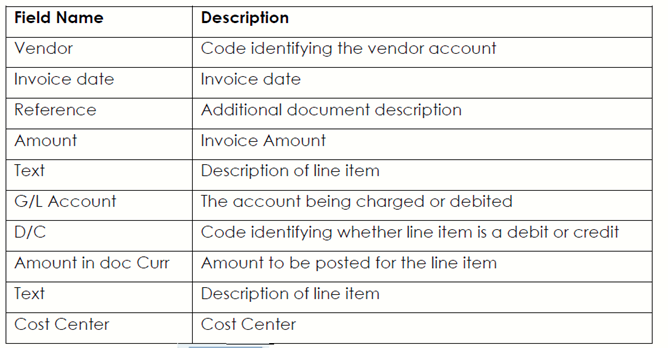

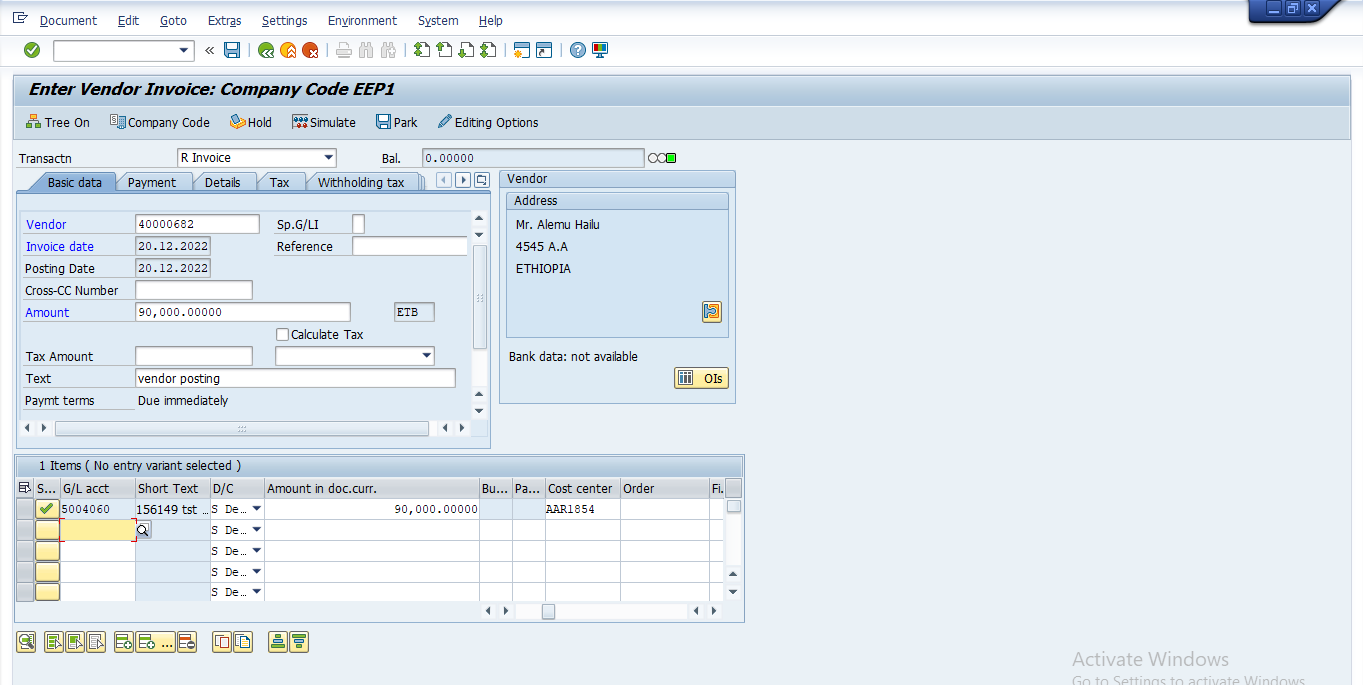

3.1.5 Vendor Invoice - FB60

This transaction allows you to enter vendor invoices. It creates postings in Accounts Payable Sub Ledger and updates also the relevant GL Accounts (e.g., reconciliation account). You can use this transaction to post the invoices that do not pass-through Purchasing Department, Instances of when a vendor invoice will be posted by AP will be payments for electricity bills, telephone charges etc.

Steps:

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Payable → Document Entry → Invoice

2. Click on the Company Code button and Enter company code

3. Update the required and optional fields:

4. Click on the Enter Button.

5. Enter Simulate Button

6. Click on the Save button or press Ctrl+S to post the Invoice.

7. The system will display the number of the document generated by this Invoice.

Document Number xxxxxxx was posted in Company Code

8. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access Screen.

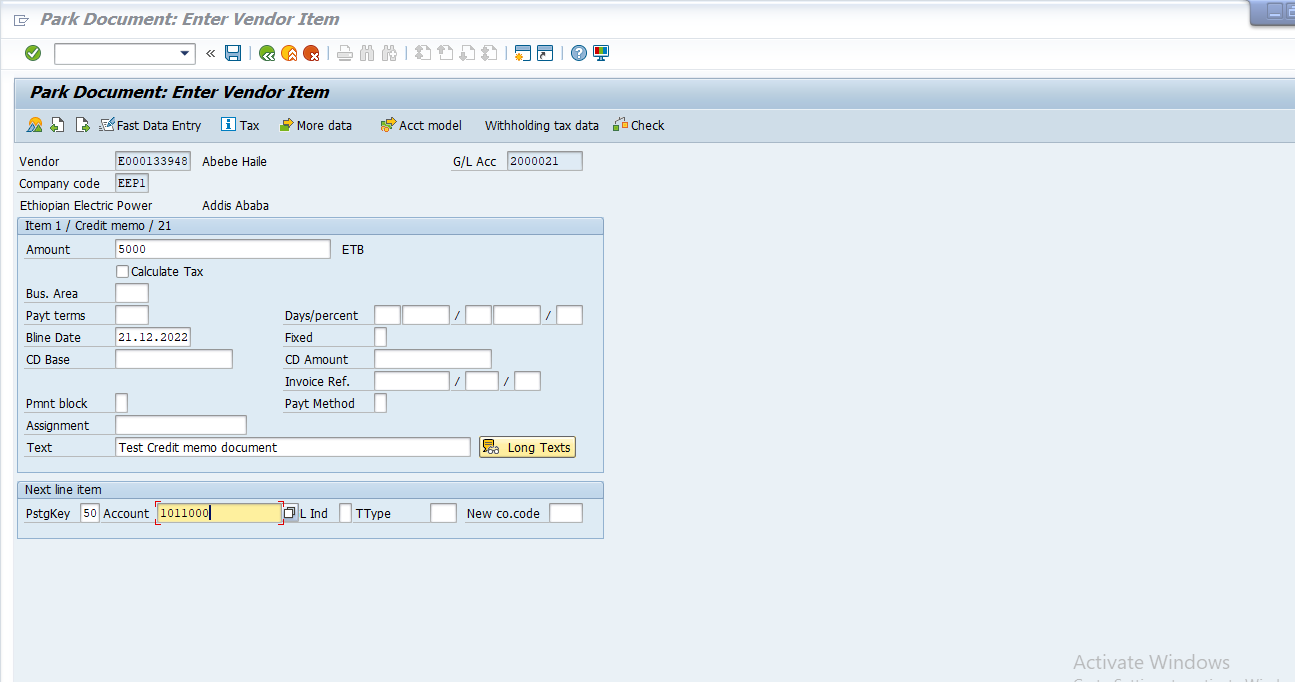

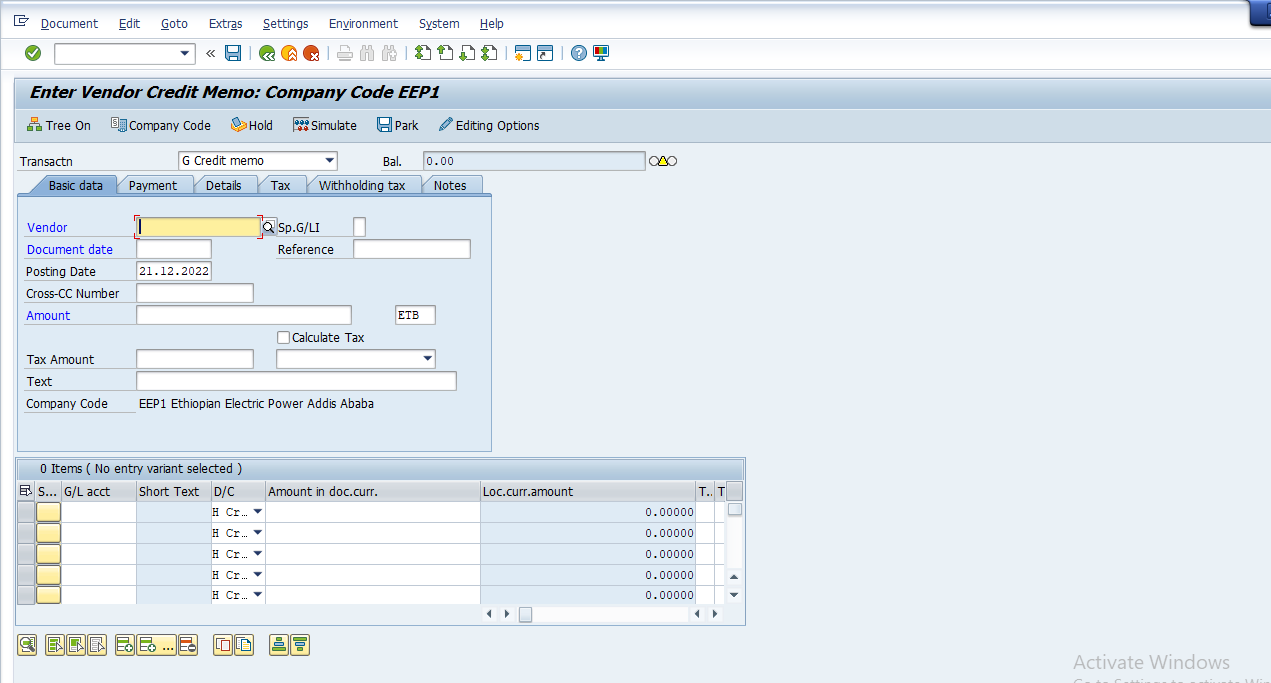

3.1.6 Park / Edit Credit Memo – F-66

Using the standard accounting function, you can enter a credit memo in the system without posting the Accounts Payable sub ledger. The Parked credit memo is subsequently checked, approved and posted to Accounts Payable.

Credit memos have the effect have reducing our liabilities under the vendor’s accounts. Vendors normally issues credit notes when we return purchased goods orif we had overpaid them.

Steps :

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → Accounts Payable →Document Entry → Document Parking → Credit Memo parking

2. Update the required and optional fields:

3. Click the Enter button to confirm the entries.

4. Enter Value in the amount field.

5. Enter Text that describes the transaction in the text field.

6. Enter Posting key 50 in the PstgKey field

7. Enter General Ledger Account xxxxx being charged / debited in the account field.

8. Click the Enter button to confirm the entries.

9. Enter * a start in the Amount field.

10. Enter Cost Center in cost center field.

11. Click on the Document overview button.

12. Click on the Save button or press Ctrl+S to park the invoice

13. The system will display the number of the document generated by this Invoice.

Document Number xxxxxxx was parked in the Company Code xxxx

14. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

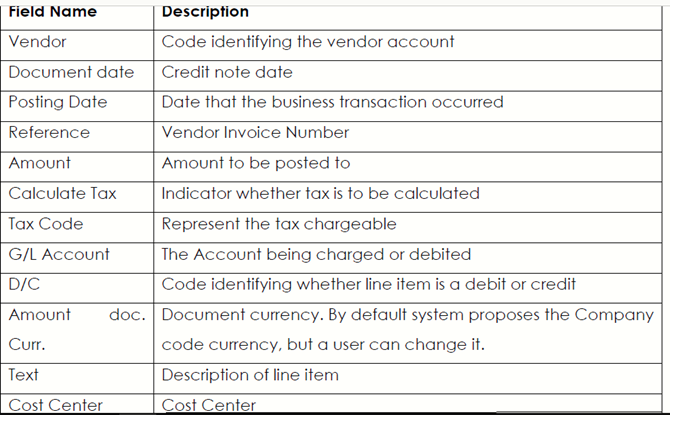

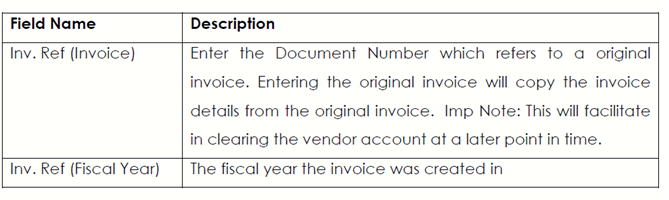

3.1.7 Post Credit Memo – FB65

The vendor invoiced for an excess amount and vendor issued a credit memo to correct this mistake. So here we need to post the received vendor credit memo.

Steps :

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → Accounts Payable →Document Entry → Credit Memo

2. Click on the Company Code button and Enter Company code xxxx in the field.

3. On the main screen Update the following required and optional fields:

4. Click on the Enter button to confirm the entries.

5. Click on Payment the Tab (If)

6. Update the following required and optional fields:

7. Click on the Enter button to confirm the entries.

8. A message will appear on the status bar that Data was copied.

9. Click on the Simulate button to replicate an overview of a document before posting.

10. Click on the Save button or press Ctrl+S to post the invoice

11. The System will display the number of the document generated by this Invoice.

Document Number: xxxxx was posted in Company Code

12. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

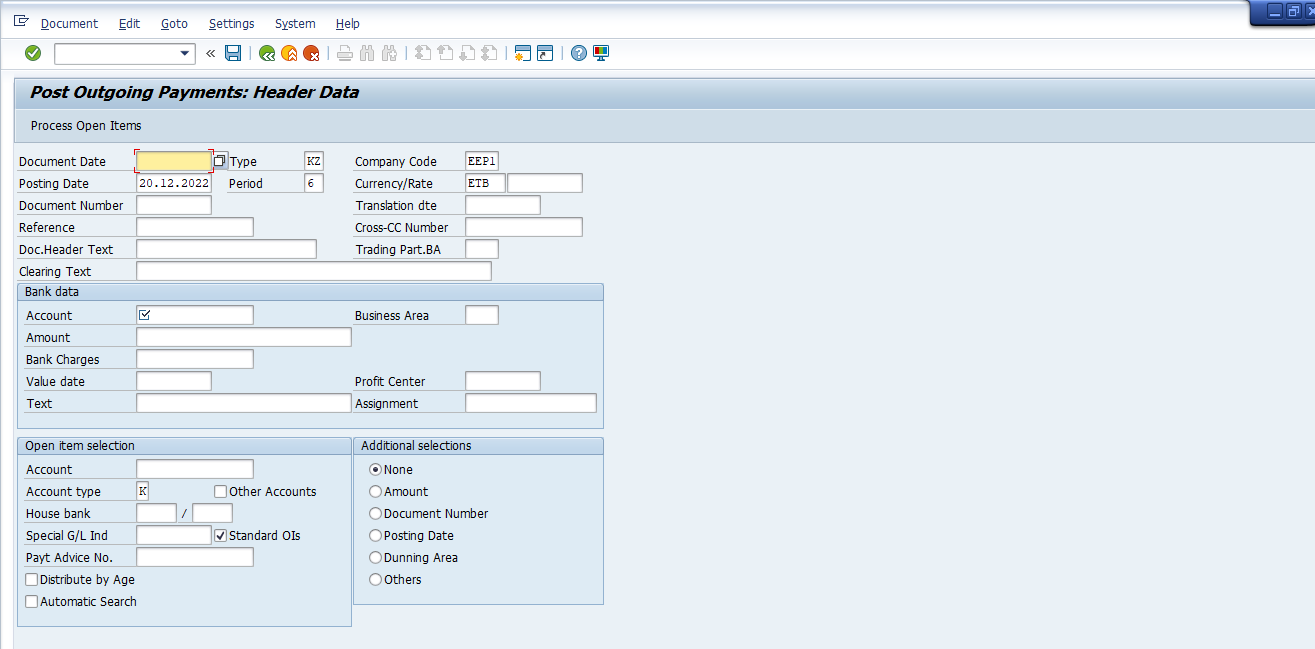

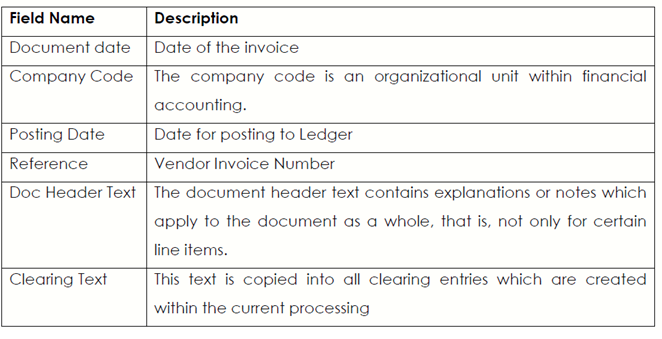

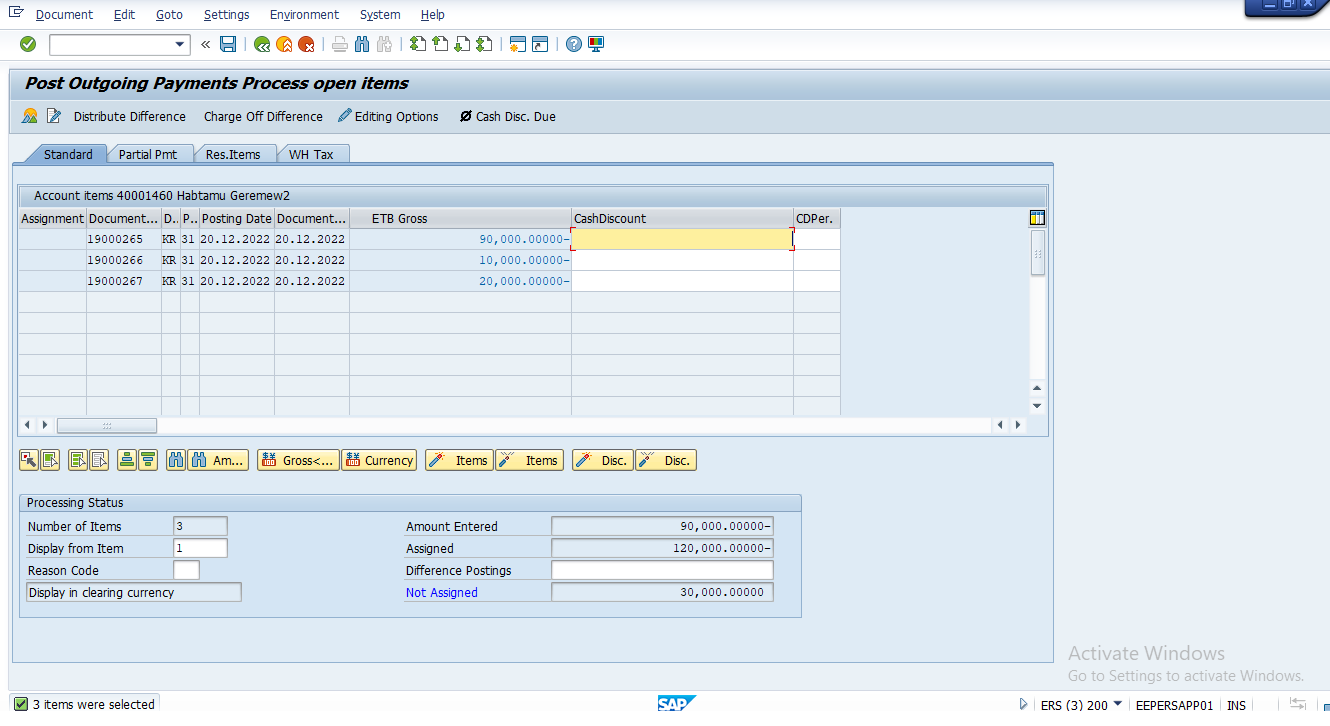

3.1.8 : Post Outgoing Payment – F-53

This functionality is used to process outgoing vendor payment but can only process single vendor accounts at any time.

A request has been made for the processing of an urgent payment which cannot wait for the normal payment run process. Invoices have been parked checked and approved (posted) process the payment

Steps :

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → Accounts Payable →Document Entry → Other → Outgoing Payment → Post

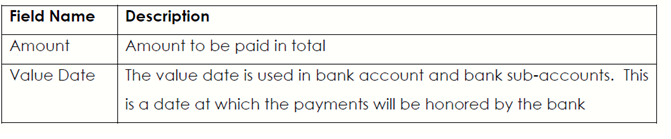

2. Update the following required and optional fields:

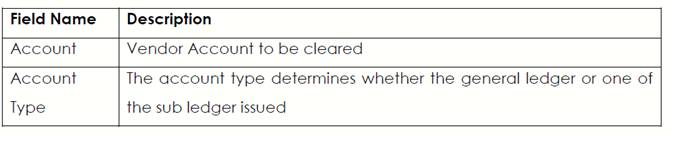

3. Update the following fields under bank data box

4. Update the following required and optional fields under Open item selection box.

5. Click on the Process Open Item button

6. All open items are selected by default. To deselect the items first click the Select All button.

7. Then click on Deactivate Items button. All the open items are now deactivated (they are no longer highlighted in blue).

8. Now you need to choose and select the items you want to clear. Double click on the Gross Group field for each of those items to be cleared.

9. You will need to select one or more documents to balance this clearing. Scroll through the remaining documents and select this document.

Note : The system will highlight these items in blue. When the value of the field not assigned is equal 0 and you can clear open items. See Screen below

10. You can check your document before postings. Select Document →Simulate.

10. You can check your document before postings. Select Document →Simulate.

11. To post your entries, click the Save button.

12. The message bar displays : “Document No. XXXX was posted in company code “

13. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access Screen.

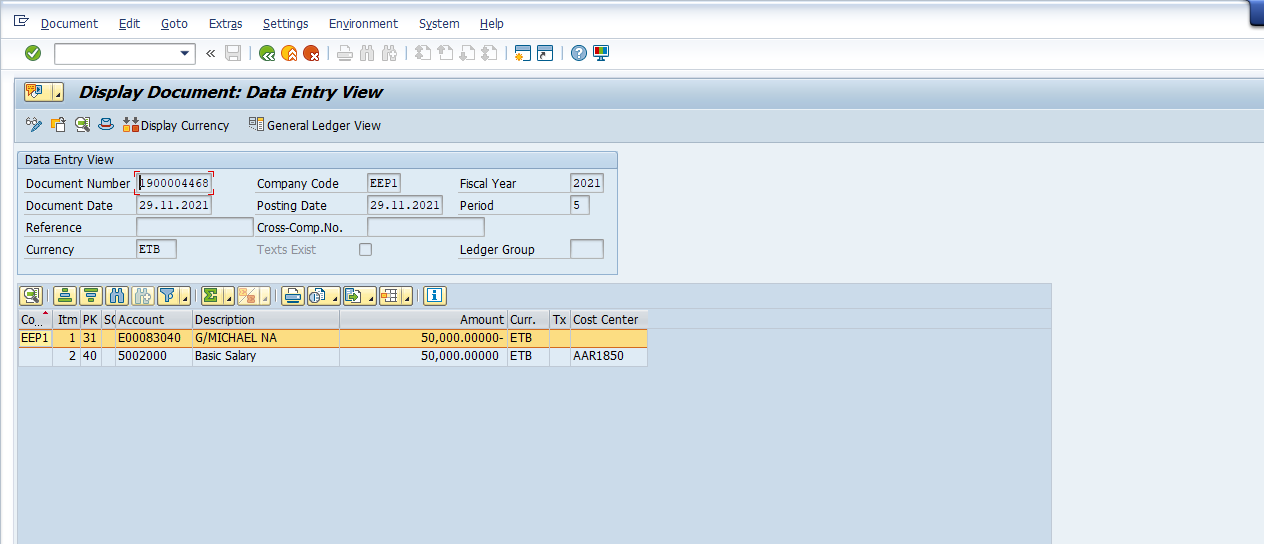

3.1.9 Display Accounting Document – FB03

Documents entered in the system can be viewed as and when they are required. You are required to display a vendors’ document. This function will you allow to quickly address queries pertaining to individual invoices / documents.

Steps :

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Payable→ Document → Display

2. If you know the required document number, enter it in the field “document number” . If you don’t , click Document List Button to search for documents.

3. The system will display a screen where you can enter your search criteria:

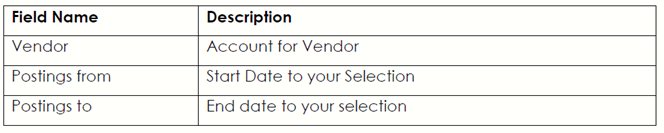

4. Update the following required and optional fields

5. Click Execute button to start searching

6. The system will display a list of documents that fulfill your criteria

7. To display your document, simply double click on it. The system will display atake you to document overview:

Or from the initial screen display Vendor Document

8. Enter the Document number you have on hand.

9. Enter the Company code XXXX

10. Enter the Fiscal Year XXXXXX or leave field blank,.

11. Click on the Enter button to proceed

12. Click on the General Ledger View button to change you screen view

Note : the system will show you more fields not shown under entry and youcan be able to and a change your document from this document displayscreen.

13. Click on the menu Document → Display → Change

14. Click on the Document Header button if you want to change header details

15. Identify fields that can be changed and change header text

16. Analys it and Click on the Enter continue / Confirm button to leave the displayed document header sub screen

17. To store your changes in the document, click Save button

18. To exit this transaction, click on the Exit button or press Shift-F3 until the SAP Easy Access screen is displayed.

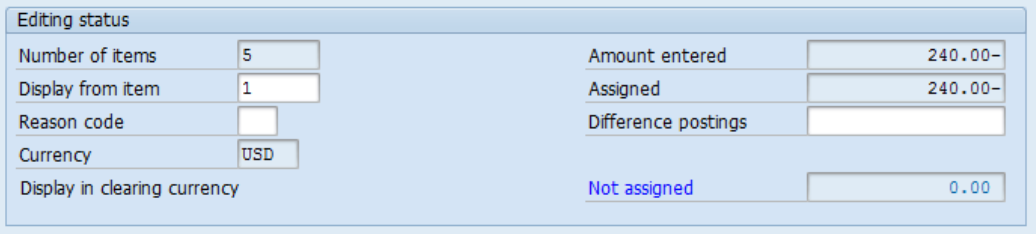

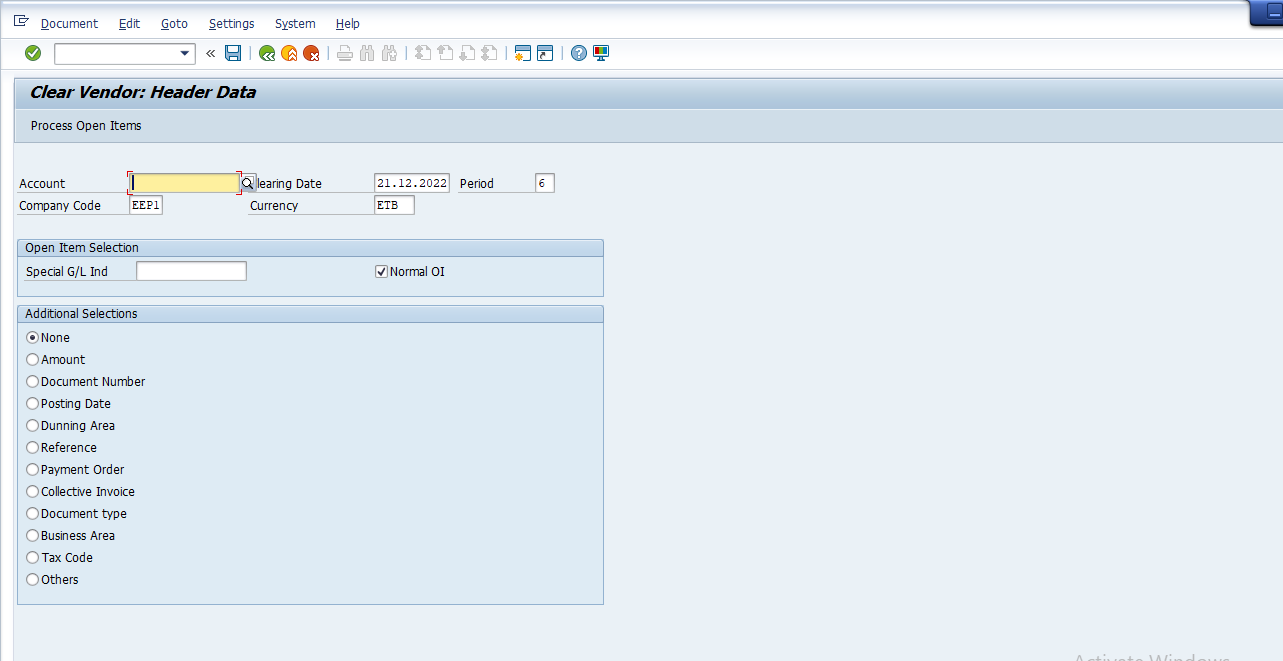

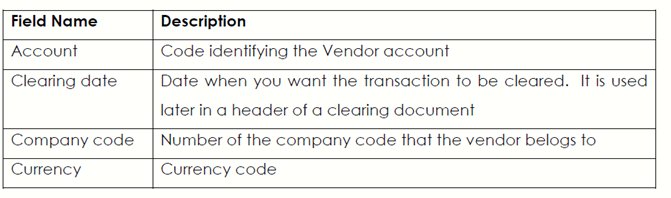

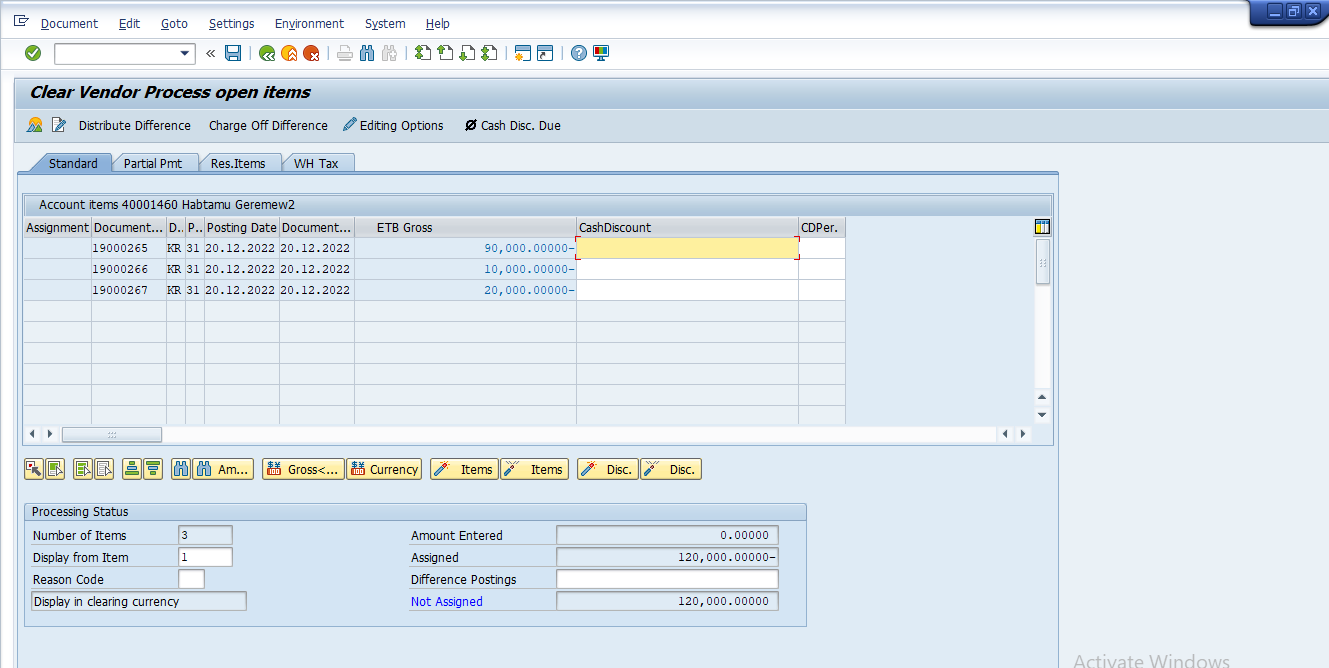

3.1.10 Clear Vendor Account – F-44

The function allows you to clear open items on Vendor account. You have to identify open items that can be matched in terms of debits and credits.

Steps :

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → Accounts Payable → Account → Clear

2. Update the following required and optional fields

3. Click the Enter button. The system will display open items that fulfill previously entered criteria:

4. All open items are selected by default. To deselect the items first click the Select all button.

5. Then click Deactivate items button. All the open items are now deactivated (they are no longer highlighted in blue).

6. Now you need to choose and select the items you want to clear. Double click on the Gross field for each of those items to be cleared.

7. You will need to select one more document to balance this clearing. Scroll through the remaining documents and select this document.

Note : The system will highlight these items in blue. When the value of the field not assigned is equal 0 and you can clear open items. See screen below

8. You can check your document before postings. Select Document → Simulate

9. To post your entries, click the Save button. No “real” posting took place, but the system stored a clearing document.

10. The message bar displays: “Document no. xxxxxx was posted in company code xxxx”

11. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

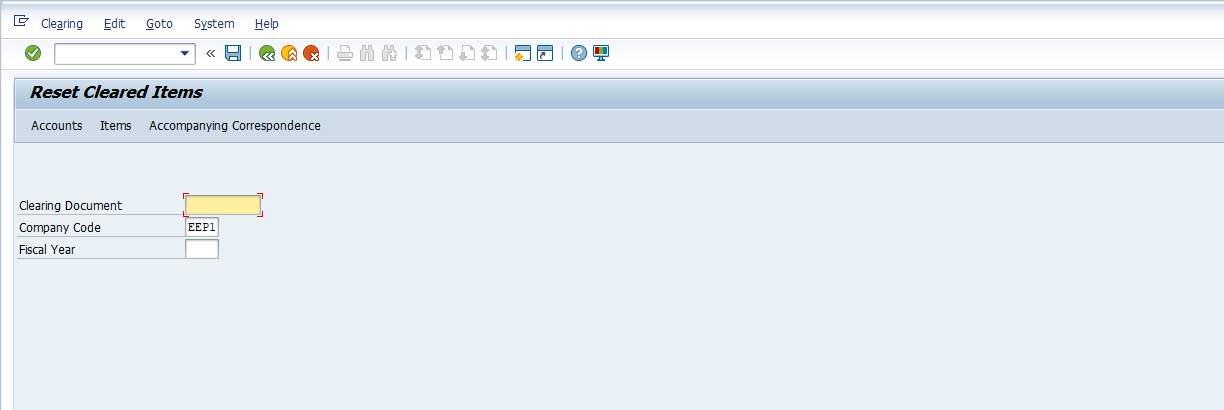

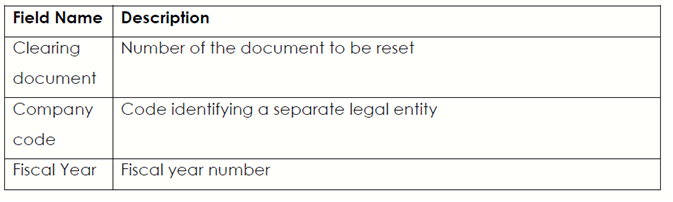

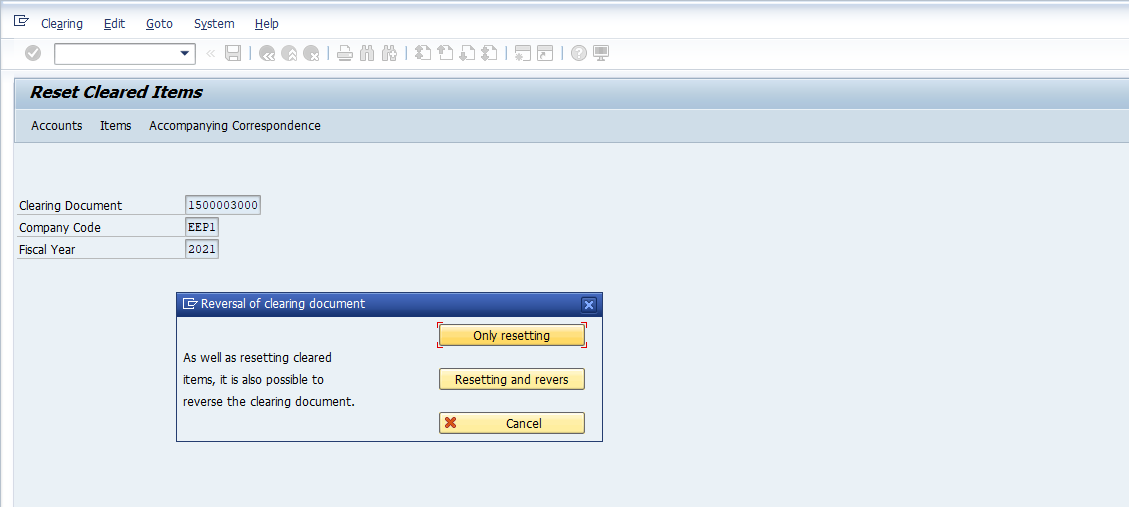

3.1.11. Reset Cleared Items – FBRA

A Posting with clearing had been made to a wrong Vendor account due to similarities in name therefore the outgoing payment document has to be reversed to enable the correct transaction to take place.

Note : An Accounting Document that contains line items have cleared been cannot be reversed it requires that the cleared items be reset first.

Display the clearing document and its line items, and then reset the cleared document.

Steps :

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → Accounts Payable →Document → Reset Cleared Items

2.Update the following required and optional fields

3. Click the Accounts button. The system will display all the accounts involved in clearing operation:

4. Click the Continue button to continue

5. Click the Items button to display documents cleared by the clearing operation

6. Click on the Save button or press Ctrl+S to post the resetting

7. A screen reversal of clearing document will be displayed with 2(two) options to select from.

. Only Resetting will remove the clearing from the document that was cleared and changes the documents’ status from cleared item to open item - The clearing document also changes status to an open item, and this has effect on the overall Vendor Account -

. Resetting and reversing will reset the cleared line items and also reverses the clearing document.

Note: Only resetting will remove the clearing document from the cleared document and restore it to its pre-clearing state i.e., open item stage. The clearing document will also be found under the open items of the Vendor Account and must be removed from this environment by the reversal process. A message will appear on the status bar clearing document xxxxxxxxx reset.

9. Click on the Exit button or press Shift+F3

Note : if you choose the later button the system will reset and reverse the clearing document in one transaction. For you to carry out a transaction where you are going to select on resetting and reversing you have to start with a new document. Otherwise the above resetting transaction is complete.

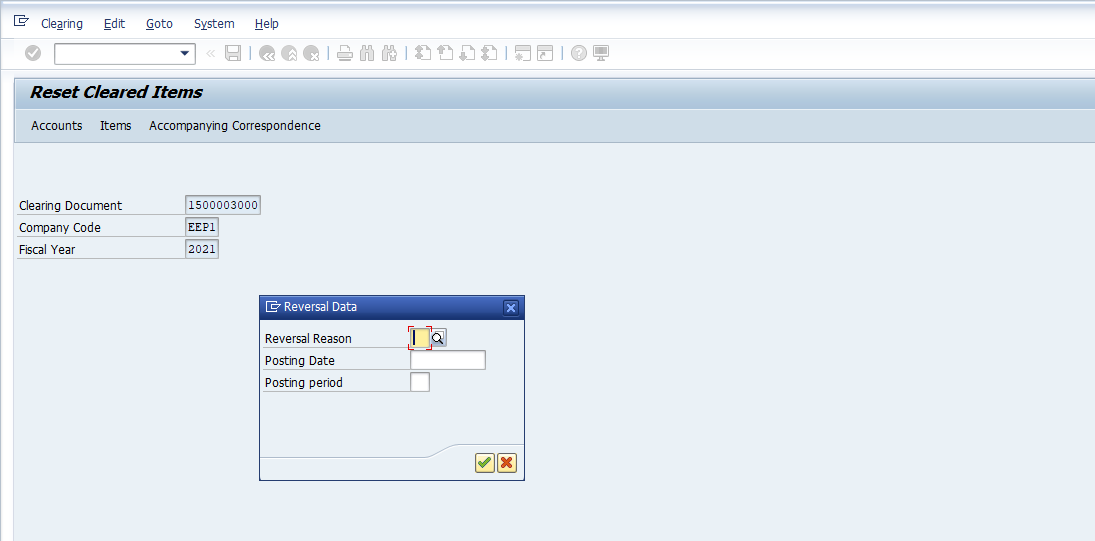

If you choose to Click on Resetting and Reversing button you will proceed as follows

10. Enter Reversal Reason Code in the Reversal Reason field.

11. A message clearing reset will appear

12. Click the Continue button

13. A message will appear that two Document no. XXXXX was posted in Company code XXXX

14. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen

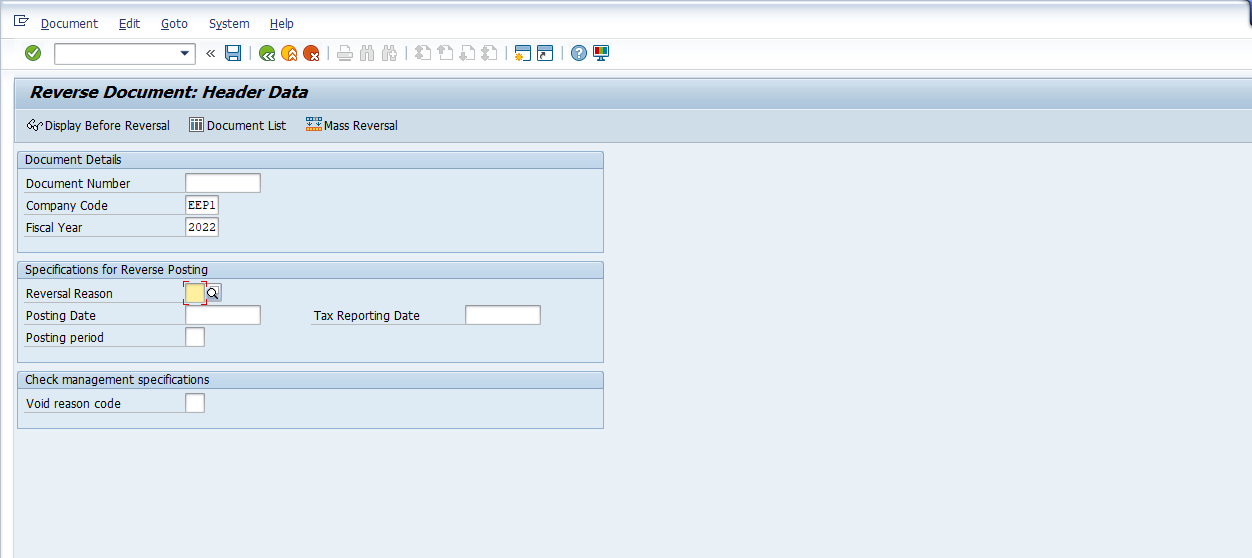

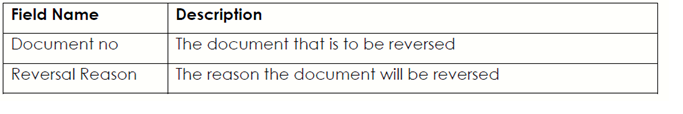

3.1.12. Document Reversal (Individual Reversal) document – FB08

Sometimes posted document contains incorrect information. This function allows you to reverse an incorrect document. A document to be reversed cannot include already cleared items. If you want to reverse document that was already cleared, you need to reset all cleared items before posting a reversal.

This is also a function that allows mass document reversal (Transaction code), unlike resetting clearing documents which only allow resetting one clearing document at a time.

Steps :

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Receivable→ Document → Reverse → Individual Reversal

2. Update the following required and optional fields

3. Click the Display document before reversal button or press F5

4. Click the Back button or F3

5. Click on the Save button or press Ctrl + S

6. The system will post a reversal document and a message will appear on the status bar “Document no. xxxxxx was posted in Company Code xxxx”

7. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen

3.2 Advance Payments in Accounts Payable

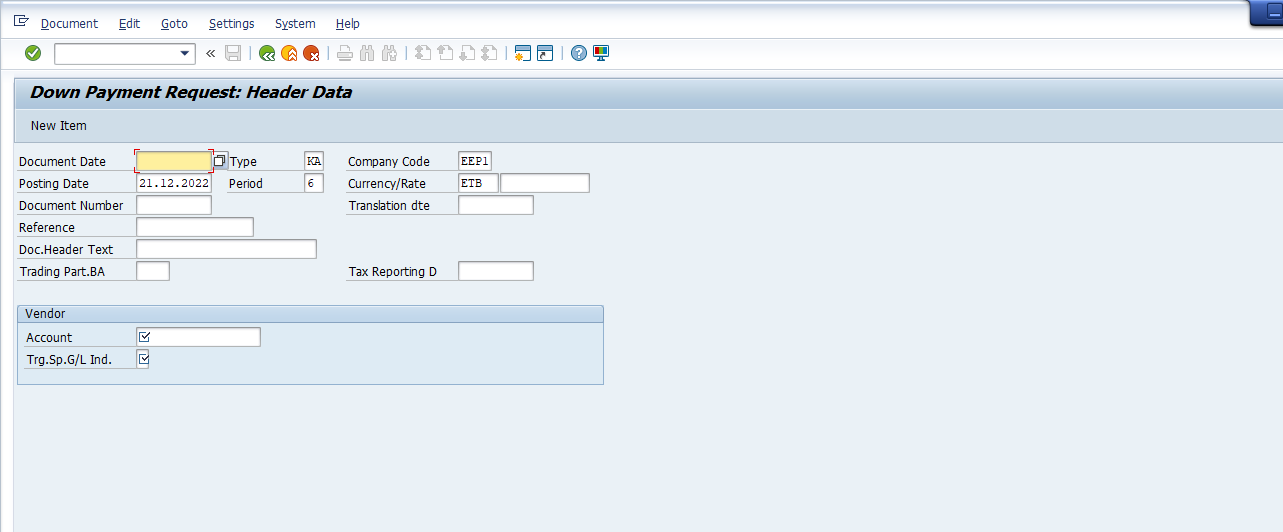

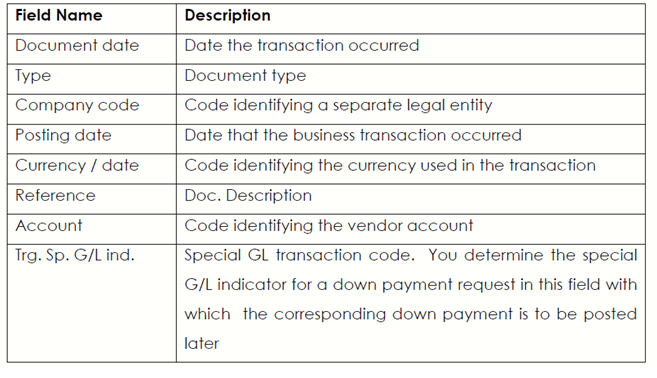

3.2.1 Down Payment Request – F-47

Down payment request function does not create posting but only stores information in the systems that can be used later to post a “normal” down payment manually or using the automatic payment program.

Steps :

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Receivable → Document → Entry → Down Payment →Request

3. Click the New item button to enter Down Payment line item.

2. Update the following required and optional fields

3. Click the New item button to enter Down Payment line item.

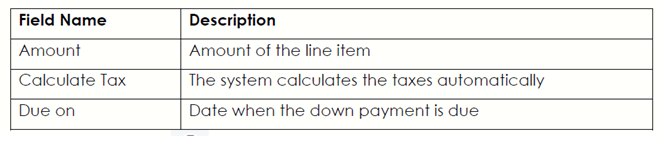

4. Update the following required and optional fields Field

5. Click the Enter button to confirm your entries

6. Click the Overview button to display a document before posting

7. Click the Save button to post the down payment request

8. A message will appear on the status bar informing you that “Document no. XXXX was posted in company code XXXXX”

9. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen

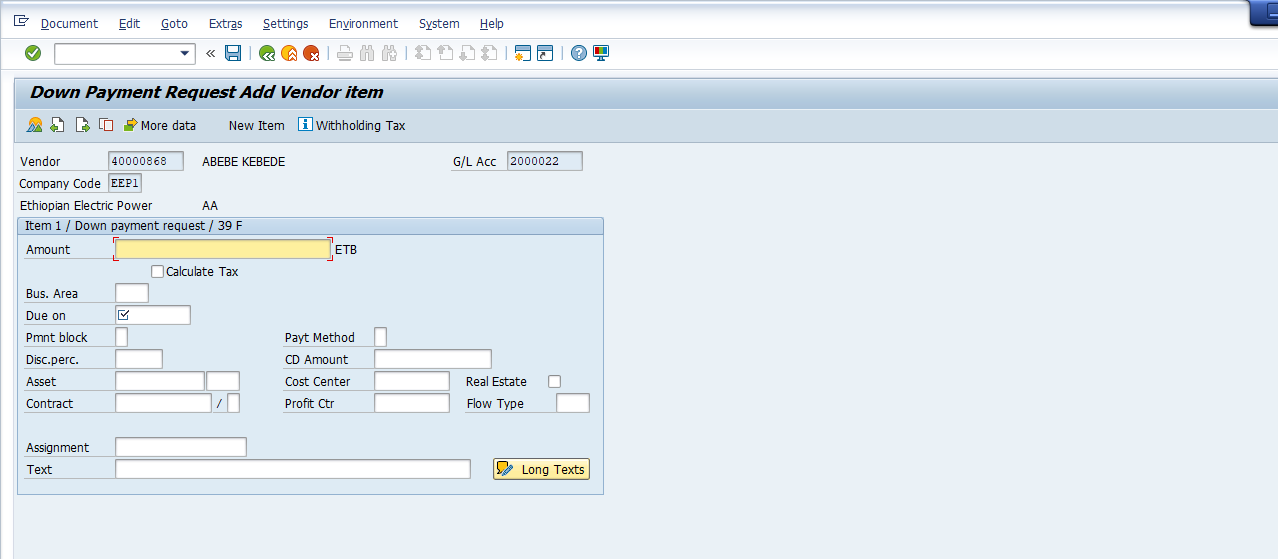

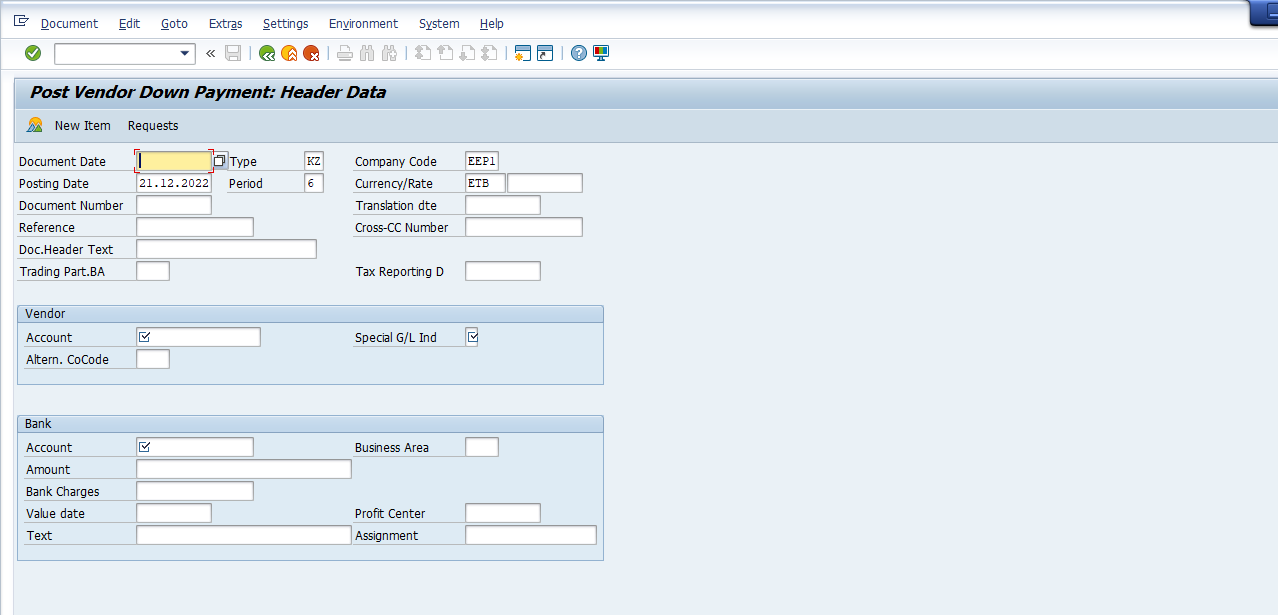

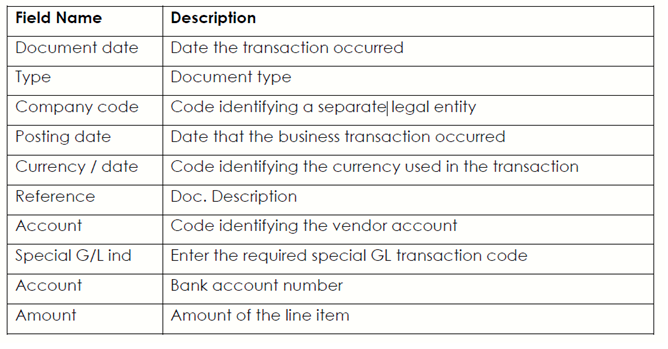

3.2.2. Post Vendor down payment– F-48

A down payment is an advance payment for a service or goods and down payment is a function that allows you to post the document to an alternative GL account instead of “normal” vendor’s reconciliation account.

Steps :

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → Accounts Payable →Document Entry → Down Payment → F-48 down payment

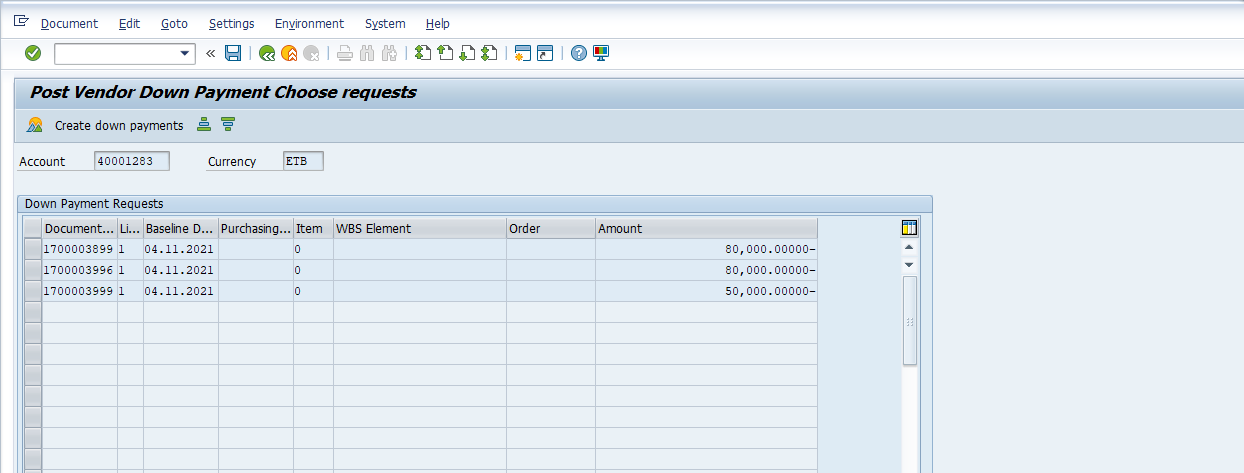

2. Update the required and optional fields

3. You can use an existing down payment request to post the down payment. Click the Request button.

4. Select the Down payment request number, by selecting the row containing the document number like XXXXX by clicking anywhere on that row.

5. Click on the Create down payment button. The system will display a document overview

6. Click on the Save button to post the down payment

7. The message bar displays “Document no. XXXX was posted in company code XXXX”

Note : Before proceeding to clear down payment you are required to post vendor invoice (FB60) so that invoice and down payment can clear. In case if the invoice amount is more than down payment then rest of the balance will be paid through normal payment and the clearing will automatically take place for the balance

8. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

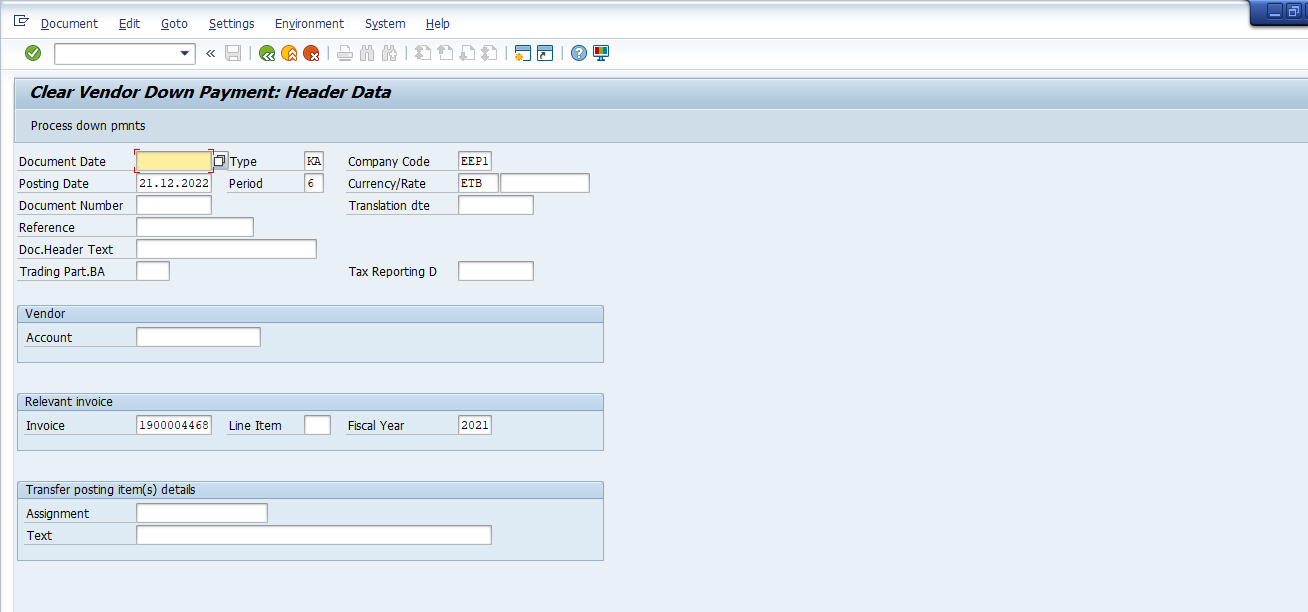

3.2.3 Clear Vendor down payment – F-54

This function allows you to post a clearing document manually. You can use it e.g. to clear a down payment (posted with special GL transaction) with another vendor document (e.g. vendor invoice)

Steps :

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → Accounts Payable →Document Entry → Down Payment → Down Payment Clearing

2. Update the following required and optional fields

Note: If you don’t know the vendor invoice number, you can open another SAP session (Press Create New Session button) and display the vendor open items –transaction code FBL1N

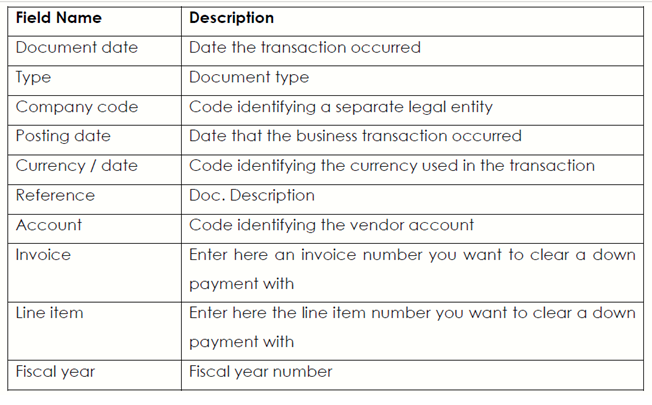

3. Click on the Process down payment button to process down payments.

4. Select the Down payment request number, by selecting the row containing the document number like XXXXX and by clicking anywhere on that row.

5. Click the Enter button to confirm your entries. The system will enter theamount in the field Transfer posting. (Side scroll to the right to see this entry)

6. Click the Save button to post a clearing document.

7. Line item 002 is highlighted in blue. Some additional data must be entered. Double click on this line.

8. Enter Text describing the down payment.

9. Click the Enter button to confirm your entries.

10. Click the Save button. (Please confirm the information message thatappears on the status bar with enter)

11. The message bar displays “Document no. XXXX was posted in company code XXXX”

This transaction clears only down payment posting and stores information in the system which amount of the invoice was cleared.

12. To display / Change Vendor Open Items execute Transaction FBL1N. As you can see, the newly posted clearing document is still outstanding and you need to clear it with the invoice using the account clearing process (Transaction F-44).

13. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

3.3 Check Voiding

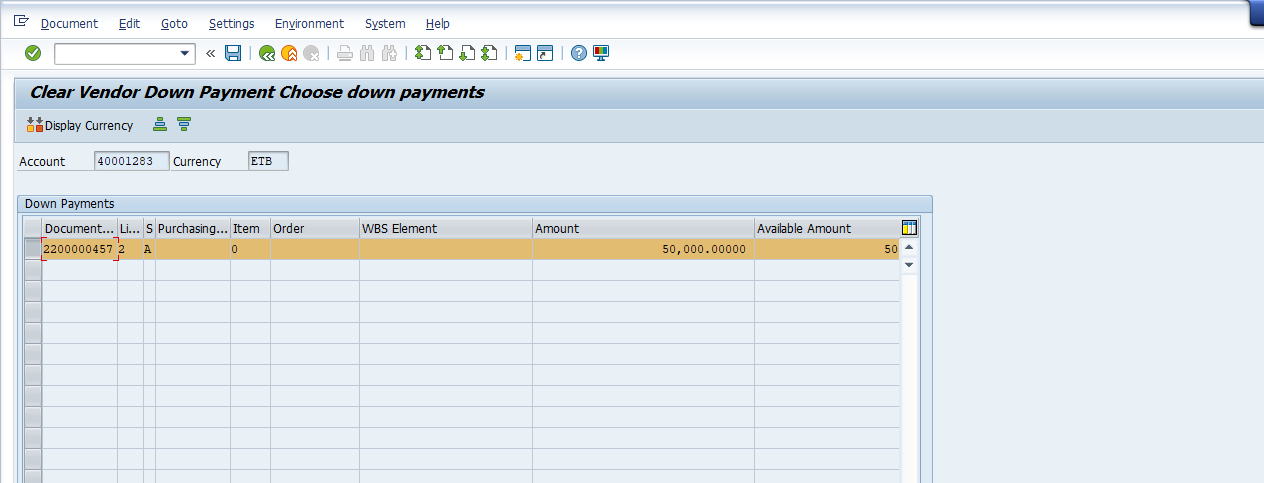

3.3.1 Voiding of Unused checks – FCH3

Checks can be cancelled before they are printed due to various reasons: Soiled, stolen, destroyed etc. These reasons warrant the cancellation in order to maintain the correct sequence of pre-numbered checks in the check lot.

Steps:

1. Access transaction by:

2. Enter Company code in the paying company code field.

3. Enter bank key in the House Bank field.

4. Enter Account ID field

5. Enter XXXX the Check(s) to be cancelled in the Check number from – to Check no. from fields.

6. Enter the void reason code.

7. Click on the Enter button to confirm your entries.

8. Click on the Void button.

9. A message will appear on the status bar: checks XXXx to XXXX have been voided.

10. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

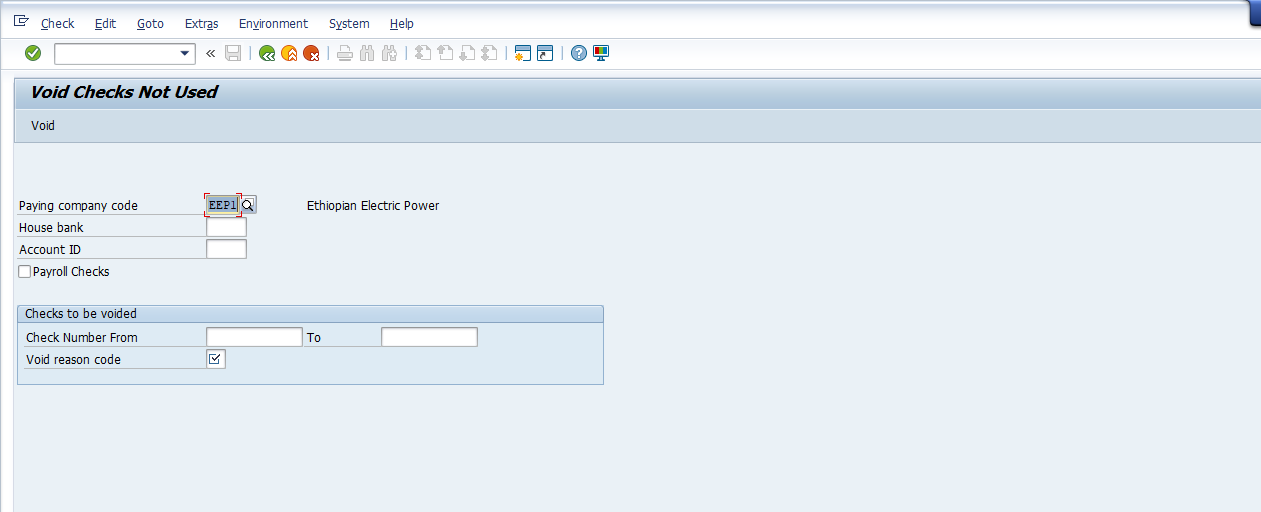

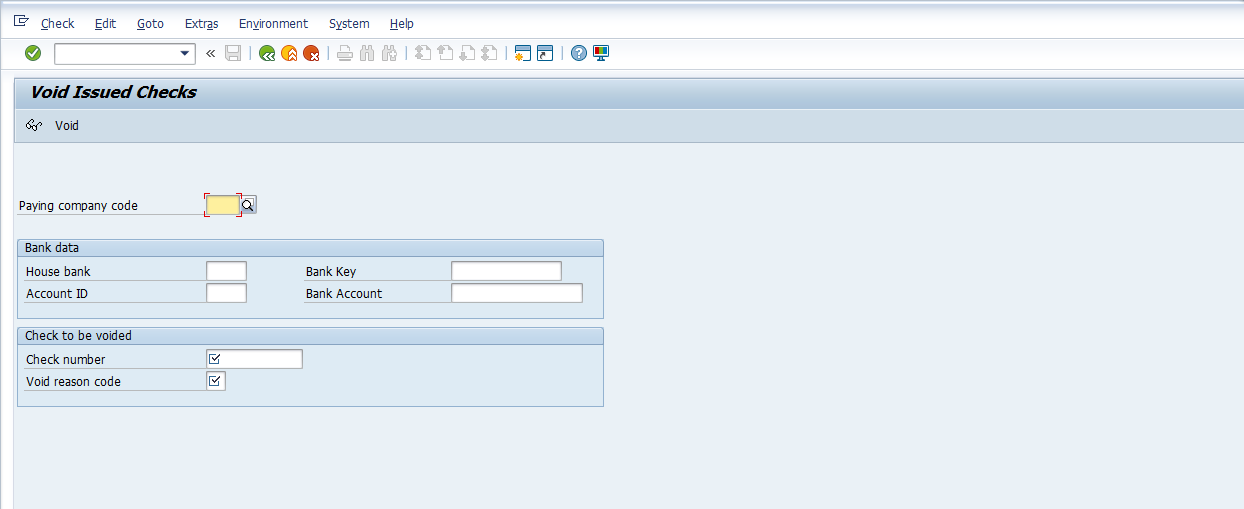

3.3.2. Void Issued Checks – FCH9

This function allows you to cancel a Check that was issued to a vendor and was not presented to the bank until it went stale.

Steps:

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Payable → Environment → Payments → Check information → Void → Issued Checks

2. Enter Company Code in the Paying company code field.

3. Enter Bank key in the House Bank field

4. Enter Account ID field

5. Enter the Check number field

6. Enter the Void reason code

7. Click on the Enter button to confirm your entries

8. Click on the Display button to display the check you are about to cancel.

9. The details of the check you about to cancel will be displayed. Check and please satisfy yourself that it is the correct check to be voided / cancelled.

10. Click on the Accompanying documents button.

Check line items

11. The Check line items will be displayed

12. Click on the Back button twice.

Void Issued Checks

1. Click on the Void button

2. A message will appear on the status bar: Checks 000xxxxx voided – Payment document not reversed.

3. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

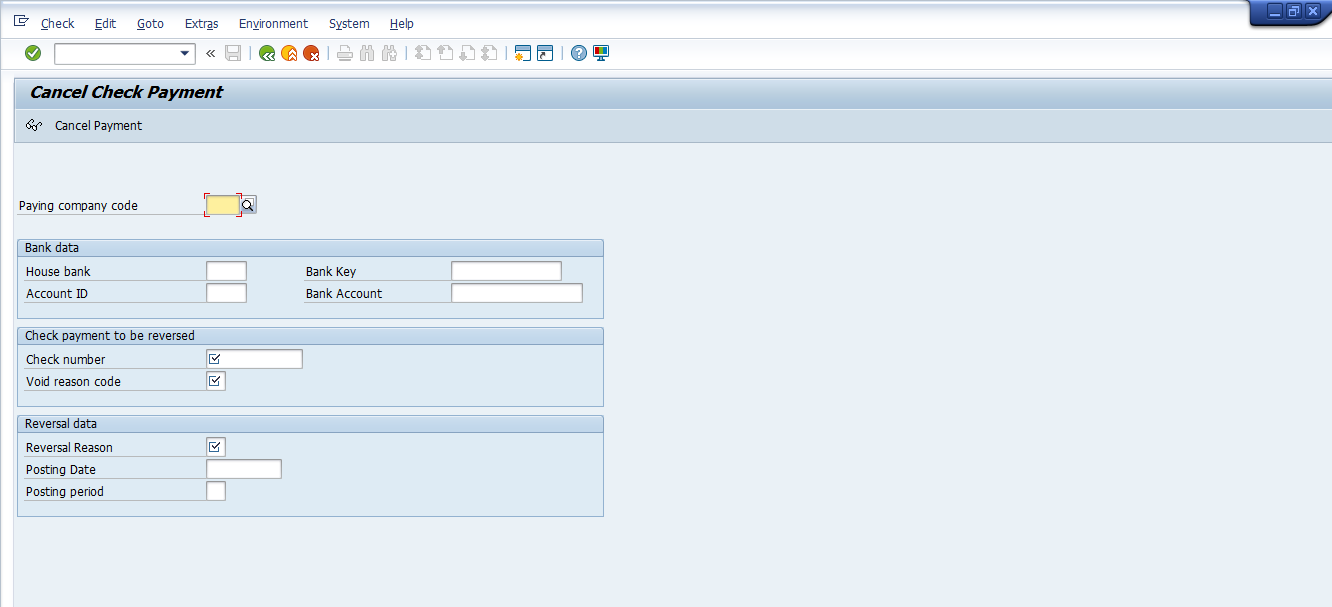

3.3.4 Cancel Check Payment – FCH8

Checks can be cancelled before they are printed due to various reasons: Soiled, stolen destroyed and these reasons warrant the cancellation in order to maintain the correct sequence of pre-numbered checks in the check lot. This functionality allows for the cancellation of the Check and at the same time reversing the clearing document.

Steps:

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → Accounts Payable →Environment → Check information → Void → Cancel payment

1. Enter Company code in the Paying company code field

2. Enter Bank key in the House Bank field

3. Enter the Account ID field.

4. Enter the Check to be cancelled in the Check number field.

5. Enter the void reason code Field.

6. Enter Reversal Reason code in the Reversal Reason Field.

7. Click on the Enter to confirm your entries.

8. Click on the Cancel payment button.

9. A message will appear on the status bar: Payment for check XXXXX was cancelled, reverse document XXXX

10. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

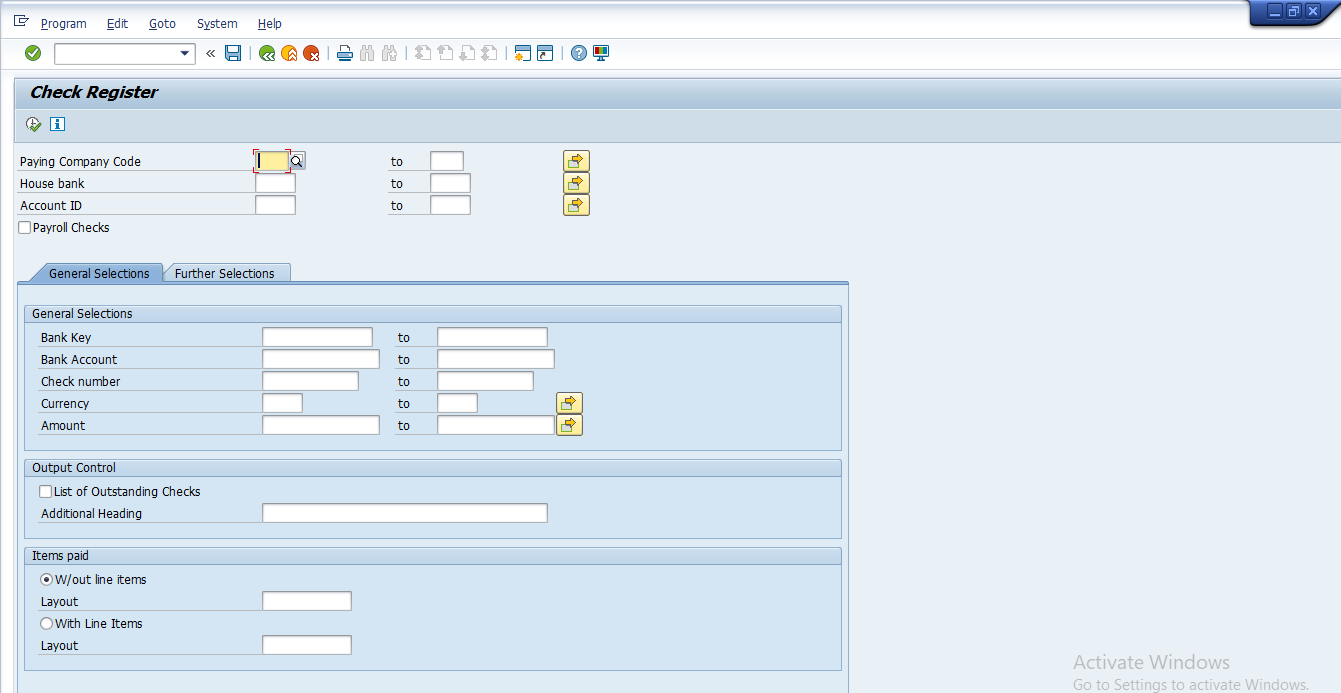

3.3.5 Display the check Register – FCHN

You can use this transaction to view a list of checks. It lists those that were cashed, voided (cancelled), yet to be presented to the bank for payment and those that have just been printed.

Steps:

1. Access transaction by:

SAP Access Menu → Accounting → Financial Accounting → Accounts Payable →Environment → Check information → Display → Check Register

2. Enter the Paying company code field

3. Enter Bank key in the House Bank Field

4. Enter the Account ID (Account Identification)

5. Select Radio W/out line-item button if you want to view a Check listing only or Select Radio With line-item button if you want to view a check listing which includes the list of documents that make up the payment

6. Click on the Execute button

7. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

3.4 Correspondences & Foreign Currency Revaluation

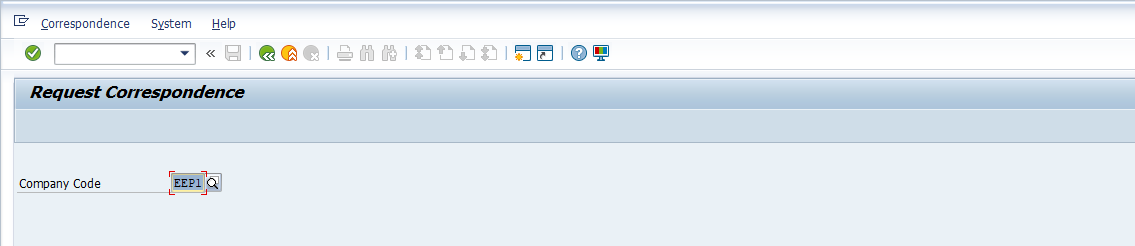

3.4.1 Vendor correspondence request – FB12

Correspondence are business documents such as Vendor account statements, Payment notice with line items, Payment notice to accounting department, Payment notice to legal department These documents can be requested and be printed any time but are usually printed at the End of the month.

Steps :

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Payable → Account → Correspondence → Request

2. Enter Company code field

3. Click the Enter button

4. Double Click on SAP06 Account Statement

5. Update the following required and optional fields.

6. Click on the Continue button.

7. A message will appear on the status bar: Account Statement was requested

8. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.

3.4.2 Maintain Correspondence – F-61

Correspondence are business documents such as Vendor account statements, Payment notice with line items, Payment notice to accounting department, Payment notice to legal department These documents can be requested and be printed any time, print the correspondences.

Steps:

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Payable → Account → Periodic Processing → print Correspondence → per Request

2. Enter ‘FILC’ in Correspondence Field.

3. Enter the company code field.

4. Click on the Execute button to continue. A message will appear within a pop-up screen: A correspondence was issued would you like to issue a request?

6. Click on the Yes button to proceed

7. Enter printer name LP01 in the output device field.

8. Click on the Continue button

9. A log will be issued for triggered correspondences

10. Select from the menu System → Services → Output Controller

11. Click on display contents – Press F6

12. Press F3 to exit the display view screen

13. Click the on Print directly button Press Ctrl + Shift + F8 to send to the printer

14. Click on the Exit button or press Shift+F3 to return to the SAP Easy Accessscreen.

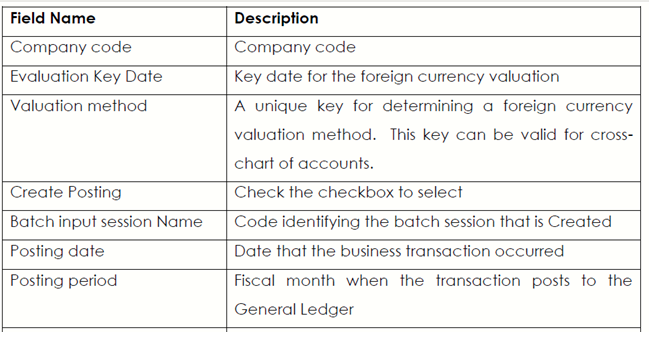

3.4.3 Foreign currency Revaluation procedure – FAGL_FCV

You carry out the foreign currency valuation before you create the financia statements. The valuation includes the following accounts and items.

Foreign currency balance sheet accounts, that is, G/L accounts that you run in foreign currency (the balances of the G/L accounts in foreign currency are valuated) Open Items (customers, vendors/L accounts) posted in foreign currency (the line items are valuated).

Steps:

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Payable → Periodic processing → Closing → Valuate → Foreign Currency Valuation of open items (New)

3. Click the Open items tab

4. Select Valuate Vendor open item by clicking in the check box

5. Select Valuate Customer open item by clicking in the check box, if required so

You can select only a particular General Ledger / General Ledger accounts to be evaluated. If you leave the selection fields empty (like in our example), all the accounts will be selected for valuation.

6. Click on the Execute button to perform valuation.

Note: The system does not create the postings immediately but creates a batch input session instead

7. Click on the Back button or press F3

8. To post the valuation, you need to process the Batch Input session that you’ve just created. You can open another SAP session. From the main menu choose System →Services → Batch input → Sessions

9. Select the session you want to process. (Select the row that contains your Batch input session , e.g. FAGL_FC_VAL

10. Click on the Process button

11. Click on the Radio Display errors only button

12. Select the Process button to begin the posting of documents

13. Once the session is processed, you need to check the results. To analys yourbatch input session, follow the menu path:

14. From the main menu choose Sytem→Services→ Batch input → Sessions

15. Select the row that contains your Batch Input Session FAGL_FC_VAL

16. Click the Analysis button. The system will display the details regarding the session that was processed.

17. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access screen.85

3.5 Vendor Reports

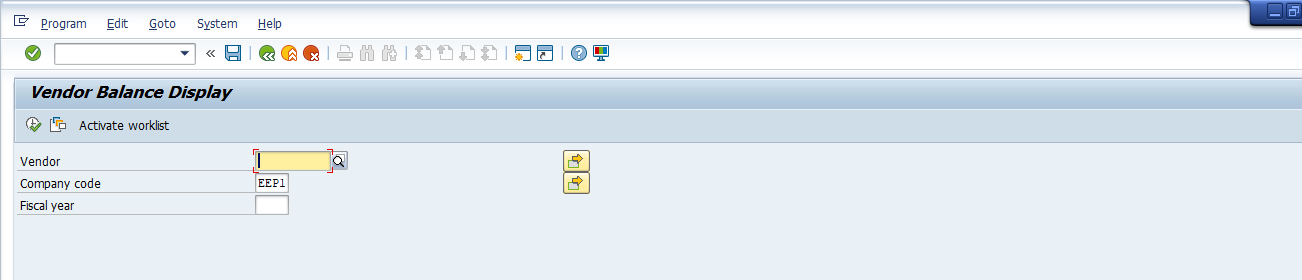

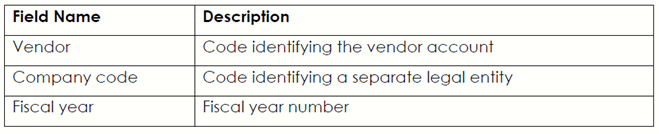

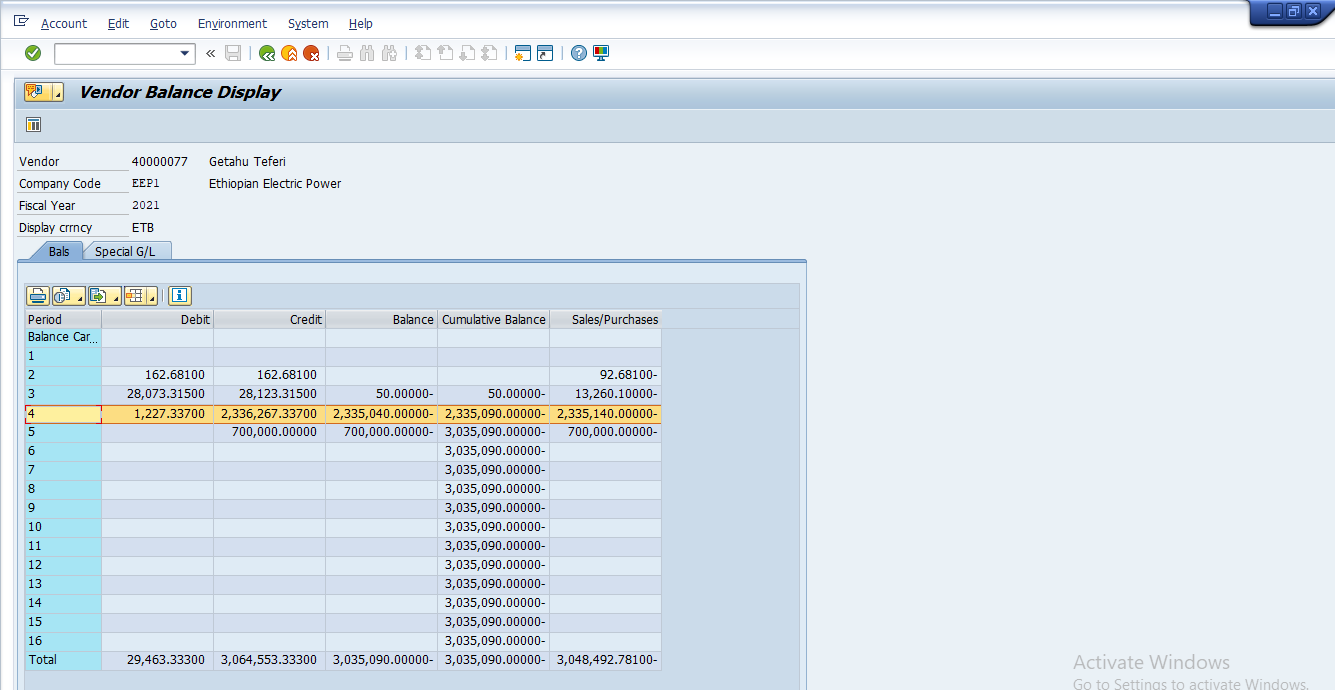

3.5.1 Display Vendor Balances – FK10N

This function allows you to display vendor balances (both per month and cumulative). You can also display balances for more than one vendor account cross-company code in a list.

Steps:

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Payable → Account → Display Balances

2. Update the following required and optional fields

3. Click the Execute button to display a report.

4. You can display the line items or even particular document directly from this report. For instances, to display all the documents for period 4 mark this row on the report screen (it will be highlighted in yellow) and click the Call up line-item report button. You can now see all the documents posted in Period 4.

5. To display the details of a particular line item simply double-click on any listed document the system will display this line item.

6. Click the Back button to return

Or

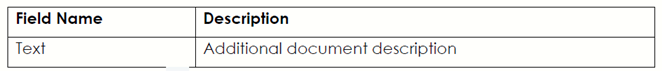

7. If you there is need, you can change some of the fields. Click the Display →Change button. The fields that can be changed are highlighted in red or they will be white. For instance you can add the description of the field “Text”

8. Update the following required and optional fields of the invoice.

9. Click the Save button to update this document

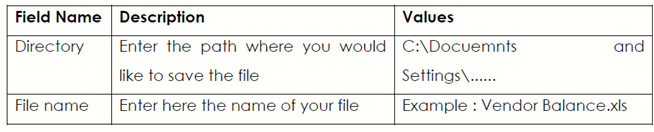

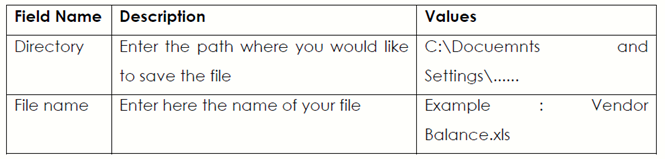

10. You can also export the account balance to a local file. Select from the menu path: List → Export → Local file….

11. Select Spreadsheet the radio button and click the Continue button to continue

12. Click on the Match Code button to select the location to save the file Select the Desktop as the location and update the following required field

13. Click on the Generate button to begin export…

14. The message bar displays “xxx Bytes transferred”.

15. Click on the Exit button or press shift +F3 to return to the SAP Easy Access screen.

16. Go to the desktop environment of your look for the file Vendors Balances you exported from SAP.

17. Double click on it; you can format this file the way you like.

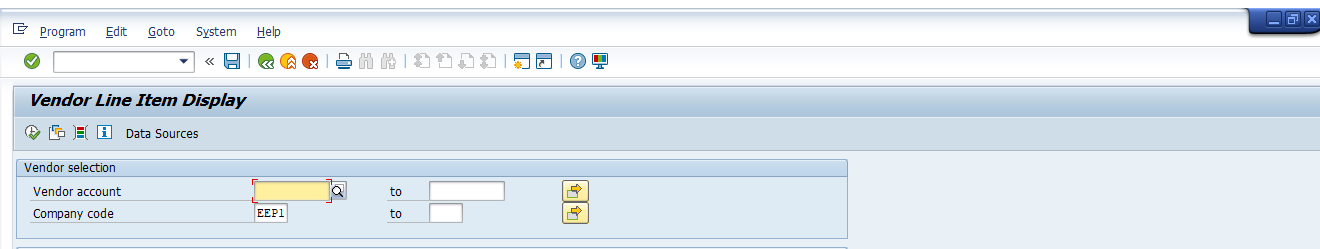

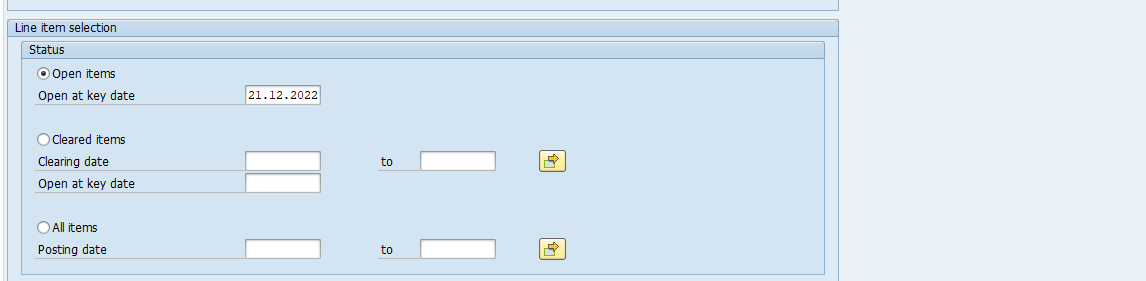

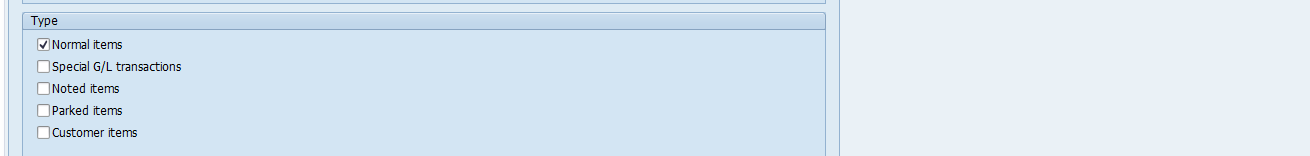

3.5.2 Vendor Line-Item Display – FBL1N

This function allows you to display Open / Closed vendor items. Selection criteria include vendor, company and many of the data sets on the vendor master record.Drill-down capability into actual vendor document is available, as are various listformatting options. You can also display balances for more than one vendor account cross-company code in a list.

Steps :

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Payable → Account → Display / Change Line Items

2. Enter the Vendor Code and Company code.

3. Enter the Company Code

4. Select the Line-Item Selection

5. Select the Account Type Check box

6. Click the Execute button to display a report.

7. To display the details of a particular line item simply double-click on any listeddocument the system will display this line item.

8. Click the Back button to return Or

9. If you there is need, you can change some of the fields. Click the Display →Change button. The fields that can be changed are highlighted in red or they will be white. For instance you can add the description of the field “Text”

10. Update the following required and optional fields of the invoice.

11. Click the Save button to update this document

12. You can also export the account balance to a local file. Select from the menu path: List → Export → Local file….

13. Select the Spreadsheet radio button and click the Continue button to continue

14. Click on the Match Code button to select the location to save the file Select the Desktop as the location and update the following required field

15. Click on the Generate button to begin export…

16. The message bar displays “xxx Bytes transferred”.

17. Click on the Exit button or press shift +F3 to return to the SAP Easy Access screen.

18. Go to the desktop environment of your look for the file Vendors Balances you exported from SAP.

Double click on it; you can format this file the way you like.

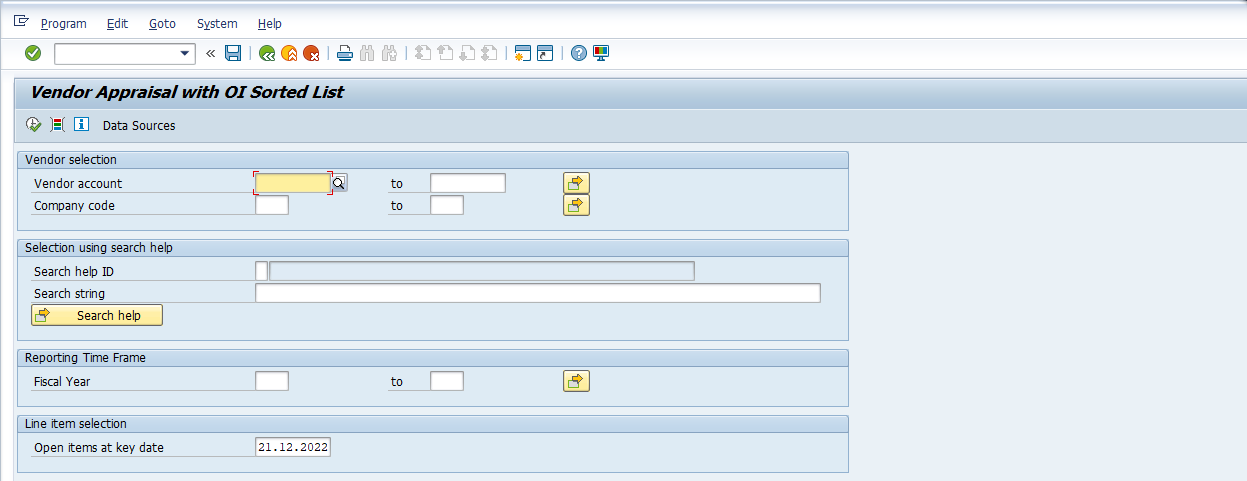

3.5.3. Vendor Payment History with 0I (Open items) Sorted list

This evaluation is used for determining, as accurately as possible, the current payment status for vendors requiring special attention. As criteria for this evaluation, you can use current data from the master database such as Balances on an open item basis or special G/L balances.

In addition to the payment status analysis, the program carries out an analysis of the vendor open items for the report.

Steps:

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Payable → Reporting → Information System → Reports for Accounts Payable Accounting → Vendor Items →Vendor Payment History with OI (Open items) sorted List

Transaction code S_ALR_87012085

3. Click the Execute button to display a report

Create Document and Send

4. The report can be sent to anyone on the SAP System. Click on the menu System → List → Send

5. Type in your message to the person(s) you want to mail that document to.

6. Type in the Receivers name (XXXX) under Recipient field and place an *at the end.

7. Click on the Continue button.

8. Click on the Send button press Shift+F8

9. The document has been sent to the chosen recipients.

10. Click on the Exit button or press Shift+F3 to return to the SAP Easy Access Screen

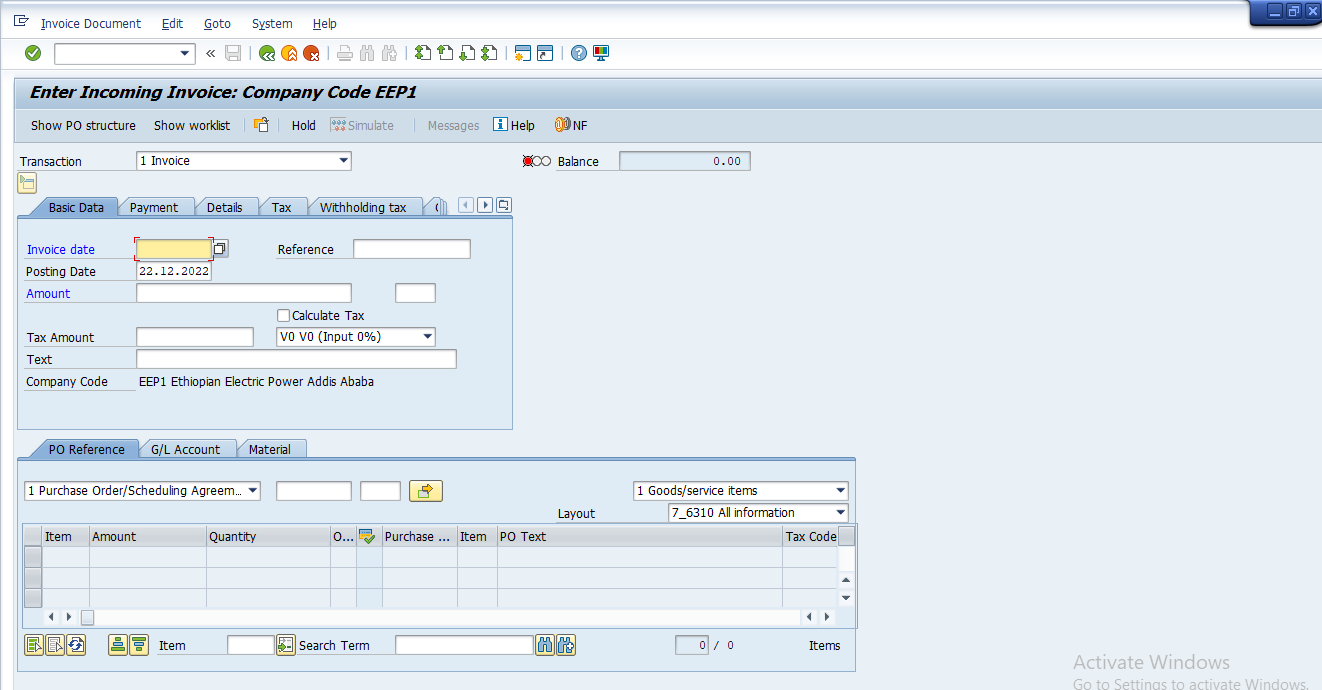

3.6 Vendor Invoice with Purchase Order

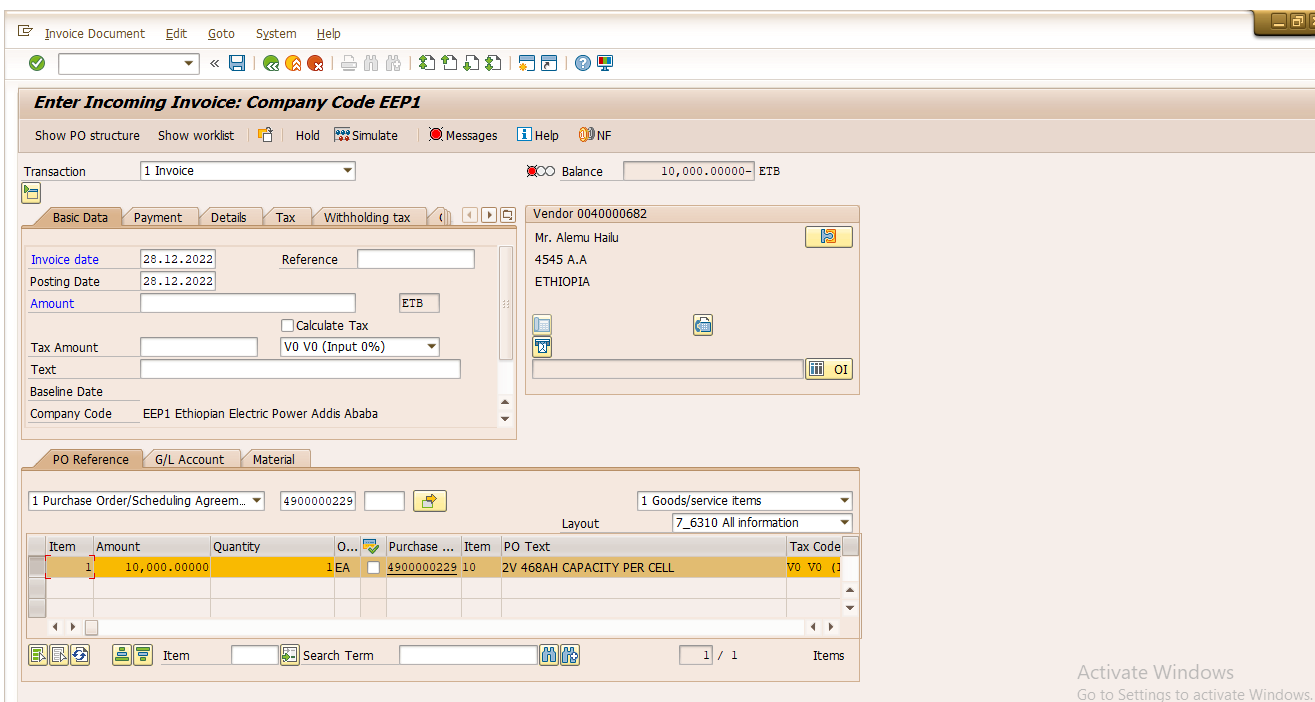

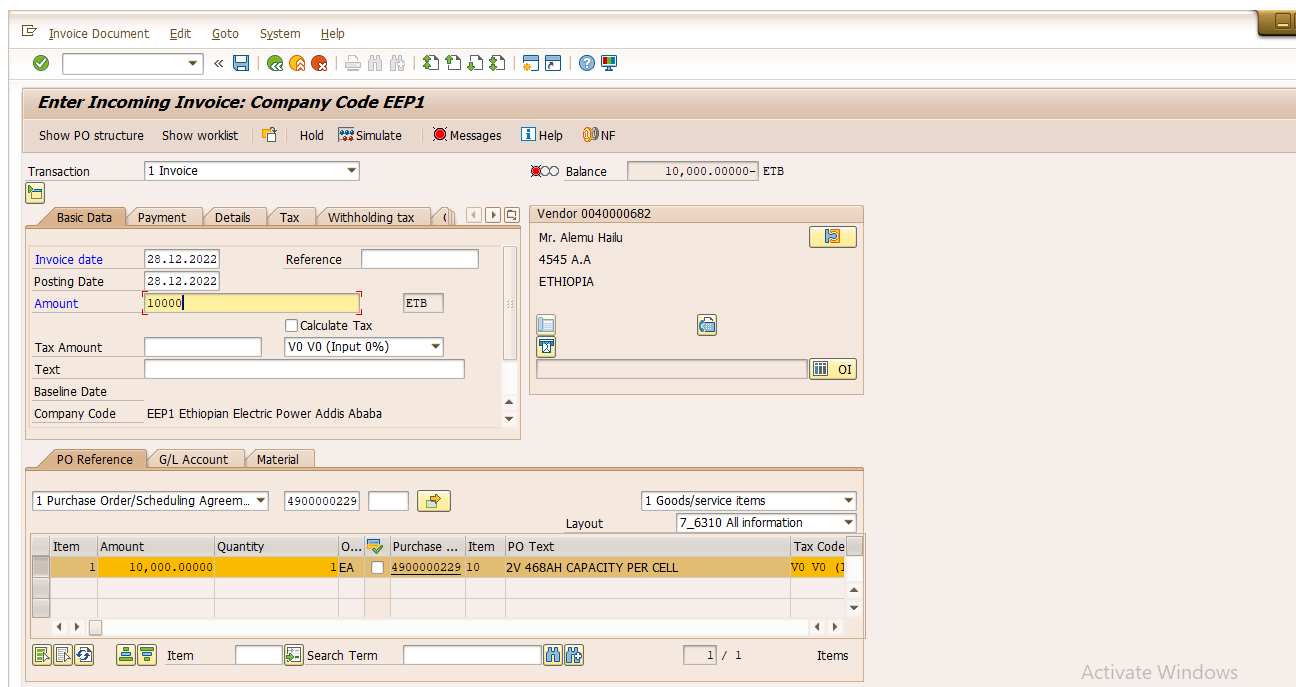

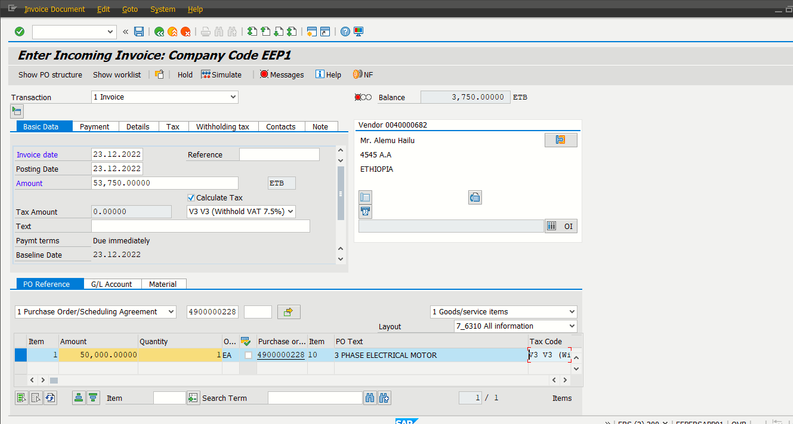

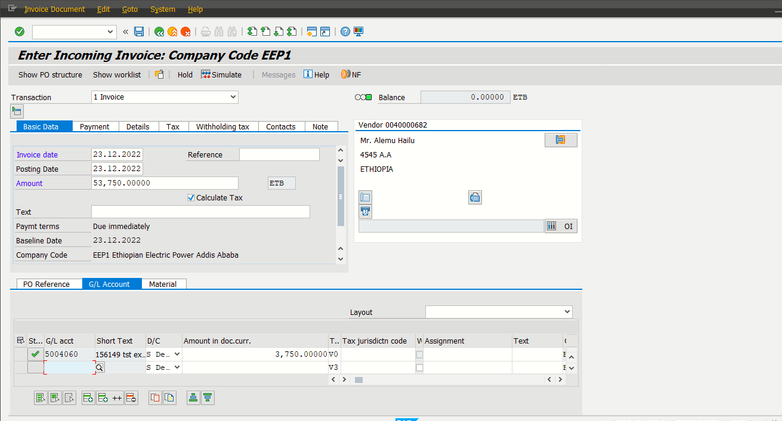

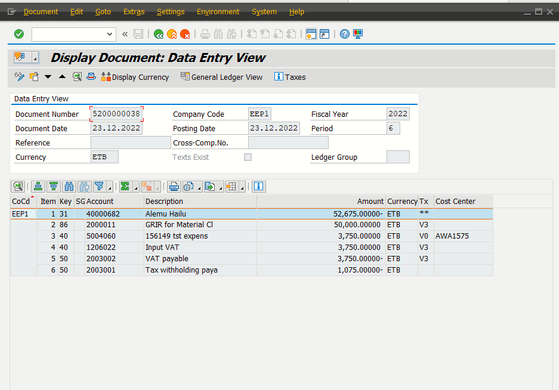

3.6.1 Invoice Verification -MIRO

Here we would like to draw your attention to MIRO transaction code in SAP. As we know it is being used in the SAP MM-IV (Invoice Verification in MM) component which is coming under MM module (Material Management). MIRO is a transaction code used for Enter Incoming Invoice in SAP.

Steps:

1. Access transaction by:

MIRO Transaction Code

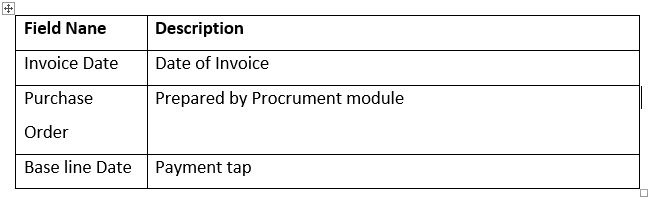

2.Update the following Optional & Required fields

3.Enter Invoice Date in Invoice Date field

5.Enter Base Line Date in payment tap

6.Enter Purchase Order Number prepared from procurement module

7.Click Enter Button

Note: There are two types of taxation option

I. If the outstanding payment less than 20000-birr, Tax should be Tax withholding (2%).

* Enter outstanding Amount in Amount field

* Click Withholding tax tap and enter outstanding amount

* Click on the Save button or press Ctrl+S to post the Invoice.

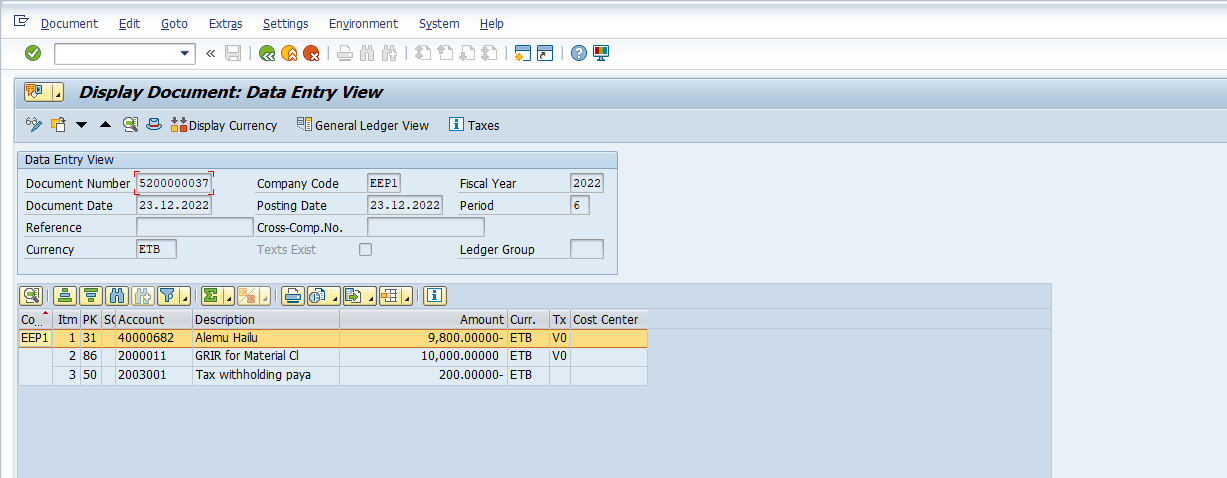

Document Overview

II. If the outstanding payment greater than 20000-birr, Tax should be Tax withholding and Withhold VAT 7.5%(V3)

* Enter outstanding Amount plus 7.5% of outstanding amount in Amount field

* Thick Calculate tax check box button

* Select V3 (Withhold VAT 7.5%)

* Update Tax Code for outstanding amount line item from V0 to V3

* Click G/L Account tap and

* Enter Expense GL Acc. (Dr)

*Enter 7.5% of outstanding amount in Amount field

* Enter Cost Center in Cost Center field

* Enter V0 tax in Tax Code field

* Click Withholding tax tap and enter outstanding amount plus 7.5% of outstanding amount in Amount field

* Click Save Button

Document Overview

4. ACCOUNTS RECEIVABLE

In Accounts Receivable, much of its data is obtained from Sales and Distribution tobe available in the second phase.

Master data must be maintained centrally to ensure data integrity.

4.1 Accounting transactions in Accounts Receivable

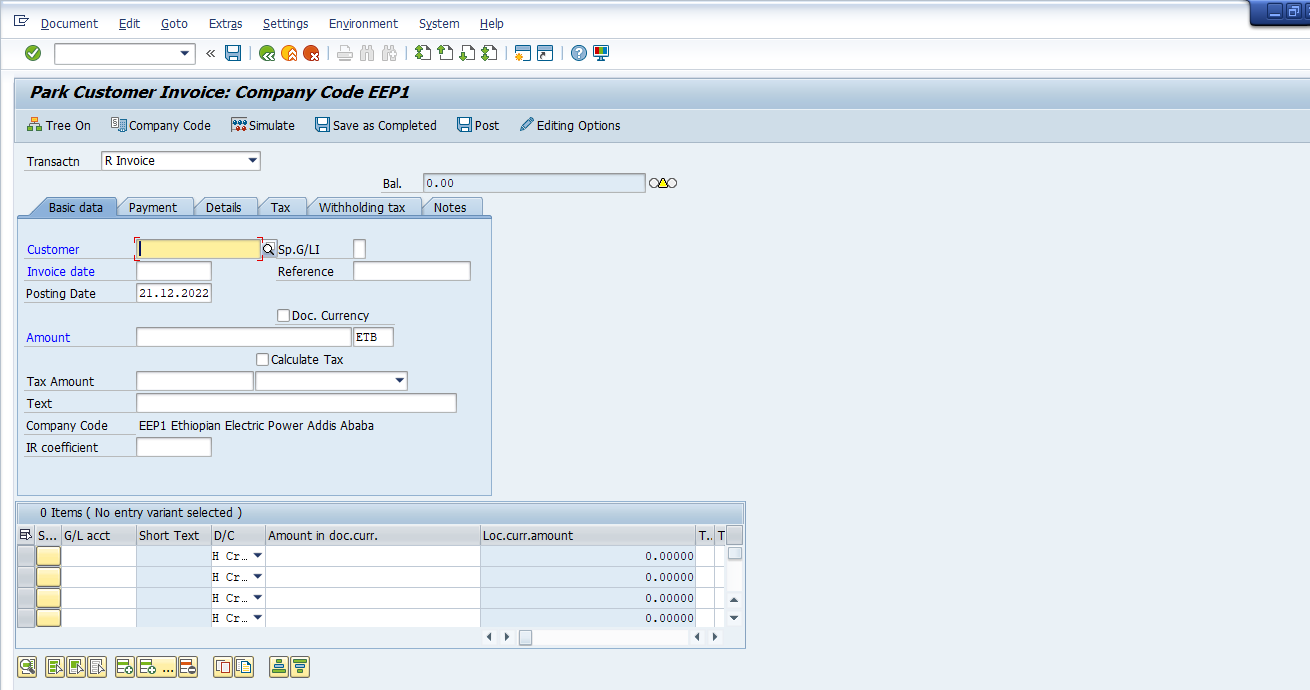

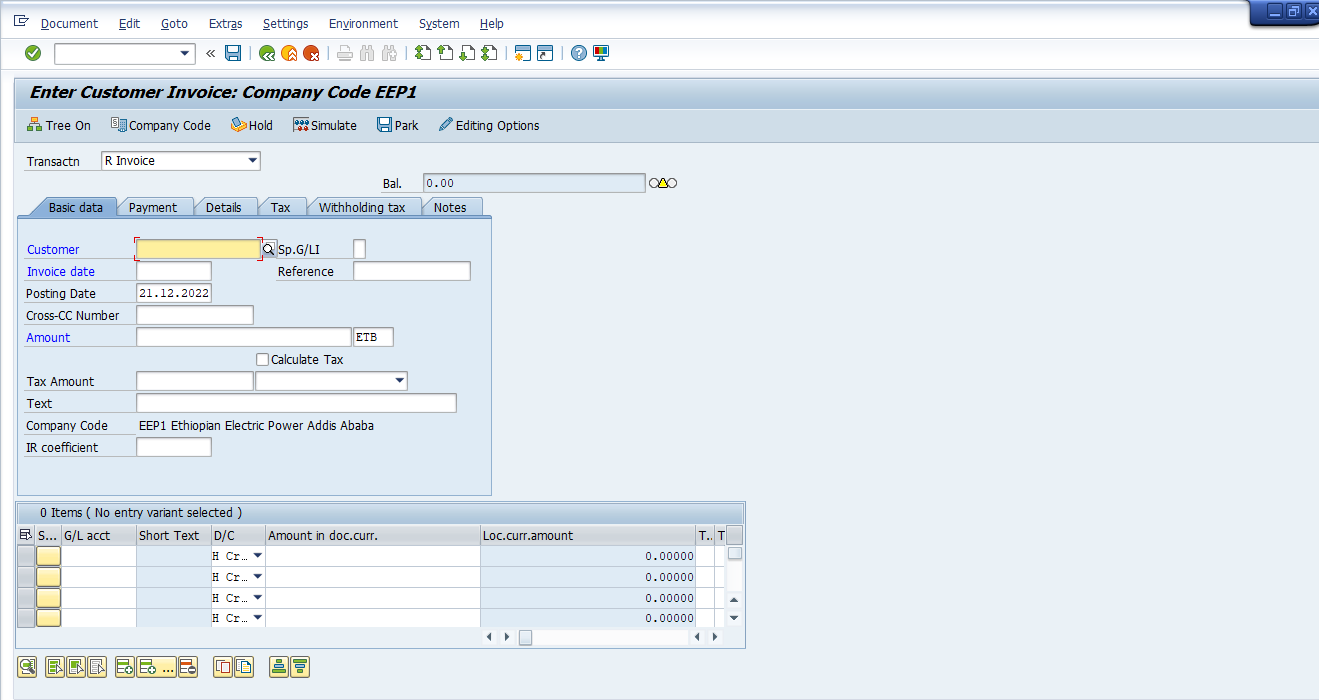

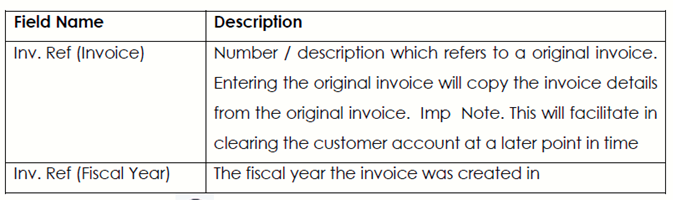

4.1.1 Park Customer Invoice – FV70

Using this standard accounting function, you can enter Invoice in the system without posting to the Accounts Receivable sub ledger. The PARKED invoice is subsequently subjected to checking, approval and posting to Accounts Receivable.

- Steps:

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Receivable → Document entry → Document Parking → Edit / Park AR Invoice

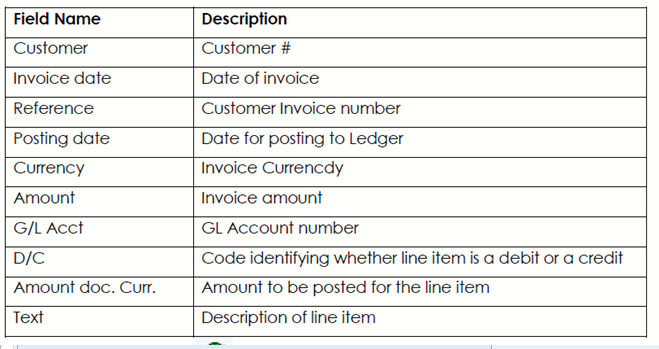

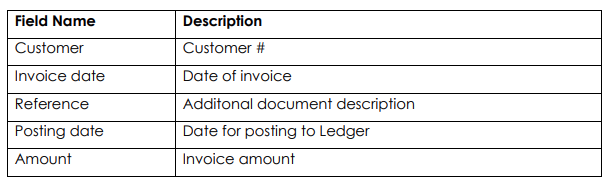

2. Update the following required and optional fields:

3. Click on the Enter button

4. Simulate invoice before posting. To do so, click Simulate button. Simulation button enables the user to review the Invoice as if it had been posted including any system generated postings. The system also validates the posting data.

5. Click on the Back button

6. To park the Invoice, click Save Parked Invoice button.

7. The message at the status bar informs you that “Invoice number xxxx was PARKED”

4.1.2 Post Customer Invoice – FB70

This transaction creates postings in Accounts Receivable Sub Ledger and Updates also the relevant GL Accounts (e.g., reconciliation account)

Steps:

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Receivable → Document entry → Invoice

2. Update the following required and optional fields for 1st line item by clicking tab button:

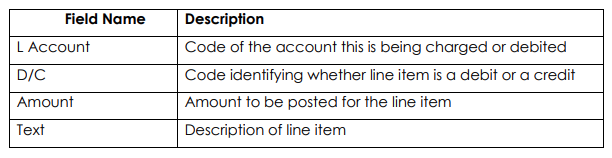

3. Update the following required and Optional Fields for 2nd line item

4. Click the Simulate button to replicate an overview of the document before posting. The system will display the document overview.

5. Click on the Save button or press Ctrl+S to post the invoice

6. The system will display the number of the document generated by this Invoice.

7. Click on the Exit button or press Shift+F3 to return to the SAP Easy Accessscreen

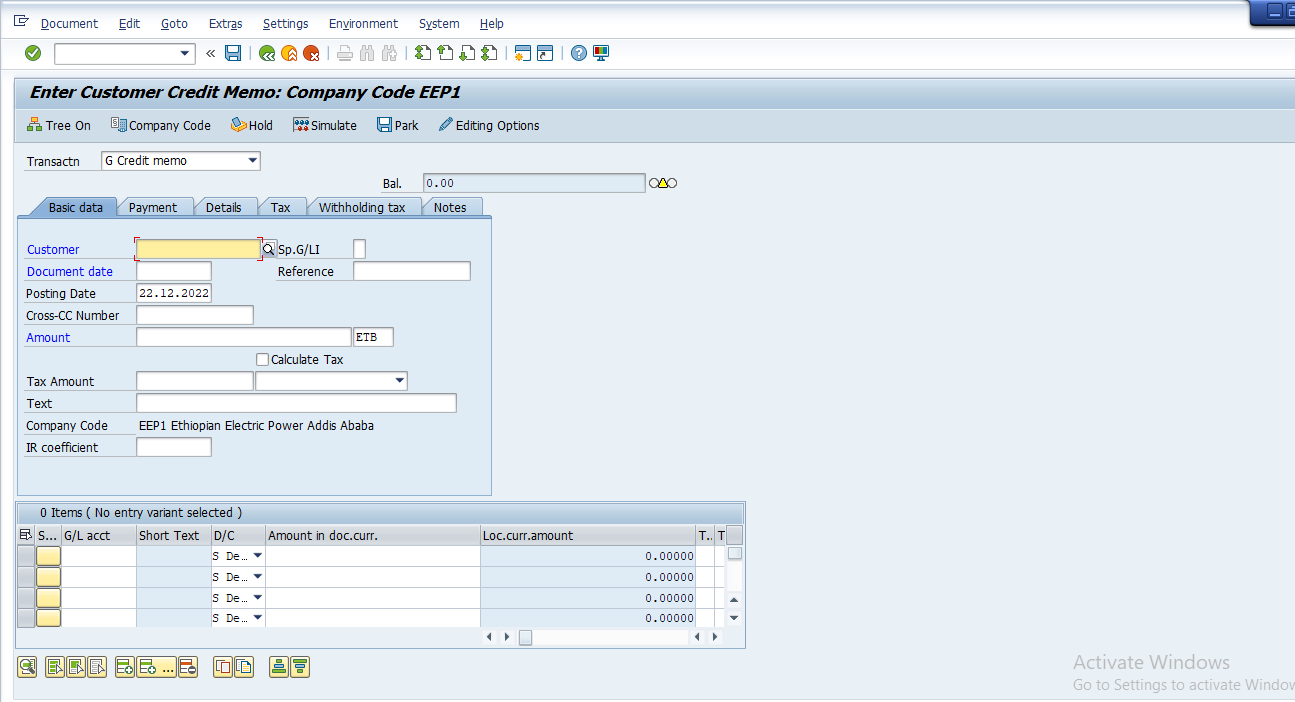

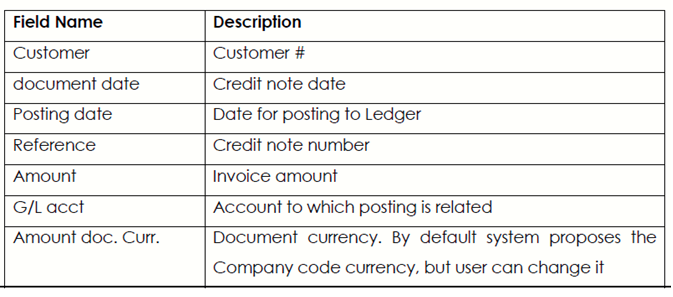

4.1.3 Post Customer Credit Memo – FB75

The SAP ERP system allows you to post a document with a complete opposite entry to the original customer invoice. This function can be used when a customer returns goods sold

Note : An account that was once debited will be credited and the other once credited will be debited.

Steps :

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Receivable → Document entry → Credit memo

2. Update the following required and optional fields:

3. Click the Enter button to confirm the entries

4. Click the Payment tab and update the following field.

5. Click the Enter button to confirm the entries

6. Click the Simulate button to simulate the posting. The system will display document overview

7. Click on the Save button or press Ctrl+S to post the document.

Note : The message bar displays “Document XXXX was posted in companycode xxxx”

8. The system will display the number of the document generated by this Invoice.

9. Click on Exit button or press Shift+F3 to return to the SAP Easy Access screen.

4.1.4 Change Parked Document – FV70

The SAP ERP system allows users to change parked Customer documents since invoices need to be verified for correctness before they are posted; therefore, errors on documents can be corrected before being posted.

Steps:

1. Access transaction by:

SAP Access Menu Accounting → Financial Accounting → Accounts Receivable → Document Entry → Document Parking → Edit / Park

2. Click on the Tree on button and the tree will be displayed

3. Click on the Parked document button

4. A listing of parked documents will be displayed; double click on the document you want to change / edit. The details of the parked document will be populated in the relevant field: Add extra text.

5. Enter any detail in the Reference field.

6. Click on the Save button to record you changes

7. A message will appear on the status bar informing you what has happened to the document you changed.

8. To exit this transaction, click on the Exit button or press Shift+F3 until the SAP Easy Access Screen is displayed

4.1.5 Display Accounting Document – FB03